The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Key Takeaways:

- S&P 500 EPS growth for Q4 tops 30%

- Cash heavy corps have been putting money into dividends and buybacks, but the latter is changing in Q1

- The D/A ratio drops to its lowest level in 10 years, pointing to higher corporate confidence

- Potential surprises this week: CROX, SEE, PK, AMCX

- Peak earnings continue this week with results out of tech, hotels & leisure and retail.

Where Things Stand with 72% of S&P 500 Companies Reported

The second peak week of Q4 2021 earnings season continued to pump out impressive results, but that wasn’t enough to offset disappointing economic data. After investors took stocks higher on the back of better-than-expected results from Disney, Chipotle, Twilio, Sonos, Mattel and others, markets sank due to an inflation reading that hit the highest level since 1982, and concerns that would lead to more aggressive Fed tightening.

With 72% of S&P 500 companies having reported, YoY EPS growth now clocks in at 30.3%, an increase of 1.1 percentage points from last week. Revenues also continue to climb, now standing at 15.3%. (Earnings and Revenue growth rates from FactSet)

Companies Flush with Cash, But What are They Doing with it?

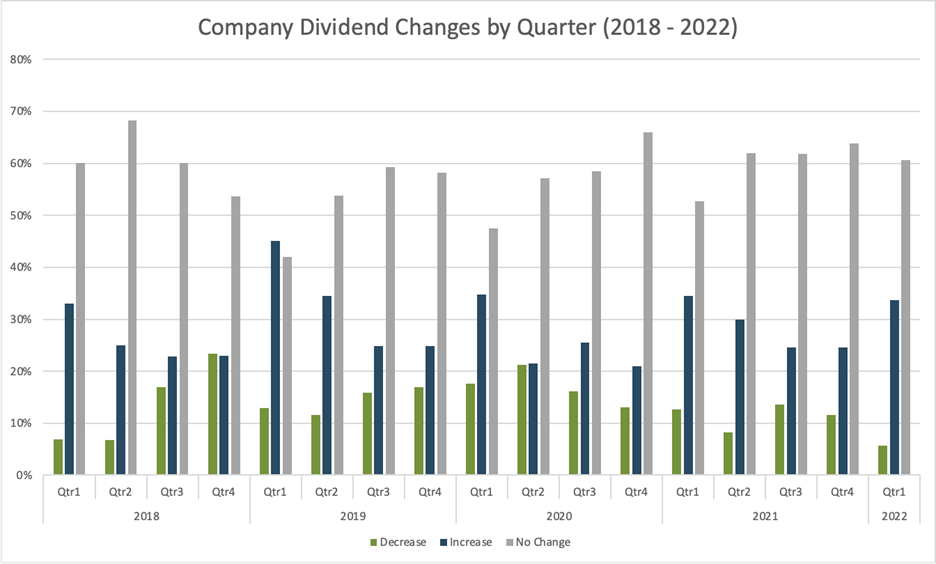

Earlier in the earnings season we pointed out how fewer companies were decreasing dividends, but that accompanied less increases as well, with a majority of firms announcing unchanged dividend payouts. That trend has changed since then. More dividend announcements at this point in Q1 are for increases, the highest percentage since Q1 2021. We’re also seeing the least number of dividend decreases in our 4 year history of this data. This is great news for investors.

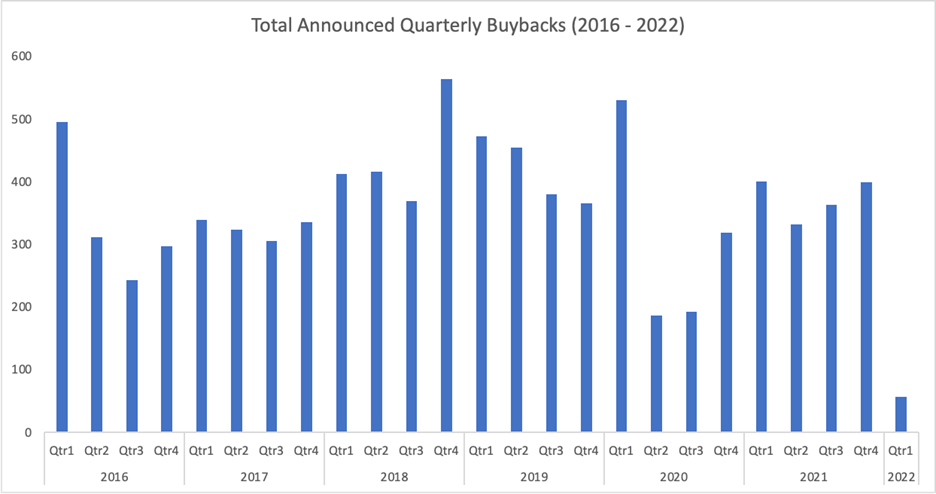

Another not terribly creative way companies use the massive amounts of cash they’ve been hoarding is by repurchasing stock shares. While we know executed corporate buybacks for Q4 2021 came in at $265B, catapulting the full year number to a record of $876B*, the number of companies announcing buybacks in Q1 2022 (out of our universe of 9,500) is running lower than average, perhaps a sign that companies are ready to put their money to work in more efficient ways such as increasing Capex and R&D spending.

