Today we veer away from sector ETFs and major stock market indices to shine a spotlight on an outperforming stock: Deere & Co (DE).

Deere & Co (previously known as John Deere) is in the farming and machinery sector and finds its stock currently ranked in the top 20 on the MarketSmith Growth 250 list.

We spotlight $DE today because it is testing an extremely important breakout resistance price area on a “weekly” basis. As well, $DE is showing relative strength, strong momentum, and EPS.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

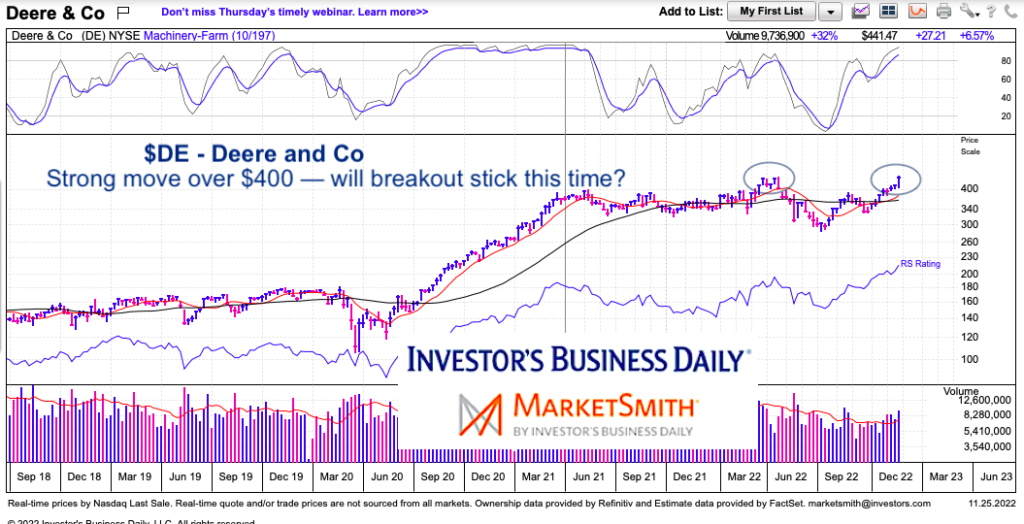

$DE Deere & Co “weekly” Chart

Deere & Co (DE) comes in with a glowing resume for this stock setup. It included rankings in the 90’s across MarketSmith’s key technical and fundamental indicators. And just this week, the stock price surged 6.5% and is attempting to confirm a breakout above the $420 area. The last attempt at a clean breakout (circled) turned into a fakeout.

Note that the 10-week MA is turning up through the 40-week MA (bullish). This allows bulls to buy pullbacks and set stops just below $400 depending on risk tolerance.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.