If you’re looking to invest in a commodity with high trading potential, sugar has seen significant price fluctuations in recent years.

Sugar prices have been rising due to increased demand in countries like China and India, which is likely to continue.

Many factors affect the global sugar market, ranging from political and economic factors to environmental and health concerns.

Sugar prices also have a historically low correlation with the overall U.S. equity market, making sugar an attractive option, as represented by the CANE ETF shown above.

Sugar remains a profitable commodity for those who understand the market risk.

Sugar futures are one way to invest in sugar.

A select few ETFs, like CANE shown, provide access to sugar futures through an ETF. The Teucrium Sugar Fund (CANE) provides investors with an easy way to gain exposure to the price of sugar futures.

On the daily chart above, our proprietary Real Motion Indicator displays that CANE’S price can continue higher. CANE is above the 200-day moving average, and our Triple Play Indicator exhibits new leadership performance.

CANE is attempting to overtake the SPY, indicating a possible change in leadership.

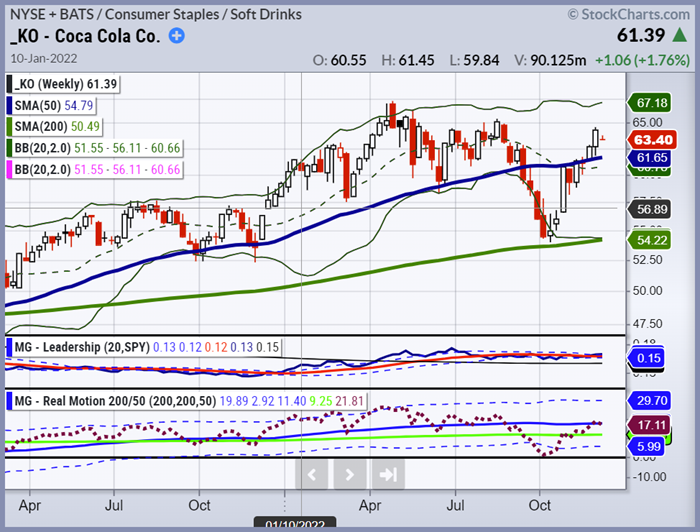

Another way to get exposure to sugar is by purchasing stock in a company that makes foods or drinks with sugar. This strategy does put all your eggs in one company, for example, Coca-Cola.

Coca-Cola (KO) is up 6.8% year-to-date. Coke is an excellent example of a company with a premium product and pricing power.

Coca-Cola is in a bullish phase and can raise the price of its products.

Our platform offers trading ideas, like CANE and Coca-Cola, with real-time alerts for buys and stops – so investors can make informed trading decisions, such as when to buy or sell.

In addition, we also offer live trading analysis of markets, including the sugar market, and provide our analysis available on private video demand so investors can understand and review what’s driving the market and the pricing of specific commodities.

If you are looking for a sweet trade with the potential for significant returns and vol, sugar may be just what you’re after.

Please remember that when it comes to higher sugar prices, turmoil and chaos are often around the corner – so stay alert and manage your risk.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 396 is support and resistance at 404

Russell 2000 (IWM) 179 support; 185 resistance

Dow (DIA) 337 support; 343 support

Nasdaq (QQQ) 284 support; resistance 290

KRE (Regional Banks) 58 support; 63 resistance

SMH (Semiconductors) 218 support; 224 resistance

IYT (Transportation) 222 support and resistance at 229.

IBB (Biotechnology) 133 support and 138 resistance

XRT (Retail) 62 support; 68 resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.