The following research was written with Christine Short, VP of Research at Wall Street Horizon.

The July Retail Sales report revealed a drop of 1.1%, disappointing analyst expectations as spending on goods fell from June’s lofty levels. Consumers ventured out to bars and restaurants, but online shopping dipped a material 3.1% month-on-month.[i] The market will soon shift its focus to how the back-to-school season unfolded amid rising COVID-19 Delta variant cases.

Many unknowns lie ahead through year-end. With supply chain bottlenecks and labor shortages still impacting the domestic economy, this year’s holiday shopping season will be particularly uncertain:

- Will consumers purchase ahead more than usual?

- Does persistent inflation find its way into the retail space?

- How are companies preparing for what should be extremely strong demand given more than $2 trillion of excess savings in the coffers of Americans?

For insight into these concerns, traders will want to pay close attention to Same Store Sales (SSS) data, upcoming retail earnings reports, and consumer-related conferences to manage risk.

Same Store Sales Data Coverage

Wall Street Horizon provides institutional investors with more than 40 corporate event types, including SSS data. Over time, many companies transitioned from disclosing SSS each month to simply including the sales numbers in quarterly earnings reports. Several retailers still issue monthly reports including Costco, PriceSmart, and The Buckle. Traders must monitor the earnings calendar for when market-moving SSS news strikes.

With nearly 90% of companies beating on Q2 earnings estimates, it’s even more important to dig into sales and EPS data to determine which firms are truly outperforming. If a company beats on the bottom line but has SSS results that fall short of expectations, that’s a red flag for investors.

Back-To-School

Kicking things off with the back-to-school season—Walmart’s quarterly report showed strong sales related to school spending. It’s not a surprise considering American consumers are flush with cash following the litany of economic aid packages since March 2020. Bolstering demand in July was the commencement of monthly Child Tax Credit payments focused on low to middle-income families. As a result, Walmart reported a 5.2% increase in comparable-store sales.[ii] Target’s comp-store sales came in at +8.9% driven entirely by traffic according to the August 18 report.[iii] Shoppers appear to be aggressive as the academic year gets underway.

Beyond the quarterly earnings reports from America’s big-box retailers, we can look to the National Retail Federation (NRF) annual Back-to-School 2021 report. The NRF survey found that families with children in elementary through high school plan to spend an average of $849 on school-related items, up $59 from last year.[iv] Total seasonal spending is estimated to register at $37.1 billion, up more than 9% from a year ago, according to the NRF. A slightly smaller percentage uptick is forecast for college-related spending.

It’s not a slam dunk, however. There was some uncertainty among analysts heading into this spending season as last summer’s buying spree might have pulled forward sales of big-ticket items such as laptops. Traders will want to pay close attention to sales reports of retailers big and small in the coming weeks to see if those concerns verify. While Q4 garners the most attention, some Consumer Staples and Discretionary companies produce bigger profits in advance of the school year than during the holidays. Now is crunch time for retail.

Shoppers have likely noticed a drop in promotions over the last several months. Retailers know that consumers are going to be aggressive this season (as the NRF record sales forecast shows). Tight inventories are also playing a pivotal role in the decrease in promos, according to the Census Bureau’s August 17 report.[v] This is yet another contributor to a potentially strong back-to-school shopping season, but if inventories deplete, it could have negative implications for the retail industry. There is much uncertainty amid high hopes for consumer spending.

Looking Ahead

Following what is poised to be a record back-to-school shopping season, how the school year unfolds is still unknown. Plans were to have traditional in-person learning, but the pandemic once again surprised us in a negative way. Rising Delta variant cases have already prompted the corporate world to delay plans to return to the office. (After all, if students are sent back home to virtual learning, many parents cannot commute to the office.) A worsening of the COVID situation would undoubtedly be a boon to online retail at the expense of brick and mortar. It’s yet another risk to consider.

While Q2 earnings season is mostly in the books, there are still key retailers yet to report. Below are some of the most important reports to gauge the state of the consumer.

August 24: Best Buy (BBY), Urban Outfitters (URBN), Nordstrom (JWN)

Best Buy is confirmed to report Q2 earnings Tuesday Before Market which will include SSS. A conference call with analysts takes place at 8:00 AM Eastern Time. WSH projects BBY’s Q3 report will be released on November 23. Best Buy is particularly important because of laptop sales—electronics is the lead spending category during the back-to-school shopping season. Laptop purchases are expected to clock in at more than $16 billion according to the NRF seasonal survey.

A stylish wardrobe is a must for students! Urban Outfitters and Nordstrom report after the bell on Tuesday with conference calls immediately following their respective releases. These two retailers will shed light on the strength in clothing sales during the back-to-school season, the second leading spending category this time of year.

August 26: Abercrombie & Fitch (ANF), Gap (GPS)

We’ll get further insight into Q2 clothing and accessories spending on Thursday when ANF reports in the morning and GPS in the afternoon. While these figures will not include August sales, the market will have more clarity on the strength of the shopping season was once these reports hit the street.

September 1: Costco (COST)

Costco is confirmed to report August SSS next Wednesday After Market. The $200 billion market cap Consumer Staples firm is confirmed to report its Q4 earnings report on Thursday, September 23 After Market with a conference call to follow. September SSS is scheduled for release on October 6. This will be among the first true gauges at the state of the consumer and US economy for August.

September 2: The Buckle (BKE)

Investors will get another glimpse of August spending in BKE’s SSS report next Thursday. While just a $2.2 billion market cap teen apparel retailer, its July SSS report included a massive 33.8% sales gain versus a year ago and a whopping 38.8% jump from the same period in 2019.[vi] Comparing sales to 2019 is a helpful tactic to gauging true changes due to quirky base effects of 2020. September SSS is scheduled for release on October 7.

