The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

The tone among corporate executives has shifted immensely over the past few quarters. We went from re-opening optimism and a tech-led boom to macroeconomic fears and company-level missteps in short order.

Over the last few weeks there has been confusion regarding the state of the consumer and how much tighter financial conditions will negatively impact operations across a range of sectors. The good news is that our day-to-day feels back to normal.

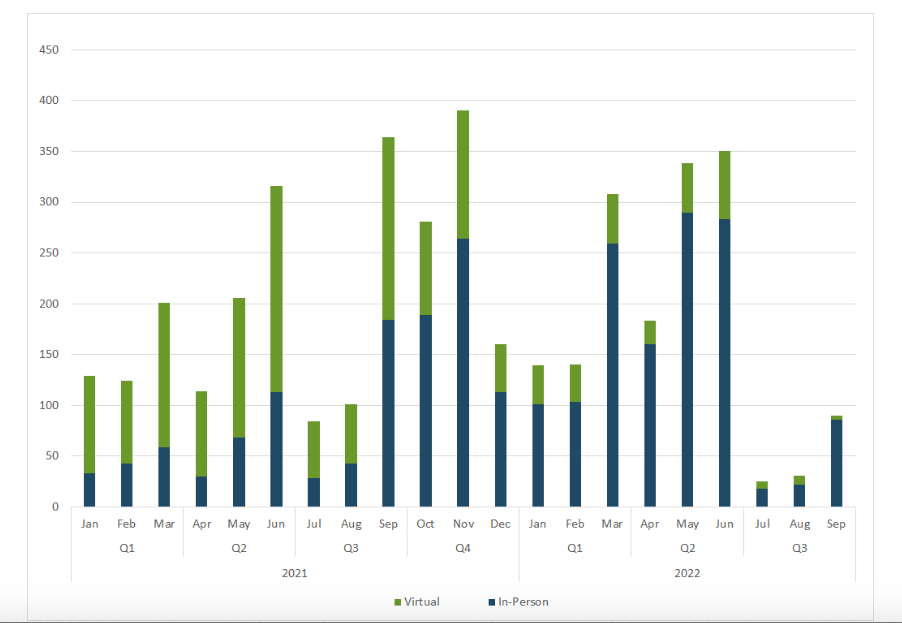

Wall Street Horizon data show that in-person events are by far more common than virtual-only for confirmed Q3 conferences.

In-Person Conferences in Full Swing

Source: Wall Street Horizon

Setting Second-Half Expectations

The Q3 conference season will be critical to monitor as CEOs seek to appropriately assess the economic landscape while balancing their tone. Too optimistic, and the table might be set for disappointing results later in the year. Too pessimistic, and investors might quickly give up on the stock. Just take a look at recent earnings guidance cuts from stalwarts like Microsoft and Target. To that end, tech and retail are two spots in focus this summer.

Bright Spots and Dark Cloud Overseas

Not everything is doom and gloom though. China’s re-opening after its hard zero-Covid policy and lockdowns has turned a positive corner. The world’s second-largest economy looks to be on the mend and its stock market outperformed the S&P 500 by about 25% from late April through mid-June. Over in Europe, however, crippling commodity costs continue to cast a dark cloud on the region. Geopolitical tensions have gone nowhere fast. Expect conferences to touch on the latest outlook in this highly uncertain global economy.

Questions to Ponder

After a stock and bond market drubbing throughout the first half of 2022, investors and analysts have had to do a reset. Valuations are lower and interest rates are higher. It is a vastly different landscape versus the YOLO months of 2021. Here are a few topics to consider over the coming months’ conferences and corporate events:

- Will the consumer hold up? While there remains $2 trillion of excess savings in people’s pockets, the personal savings rate has dipped to multi-year lows.

- When will the dramatic rise in commodity prices cool? Oil and natural gas are at or near 2008 levels.

- How are banks handling higher interest rates? Why haven’t the stock prices of many big financial firms responded well to what is normally a boon for the sector?

- To what extent will the U.S. Dollar hinder multinational corporations’ profits in the second half? We’ve already heard from some companies that FX will detract from EPS given big greenback gains lately.

- Speaking of earnings, can near record-high profit margins keep up with soaring input prices and labor costs?

- Finally, inventory challenges sent big-box retail shares sharply lower in May. How is that situation being addressed?

