One of my early investment lessons, via a good old fashioned book, really helped differentiate between the financial news and actual investing.

The financial news, whether via the TV, the newspaper or the blogosphere, has very useful, insightful and often entertaining content. However, the VAST majority of content is focused on putting the market or economy into perspective, explaining what has happened and why. Such as why oil is dropping, why yields are rising or why markets are up or down.

While it’s important to understand the context of why things are likely happening, investing is different. Investing, or more aptly successful investing, has to be focused on what is going to happen next given the context of what is currently priced into the market. Note to reader: what is already priced into the market is often overlooked.

To make things a tad more difficult, the markets are a dynamic fluid mechanism, driven by the behaviours of participants (that is all of us), with an unlimited number of outcomes. Put more simply, nobody knows what is next. That is ok though; with an uncertain road ahead, the best approach is to rely on long-term historical norms as a guide. This is how most portfolios are structured, for the most part.

The one exception is extremes. At times, the market or even the economy will go too far in one direction or another. These extremes can create opportunities, to profit or control risk. Of course, this isn’t easy either (nothing is it seems). Is the extreme a permanent new trend? How long will it persist? “The stock market can remain irrational longer than you can remain solvent” – John Maynard Keynes.

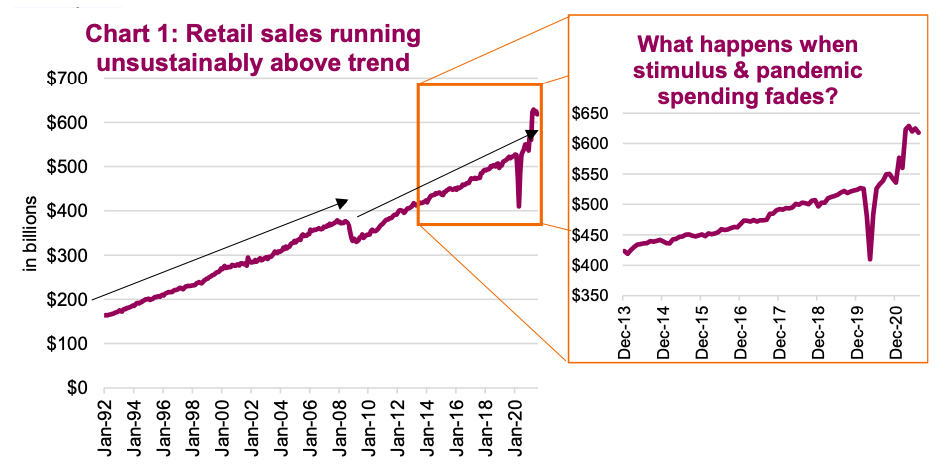

One extreme that has caught our collective attention is the behaviour of retail sales, consumer spending patterns, and related market performance of companies in this sector. Chart 1 is the monthly U.S. retail sales and clearly this has not just rebounded from the pandemic recessionary period, it has risen to a level unheard of in history. Historically, retail sales have grown at a relatively steady pace. It’s worth noting the drop in the 2008 recession, as consumers embarked on a ‘balance sheet’ focus during the recovery.

So why the elevated trend? Two big contributors: stimulus and changed spending patterns. Reports indicate that the government direct cash payment to consumers over the past year and a bit roughly went a third to savings, a third to investments and a third to spending. That certainly has led to retail sales running well above trend, with changed spending patterns. While these trends have started to reverse, spending on travel, leisure, eating out, transit, etc is down. With those expenses down, the consumer had more money to buy other things. Note that services are generally not captured in retail sales.

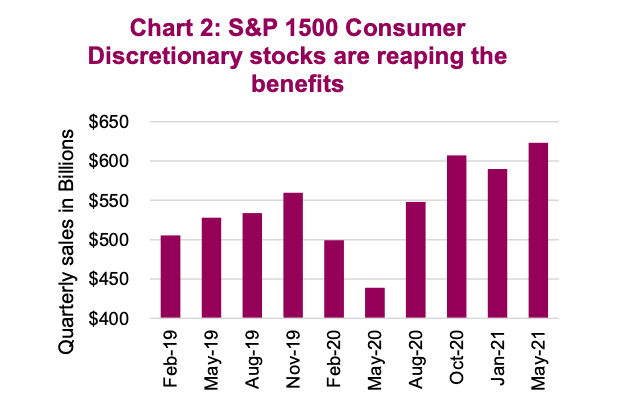

The same spending trend can also be seen at the company level. For the S&P 1500 Consumer Discretionary sector, which includes just over 200 companies, sales are running hot (Chart 2), and lifting share prices. Macy’s just reinstated their dividend and provided positive guidance. Before the pandemic, this company was often valued based on its real estate as nobody wanted ‘department store’ exposure. Or look at Costco, which is doing very well given its wide variety of merchandise and its consumers preferring to do more shopping at one location. But up 38% this year and trading over 40x forward earnings, how much is priced in?

Investment implications

We started this Ethos with ‘what’s next’. Without knowing when this pace of elevated retail sales will end, it is safe to say the current rate is somewhat unsustainable. As stimulus begins to fade and the re-opening trend has some of those spending dollars going back to travel, leisure and dining out, a return to trendline may be coming sooner rather than later. This could have big implications on those riding high on the current retail sales.

In plain English, don’t be afraid to take profits on consumer-spending-sensitive positions and/or remain underweight.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.