*Data from S&P Dow Jones Indices

D/A Ratio – Another Bullish Sign for Q1?

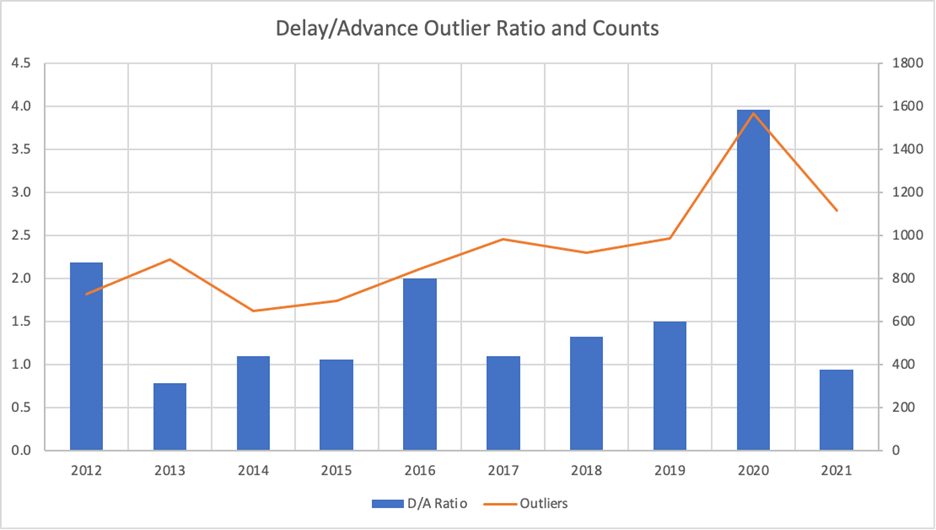

Currently we’re seeing the lowest number of companies delaying earnings reports (as compared to advancing them) in our 10 year history.

Why is this important?

A low Delayer/Advancer ratio shows companies are confident in what they have to share on their earnings call. Each earnings season we track whether companies report sooner, later, or in-line with their historical reporting date. Academic research shows that when a company delays earnings, bad news typically follows on the earnings call. Similarly, advancing an earnings date is highly correlated with good news being shared on the quarterly call. We find the Delayer/Advancer ratio to be a good indicator of corporate health.

Looking at just US companies with a market cap greater than $250M, the Delayer/Advancer (D/A) ratio for Q4 earnings improved slightly from last week to 0.6, meaning more companies are advancing earnings than delaying them. This is the best reading in our 10-year history, and well below the 1.1 average over that time period.

The chart below shows the D/A ratio for each of the last 10 years as well as for Q1 2022, and outlier counts (delayers and advancers) for each period.

Potential Surprises this Week – CROX, AMCX, SEE, PK

Crocs, Inc. (CROX)

Company Confirmed Report Date: Wednesday, February 16, BMO

Projected Report Date (based on historical data): Tuesday, February 22

Z-Score: -5.03

Since 2007, Crocs has reported Q4 earnings results as early as February 19 to as late as March 1, with no day of the week trend. As such we set a report date of February 22. On February 2 the company confirmed they would report on February 16, nearly one week earlier than we had anticipated based on their historical reporting range, suggesting there may be good news shared on the upcoming call.

AMC Networks (AMCX)

Company Confirmed Report Date: Wednesday, February 16, BMO

Projected Report Date (based on historical data): Thursday, February 24

Z-Score: -4.76

AMC Networks (not meme stock AMC Entertainment!) has historically reported Q4 results anywhere from February 23 – March 15, with no day of the week trend. As such we set a report date of February 24. On February 1 the company confirmed they would report on February 16, one week earlier than we had anticipated, suggesting results for the quarter may surprise to the upside.

