The following research was contributed by Christine Short, VP of Research at Wall Street Horizon.

After closing out September with high-profile speaking slots at Code 2021 and the World Internet Conference, October is lining up to be another busy month for Tesla. The cult-followed automaker reports Q3 vehicle production & deliveries on Friday, October 1, followed by their annual Shareholder meeting on October 7, ending with their Q3 earnings and conference call on October 20/21. This could possibly be the most meaningful month for Tesla investors of the entire year, they will get a ton of volatility inducing information within a 3 week period. Traditionally Tesla shares tend to have a lot more noise and volatility than most stocks.

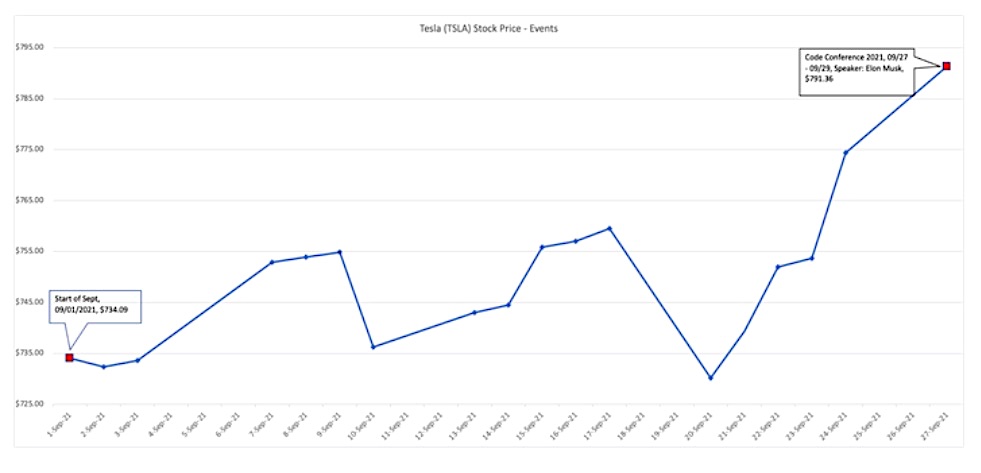

As you can see below, Tesla shares have been rising heading into this cluster of events, closing at $791.36 September 27 after the first day of CodeCon and second day of the World Internet Conference.

Oct 1 – Interim Report – Tesla Q2 2021 Vehicle Production & Deliveries

This is one to watch for Tesla, oftentimes their quarterly production and deliveries report stokes more reaction from investors than quarterly earnings. At one time Tesla was known for overpromising and underdelivering on these metrics, but in the last two years they’ve done a better job at providing guidance.

Just a quick trip down memory lane. In 2020 TSLA reported production of 509,737 vehicles and deliveries of 499,550, beating on guidance of 500k for the former, but slightly missing on the latter. In 2019 deliveries hit 367,200, and production hit 365,284 just slightly topping CEO Elon Musk’s guidance range of 360 – 400k. The three years prior they missed pretty significantly on both production and deliveries.

This year guidance was very vague, the automaker saying in January “Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. In some years we may grow faster, which we expect to be the case in 2021,” but providing no specific delivery or production expectations. That casted doubt amongst investors who have kept the stock well from the 52-week high achieved right as the year got underway. Tesla shares are still up 7% YTD, but that growth pales in comparison to last year’s rise of 700%.

The fuzzy guidance is partially due to the semiconductor chip shortage which has been especially hard on automakers. Musk admitted this is a “huge problem,” but Tesla said thus far it’s been able to “navigate through global chip supply shortage issues in part by pivoting extremely quickly to new microcontrollers, while simultaneously developing firmware for new chips made by new suppliers.” However, Q2 results offered some promising news, with deliveries of over 200,000 vehicles, up 9% from the previous quarter and 122% from Q2 2020.

October 7 – Shareholder meeting, 4:30 CDT, Virtual

Next up is Tesla’s annual shareholder meeting, always one that invokes an outsized reaction from the markets. Last year at this event the company announced that a $25,000 car was in the works, made possible by the cost savings in battery production that will benefit all of Tesla’s products. At the other end of the spectrum, they also announced the “Plaid” edition of their Tesla Model S, starting at $140k.

The event was initially set to take place in-person at Tesla’s Fremont factory in Fremont CA. However, Tesla did issue a warning on their website that they would “continue to monitor public health and travel safety protocols required or recommended by federal, state and local governments,” and make changes to the event as necessary. On Friday, Sept 24 those changes came, with Tesla announcing the event would now be held virtually, broadcasted from their Gigafactory in Austin, Texas.

Corporations are still being very diligent with their event planning. In regards to Shareholder meetings specifically, of the 402 that have been so far been scheduled for Q4, 299 are in-person, while 98 are virtual.

Oct 20 – Q3 Earnings Report and Conference Call

Rounding out the Oktoberfest of events is Tesla’s Q3 earnings report. Currently we have an unconfirmed report date of Wednesday, October 20, AMC. Note, however, that starting this year Tesla suddenly began to release quarterly results on Monday, after a 5-year trend of reporting on Wednesday. We will be waiting to see if that trend continues when they officially announce their report date for Q3, which we expect to come sometime next week. Whatever the date, investors will be looking to hear updates on earnings and revenues, among other things, which they handily beat during the first half of the year. Currently FactSet has a Q3 estimate of $1.38/share on the bottom-line and $13.03B on the top-line.

Peer Clusters

In late July/early August we saw a similar cluster lining up for competitor Ford. By the time of their first cluster event, Q2 earnings on July 28, the stock was down 13% from their 52 week high. After two high profile speaking placements at a Barclay’s event on Aug 2 and a Jefferies conference on Aug 3, the stock continued to travel lower, until mid-August. Shares have since rebounded to $14.28 today, a 68% increase YTD. Ford is having an incredible year thus far, recently adding jobs in order to increase production capacity for its all electric F-150 Lightning pickup as reservations top 150k.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.