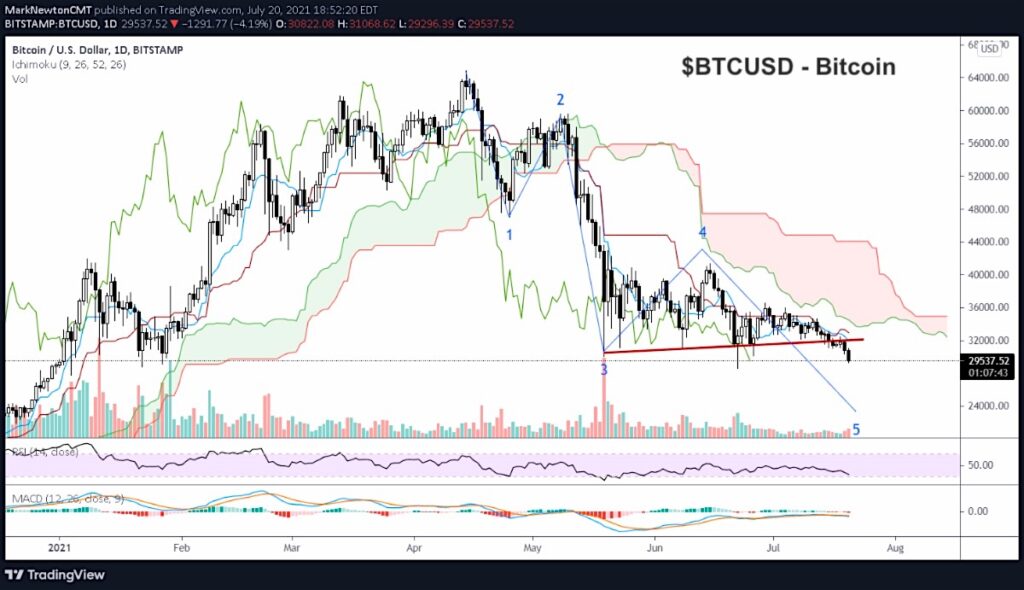

Bitcoin timing cycles are pointing to an inflection point this weekend. And although price cycles originally pointed to that being a trading “high”, it is now looking like it very well could be a low.

Bitcoin is breaking down below key price support, and odds are favorable that Bitcoin bottoms into this weekend before bouncing.

Structurally, Bitcoin is a mess and in poor technical shape. However, I don’t mind taking a stab and buying (in small size) if Bitcoin gets down to 25000-27000 for a bounce.

For those eyeing other cryptocurrencies, Ethereum has price support near 1600. That price area marks a minor undercut of recent lows and may cause stops to be set off at precisely the wrong time. My interpretation of DeMark’s tools show most Cryptocurrencies to be 3-5 days away from any sort of tradable bottom.

The bottom line, however, is that even if this sparks a bounce higher there isn’t any guarantee of a long lasting low. That said, I am opening up to the idea of attempting to buy weakness in small size and seeing what kind of rally develops.

In full disclosure, my weekly cycle composite shows a difficult time for most of 2021 and that even next year could be choppy before a very good 2023. However, as a trader, I suspect opportunity is near and will attempt to finally re-enter this market likely within a week after having sold most Crypto back in January-March time period.

If you have an interest in reading more thorough technical research twice a day, please visit NewtonAdvisor.com. Additionally, feel free to send me an email at info@newtonadvisor.com and I’d be happy to send you copies of recent reports or add you to a trial of my work. Individual and Institutional clients are shown pre-market thoughts on several markets and asset classes, mid-day thoughts and long/short ideas at @MLNewtonAdvisors (private Twitter). Email for details.

Twitter: @MarkNewtonCMT

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.