Sealed Air Corp (SEE)

Company Confirmed Report Date: Thursday, February 17, BMO

Projected Report Date (based on historical data): Tuesday, February 8

Z-Score: 5.66

For the last 15 years, Sealed Air has reported Q4 earnings results from January 24 – February 10 (with the exception of Q4 2012 when they reported on Feb 19), typically on a Tuesday or Thursday. On January 13 the company confirmed they would report on February 17, over a week later than we had anticipated based on their historical reporting range, suggesting there may be disappointing results shared on the upcoming call.

Park Hotels and Resorts (PK)

Company Confirmed Report Date: Thursday, February 17, AMC

Projected Report Date (based on historical data): Thursday, February 24

Z-Score: -5.7

Since its spin-off from Hilton Worldwide in 2017, Park Hotels & Resorts has reported Q4 earnings results in a tight range, from February 25 – March 1. On January 10 the company confirmed they would report on February 17, one week earlier than we had anticipated based on their historical reporting range, suggesting there may be good news shared on the upcoming call.

Reports on Deck in the Week Ahead

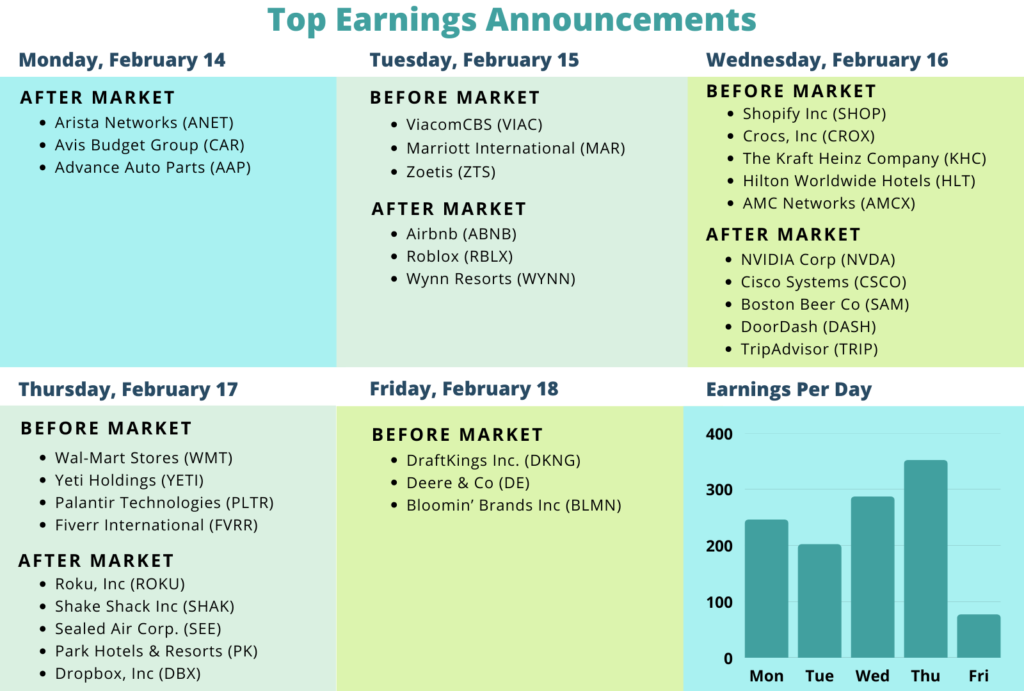

The third week of peak earnings season kicks off this week with more results out of the tech industry (NVDA, PLTR, CSCO), hotel & leisure (HLT, WYNN, PK) and the start to the retail earnings parade when Wal-Mart reports on Thursday.

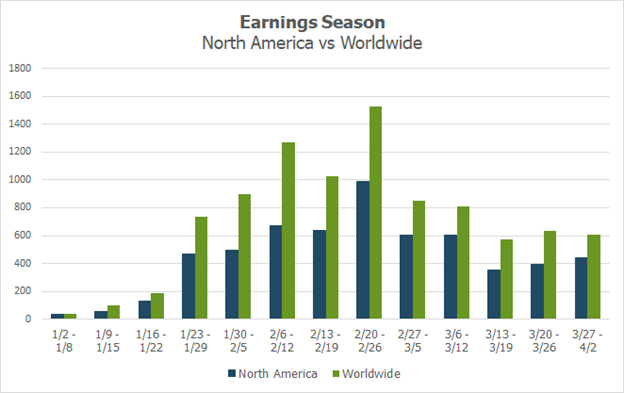

Earnings Wave

This week marks the third of peak earnings season, which will stretch on for a total of 4 weeks for Q4 2021, through February 25. February 24 is predicted to be the most active day with 736 companies anticipated to report. At this point 66% of companies have confirmed (out of our universe of 9,500+ global names).

*Source: Wall Street Horizon

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.