There’s a bevy of uncertainties. The good news is we can get key insights into broad topics and firm-specific opportunities and risks by keeping tabs on corporate conferences. The summer is no time to tune out what company managers are saying. Here are the major conferences to watch in the coming months (dates subject to change / miscommunications):

Information Technology & Communication Services

July 12: Gartner Tech Growth & Innovation Conference 2022 (virtual)

August 9: Oppenheimer 25th Annual Technology, Internet & Communications Conference 2022 (virtual)

August 22: Gartner Data & Analytics Summit 2022 (Orlando, FL)

August 30: Jefferies Semiconductor, IT Hardware & Communications Infrastructure Summit 2022 (Chicago, IL)

September 1: Barclays Technology Media and Communications Conference 2022

September 7-9: Citi Global Technology Conference 2022 (New York, NY)

September 12-15: Goldman Sachs Communacopia Technology Conference 2022

Health Care

July 12: Guggenheim I&I Spotlight Series – Treg-based Therapies 2022

July 13: William Blair Biotech Focus Conference 2022 (New York, NY)

July 31: Alzheimer Association International Conference 2022 (San Diego, CA)

September 7-8: Citi 17th Annual BioPharma Conference 2022 (Boston, MA)

September 7-9: Wells Fargo Healthcare Conference 2022 (Boston, MA)

September 13-14: Baird Global Healthcare Conference 2022 (New York, NY)

Consumer Discretionary & Consumer Staples

September 6: Barclays Global Consumer Staples Conference (Boston MA)

September 6-8: UBS Business Services, Leisure, and Transport Conference 2022 (London, UK)

September 6-11: Cannes Yachting Festival (Port Pierre Canto, Vieux Port de Cannes)

September 7: Goldman Sachs 29th Annual Global Retailing Conference (New York, NY)

September 13-14: Piper Sandler Co`s Global Consumer Technology Conference 2022

Financials & Real Estate

August 8: Wells Fargo 7th Annual FinTech & Technology Services Forum 2022 (Newport, RI)

September 6-7: ODDO BHF Commerzbank Corporate Conference 2022

September 13-14: Bank of America NY Securities Global RE Conference 2022 (New York, NY)

Industrials

July 7: Connected Future Transport Systems (virtual)

August 5-8: Needham 11th Annual Industrial Tech, Robotics, & Clean Tech 1X1 Conference 2022 (virtual)

August 10: Jefferies Industrials Conference 2022 (New York, NY)

August 14: Susquehanna Industrials, Energy Airlines Conference (New York, NY)

September 8-9: Morgan Stanley Industrial CEO Conference 2022

Energy & Utilities

July 12: TD Securities Calgary Energy Conference 2022 (Calgary, Alberta)

August 16: Citi One-on-One MLP/Midstream Infrastructure Conference 2022 (Las Vegas, NV)

August 16: Energy Leaders Transition Summit 2022 (Aspen, CO)

September 5: IWA World Water Congress & Exhibition 2022 (Copenhagen, Denmark)

Materials

July 27-28: OTC Metals and Mining Virtual Conference 2022 (virtual)

August 1: Diggers & Dealers Mining Forum 2022 (Kalgoorlie, Western Australia)

September 13-14: Credit Suisse 35th Annual Basic Materials Conference 2022 (New York, NY)

Regional

July 6-7: Solar Energy20 Future Europe 2022 (Madrid, Spain)

July 6-8: 3rd Credit Suisse Japan Virtual New Economy Day (virtual)

August 30: Deutsche Bank dbAccess European Technology, Media, and Telecommunication Conference 2022 (London, UK)

September 1: The Latin American Satellite Congress (Rio de Janeiro, RJ, Brazil)

September 5-8: Credit Suisse 23rd Asian Technology Conference 2022 (virtual)

Investor Specific & Multi-Sector

August 8: SET Opportunity Day Quarter 2/2022 (virtual)

August 8: Canaccord Genuity 42nd Annual Growth Conference 2022 (Boston, MA)

August 16-17: Q3 Investor Summit 2022 (virtual)

August 17-18: Sidoti August Micro Cap Virtual Conference 2022 (virtual)

August 24: Berenberg Copenhagen Top Picks Seminar 2022 (Copenhagen, Denmark)

August 25: Nordea Small & Mid Cap Days 2022 (Stockholm, Sweden)

September 8-9: Citi`s Growth Conference 2022 (London, UK)

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.