The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary

- Traders gear up for results from Apple, Google, Meta, and Microsoft.

- Cyclical stocks remain in focus as 3M, Caterpillar, and Southwest Airlines offer glimpses into the health of the economy.

- Increasing dividend trends pose an optimistic data point in an uncertain world.

First-quarter earnings season has been on track so far. While there have been some fits and starts from big-name U.S. companies, the overall EPS beat rate is a respectable 79%, according to FactSet. Early on, the Financials sector was a mixed bag with a somewhat pessimistic report out of JP Morgan (JPM), but then an upbeat tone emerged from Bank of America’s (BAC) CEO Brian Moynihan. In week two, the fireworks really got started with Netflix’s (NFLX) huge disappointment and stock price collapse, followed by better-than-expected figures from Tesla (TSLA).

Meanwhile, more blue-chip companies like Charles Schwab (SCHW), Johnson & Johnson (JNJ), Travelers (TRV), IBM (IBM), Procter & Gamble (PG), and CSX (CSX) reinforced concerns about the overall economy. Higher labor costs, supply chain issues, rising materials prices, and tighter credit conditions are just some of the macro headwinds facing firms. Moreover, a very strong U.S. dollar might pose new FX risks for multinationals.

Macro Headwinds & Strong Consumers

Still, the consumer is strong as reported by a few firms commenting that there is actually trading-up to more expensive goods. Perhaps TSLA’s earnings blowout proves that point. Moreover, both American Airlines (AAL) and United (UAL) issued robust guidance for future quarters last week. It’s important to realize that the unemployment rate remains remarkably low with growing wages. Last week’s Philly Fed reported that a whopping 80% of firms increased wages over the past three months. As a result, firms are able to pass along higher input costs. During the UAL earnings call last week, the airline said 100% of its higher jet fuel prices are passed along to consumers.

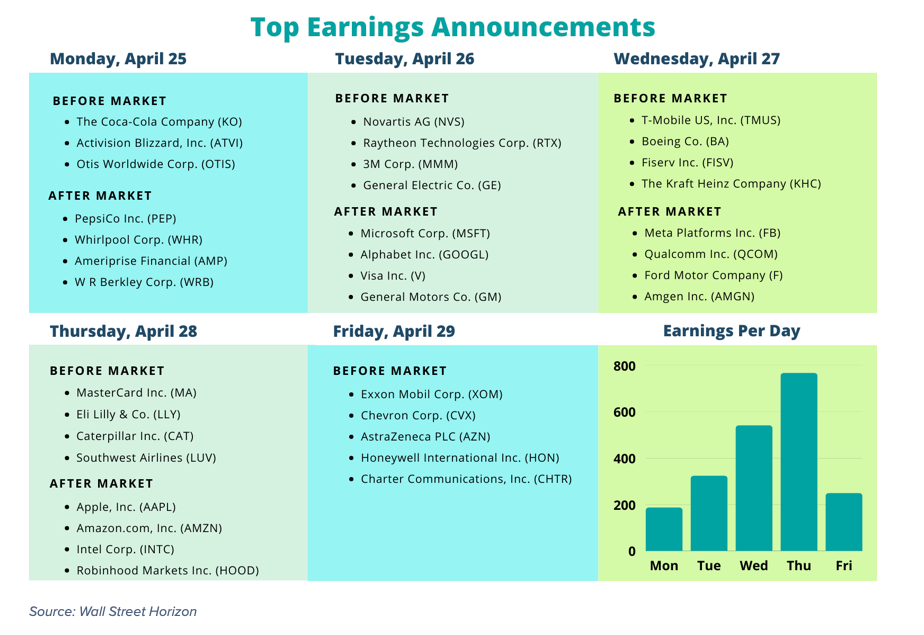

Key Firms on the Earnings Calendar This Week

First-quarter earnings results broaden out as we enter the heart of reporting season. Traders will undoubtedly eye how big tech is doing from firms like Google (GOOGL), Meta Platforms (FB), Apple (AAPL), and Amazon (AMZN). Of course, those mega-caps span a few sectors. Aside from the growth side of the S&P 500, key cyclicals provide earnings: 3M (MMM), Caterpillar (CAT), Boeing (BA), Ford (F), Southwest Airlines (LUV), and the two big energy stocks Exxon Mobil (XOM) and Chevron (CVX).

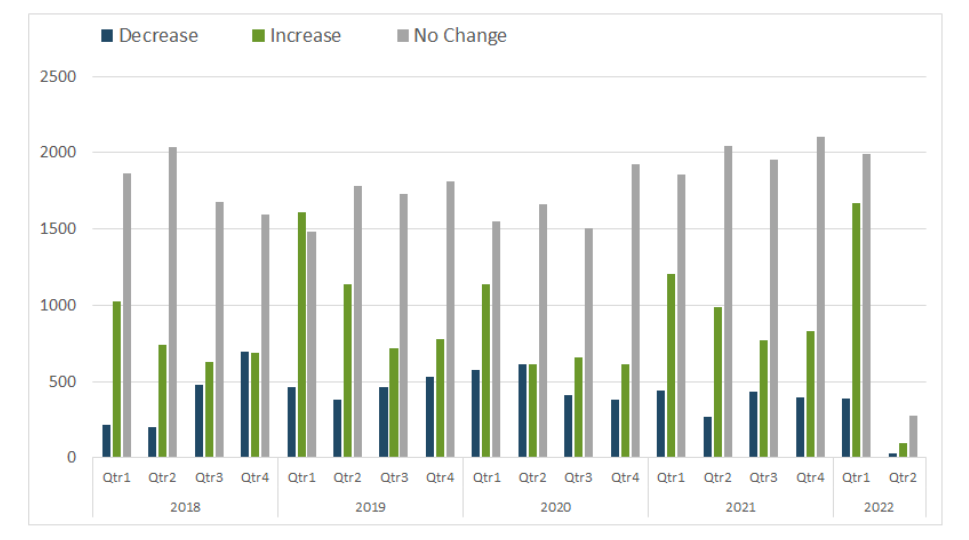

Higher Profits, Bigger Dividends

An event trend we have noticed, albeit still early among Q1 reports, is a brighter outlook from several firms raising their dividends. A few high-profile companies paying out more to shareholders include Costco (COST), Kinder Morgan (KMI), Southern Co. (SO), P&G, and JNJ. After a year of record profits for S&P 500 companies in 2021, another strong quarter of cash flows should provide an income boost for stockholders.