September 7: GameStop (GME)

Few stocks are as volatile as GameStop. Traders should prepare for important news on Tuesday, September 7 as GME reports Q2 earnings After Market. Shares fell hard following its Q4 2020 and Q1 2021 earnings releases earlier this year. On March 24, GME lost one-third of its market cap. In June, the Q1 report resulted in a post-earnings day crash of 27%.Figure 1: GME stock price from Q4 2020 (March 23) earnings release through Q1 2021 earnings release reaction (June 10)[vii]

September 29: Bed Bath & Beyond (BBBY)

Another look at August spending will come from BBBY’s Q2 report for the period ending August 28. Despite getting caught up in Meme Stock Mania earlier this year, BBBY is a solid proxy for apartment and dorm furnishing sales. It reported a strong Q1 top line number, but earnings were somewhat soft due to high SG&A expenses. BBBY reports Before Market on the 29th and it will be one to watch to reveal how much Americans splurged on furnishing dorms for this fall.

October 28: Ethan Allen (ETD)

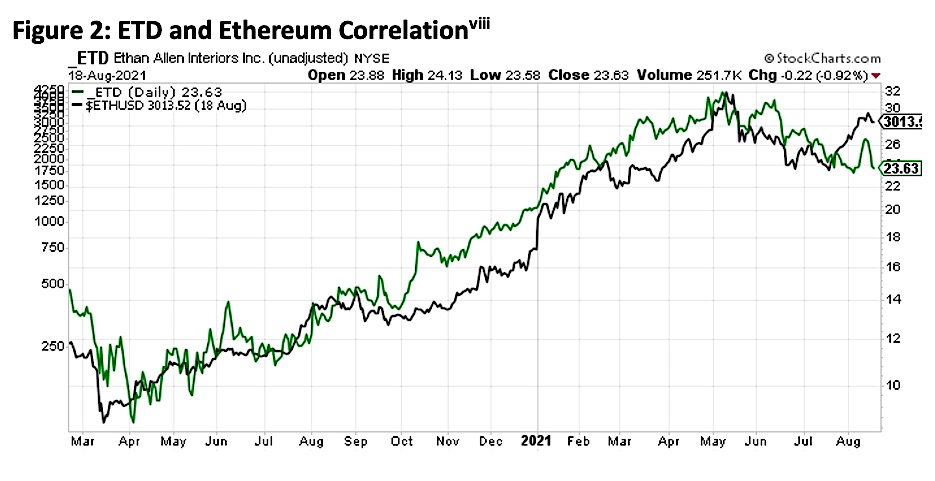

Looking further out, Wall Street Horizon set an Unconfirmed Earnings Date of October 28 After Market for Ethan Allen. ETD has been in the news recently for undergoing a name change to avoid confusion with Ethereum in the cryptocurrency space. ETD also announced a special dividend to be paid on August 31. This retailer of furnishings and accessories will provide a peek into September sales during its Q1 2022 fiscal year report.

It’s not always about fundamentals—the chart below displays an uncanny relationship between ETD (formerly “ETH”) and ETHUSD (the short-hand for Ethereum). With the new ticker, perhaps the confusion goes by the wayside, and ETD once again trades on the strength and quality of its sales and earnings.Figure 2: ETD and Ethereum Correlation[viii]

Retail Conferences

Additional insight will be gained from a slew of important retail conferences in the coming months. We gather and provide conference event details to clients. Often, breaking news from executives occurs at these corporate events.

September 9: Goldman Sachs 28th Annual Global Retail Conference

September 14: Scotiabank 25th Annual Back to School Conference

November 16: Jefferies West Coast Consumer Conference 2021

November 17-18: Bank of America Consumer and Retail Conference 2021

November 30: Morgan Stanley Global Consumer and Retail Conference

Our Q3 2021 Investor Conference Summary highlighted a broad list of major events beyond the retail industry.

Holiday Shopping Season

Investors should pay close attention to guidance and expectations regarding this year’s holiday shopping season. With a backdrop of supply chain bottlenecks, labor shortages, elevated inflation, and Delta variant fears, it’s unknown how retail sales will unfold. Wall Street Horizon has a beat on when to expect reports from the world’s biggest retailers. Stay tuned for updates from us on what events to keep on your radar as Q4 approaches.

Conclusion

Investors have never seen this kind of retail spending environment. Despite a slightly softer than expected July Retail Sales report, earnings among retail firms big and small have been stellar. Pent-up demand and tremendous excess savings should drive impressive revenue figures both via store traffic and online. There is no shortage of unknowns, however. Delta variant’s spread, tight inventories due to supply chain disruptions, delays in a return to the office, and other risks loom. Traders must closely monitor key events such as Same Store Sales data and retail conferences to manage risk.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Sources:

[i] https://www.census.gov/retail/marts/www/marts_current.pdf

[ii] https://corporate.walmart.com/newsroom/2021/08/17/walmart-releases-q2-fy22-earnings

[iii] https://corporate.target.com/press/releases/2021/08/Target-Corporation-Reports-Second-Quarter-Earnings

[iv] https://nrf.com/insights/holiday-and-seasonal-trends/back-to-school

[v] https://www.census.gov/mtis/www/data/pdf/mtis_current.pdf

[vi] https://corporate.buckle.com/sites/default/files/press_release/08_05_21_release.pdf

[vii] https://stockcharts.com/h-sc/ui?s=_GME&p=D&st=2021-03-23&en=2021-06-10&id=p12018553519

[viii] https://stockcharts.com/h-sc/ui?s=_ETD&p=D&yr=1&mn=6&dy=0&id=p54690997543

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.