Earnings season is nearing its conclusion for the U.S. and it has been a great season. With 442 S&P 500 companies having reported, 85% exceeded earnings forecasts and 83% beat on sales as well.

Looking at data over two decades, these are historically elevated positive surprise rates. Even more impressive has been the magnitude of the surprises. On average, earnings beat by +17% and revenue by +5%. Wow.

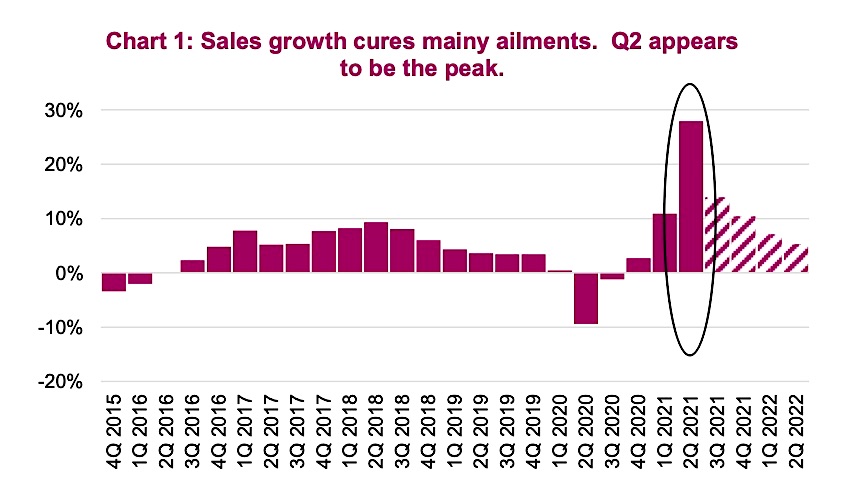

For a corporation, one thing that can cure most ailments, or at least alleviate them, is sales growth. Across those companies that reported, 86% had higher sales, and in aggregate this was an astonishing +28%. Yes, this is off depressed levels in Q2 of 2020, but it is more than just easy comparables. More sales allow a company the flexiblity to allocate, re-invest, increase dividends/buybacks, acquire and the list goes on. When sales are flat, many of these options just are not feasible.

Sales growth has also been helping alleviate the problem of rising costs. We have all seen it in our regular consumer lives – prices are up. And while many point to this inflationary burst as temporary, as the economy re-adjusts from the pandemic, price declines tend to be very slow or sticky. These higher costs are impacting companies, but rising sales growth, whether from passing through costs and/or rising volumes, have been more than offset.

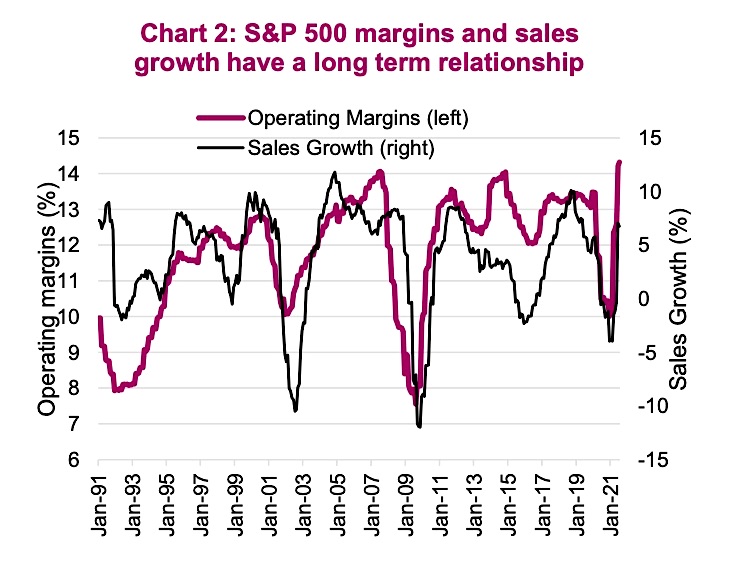

This shouldn’t be news. Sales growth has a long-term relationship with margins (chart 2). In fact, the correlation is about 0.5 and while they ocasionally drift in different directions, this is very temporary.

Inflation Could Topple Peak Margins

This of course raises the big question: What will happen next quarter if sales growth slows from the unsustainable pace of 29% to 14%, then to 10% to 7% to 5%? As the pace of sales growth slows, the importance of cost controls mounts. And if cost inflationary pressures persist, margins may drop faster than one might expect.

This trend may have already started, it is just not noticable in the aggregate data. Technology, Real Estate and Health Care sectors had more companies with deteriorating margins this quarter than those posting rising margins, compared to last quarter. Energy, Materials and Utilities enjoyed more companies with rising margins. Let me tell you, if Technology is starting to see lower margins, that is a big deal for the S&P 500 with its 28% tech weight.

Inflationary Costs to Weigh On Peak Margins? Ask Company Executives…

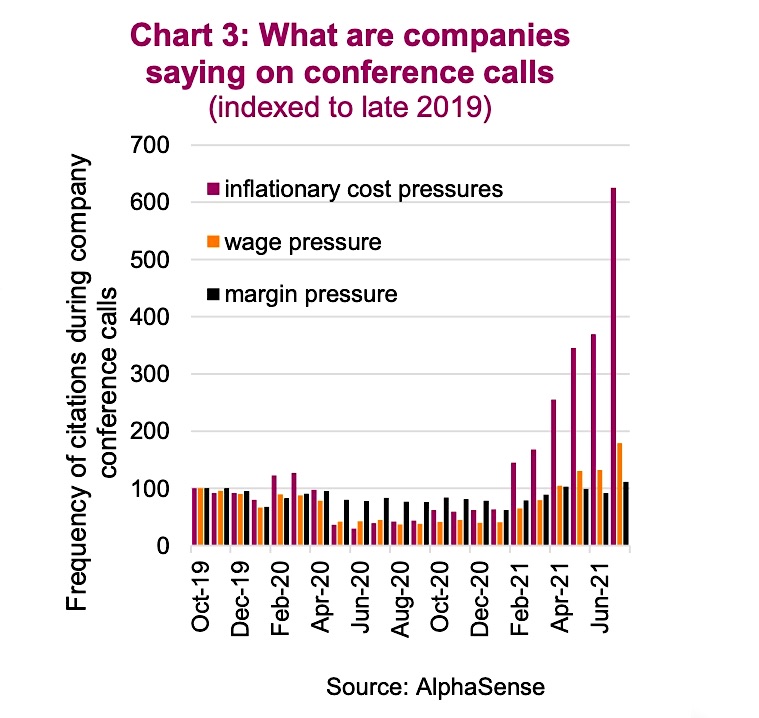

Chart 3 is what executives are saying on conference calls, mainly earnings calls. The bars are indexed to late 2019 before the pandemic and indexed to 100. Inflationary and wage pressure references dropped during the early pandemic months, but inflationary cost pressures have now skyrocketed. Wage pressures are starting to be talked about a little bit. Citing margin pressure remains low but we would be willing to bet this will start to rise in the months ahead.

As sales growth slows, and if inflationary pressure remains elevated, we believe that more companies are going to see margin pressures, especially if wages begin to pick up. Added

attention should be given to companies’ ability to pass through costs, and the sensitivity to labor cost inflation. It’s coming, but for now let’s just enjoy these fat margins.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.