The US Dollar / Japanese Yen currency pair is moving higher once more as risk-on remains in play across the financial markets. This is primarily seen with the US equity markets trading at all-time highs.

With this in mind, we assume that JPY can see even more weakness against the Dollar.

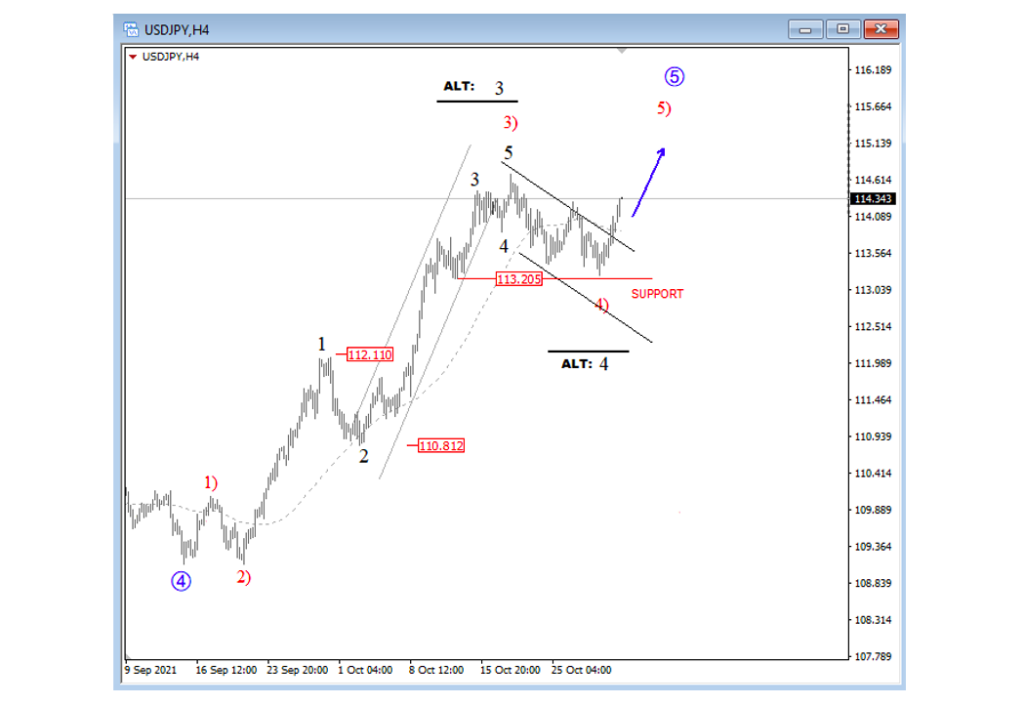

Using Elliott wave analysis, we can see that the USDJPY pair shows only a three wave set-back followed by a nice break out above its price channel. As such, we think more upside is coming this week, to around 115.00

USDJPY came once again slightly lower on the 4-hour time frame, but not in five waves yet, so it can be seen as just another correction within the uptrend. We see that retracement as a wave four so there is room for 115.00-115.50 this week into wave 5.

USDJPY 4h Elliott Wave Analysis

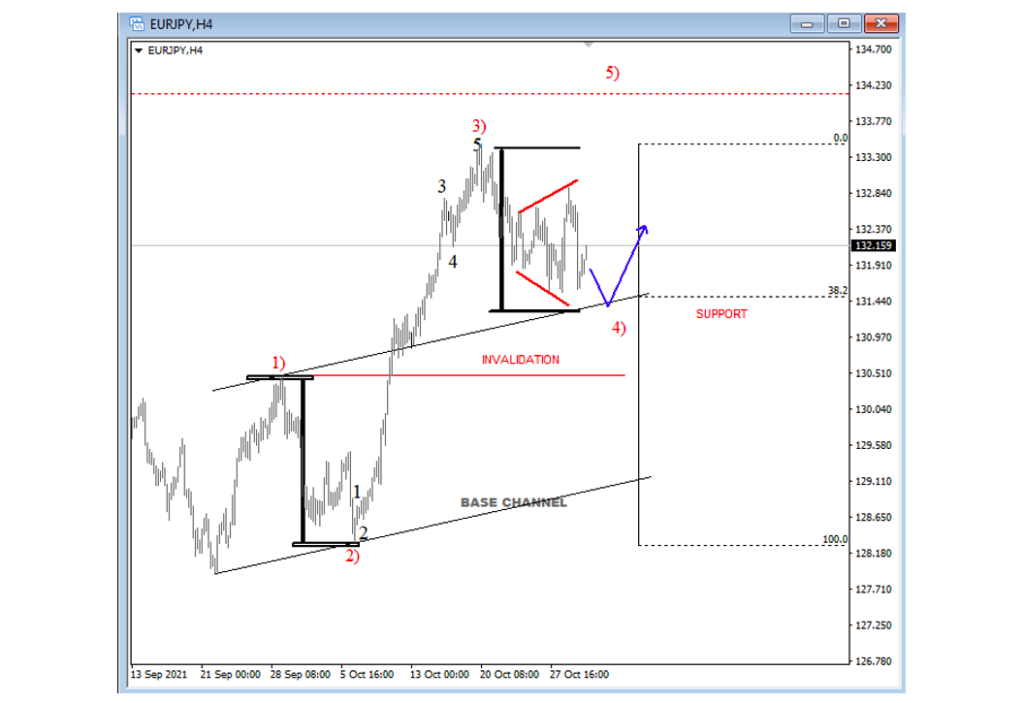

As expected, EURJPY is making a nice correction within wave 4) in the 4-hour chart, which looks to be still in play or maybe already finished after reaching 38,2% Fibonacci retracement. Anyway, support is still good here in the 132.0 – 131.0 zone, so sooner or later we can expect a continuation higher for wave 5), while the price is above 130.40 invalidation level.

EURJPY 4h Elliott Wave Analysis

GBPJPY is slowing down in the 4-hour chart after a push above May highs, which we ideally see as part of wave iv) correction of a five-wave bullish impulse, mainly because of slow and corrective price action. So, more upside is in view for wave v), probably from current 13 May swing high that can act as strong support here in the 156-155 zone.

GBPJPY 4h Elliott Wave Analysis

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.