The trend in dividends is particularly important right now considering the uneasiness about future economic strength over the coming quarters. A briefly inverted yield curve a few weeks ago brought about a wave of recession chatter. Firms might turn their focus to shoring up their balance sheets versus distributing cash to shareholders. For now, there’s enough corporate confidence to take shareholder-friendly corporate actions.

Dividend Trends: An Optimistic Data Point in an Uncertain World

In Q1, dividend increases notched a record high in Wall Street Horizon historical data going back more than four years with almost 1,700 firms raising payouts, a nearly 40% jump year over year. A relatively paltry 387 companies cut their dividend, a 13% decline from Q1 2021. There’s a long way to go in Q2, but the ratio of increases to decreases looks strong so far.

Figure 1: Dividend Changes by Quarter

source: Wall Street Horizon

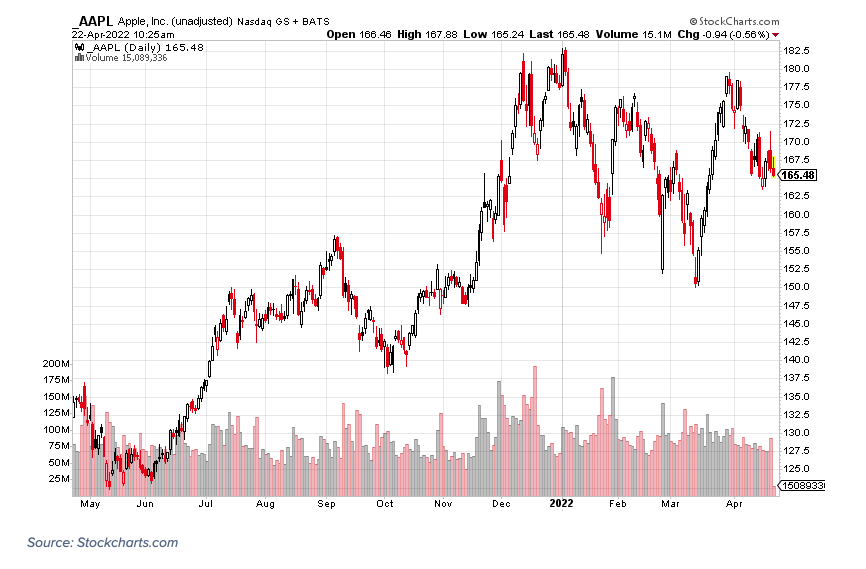

Apple: Earnings Preview and What Traders Expect

Let’s dive into what to anticipate from Apple ahead of its important profit figures hitting the tape on Thursday afternoon. Recall that shares rose sharply on January 28, the session following its after-hours Q1 results (Apple’s fiscal year ends September 30). The world’s most valuable company reported the biggest revenue quarter in its history even with ongoing supply chain issues. Sales from iPhones is always the dominant factor – last quarter, 58% of net revenues came from the segment. While Tim Cook did not offer guidance back in January, nor have outlook figures been disclosed since the pandemic hit, that could be something to watch this quarter as operations continue to stabilize. Cook said that the firm expects supply constraints to be less of an issue for the March quarter versus the prior three months.

Figure 2: AAPL Stock Price History

The forecast calls for Q2 EPS of $1.43 which would bring the trailing twelve-month sum to $6.14. Many investors view the 27x P/E ratio as reasonable given Apple’s earnings strength, care of massive reliable recurring revenue. Moreover, back out the $64 billion stockpile of cash and short-term investments, and the earnings multiple is even cheaper. Be on the lookout for more potential shareholder accretive announcements such as a dividend raise and an increased share buyback program after the bell on Thursday.

With Apple being a 13% weight in the Invesco QQQ ETF, volatility in this stock plays a significant role in what happens with overall market movements – particularly for options traders. Right now, the at-the-money straddle on AAPL shares for options expiring April 29 costs $8.23, or 4.9% of the stock price. That can be seen as the implied move, up or down, in shares between now and Friday’s close.

Maintaining Your Edge

You can tune in to hear more risk strategies on May 3 during our Data Minds event. Along with analyzing expected stock moves based on implied volatility, discussions will include risk arbitrage in a quickly-shifting global marketplace, new regulatory rules, and how lingering supply chain speed bumps impact traders.

Earnings Wave

This week we see the first of the three peak weeks of the Q1 reporting season with over 2,000 companies reporting. The week of May 1st is slated to be the most active week with over 4,000 companies expected to report. At this point, 60% of companies have confirmed their earnings date (out of our universe of 10,000 global names).

Conclusion

Many of the market’s big guns report results this week. It might be a nice reprieve from uncertain Fed-related news, geopolitical headlines, and the Elon Musk/Twitter saga. Earnings matter, and we’ll have a much better gauge of the corporate landscape and state of the consumer when this week is out. Traders should continue to monitor key corporate events from companies big and small to stay ahead of volatility.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort