According to Mish’s Economic Modern Family, the market remains mostly bullish with only the transportation sector (IYT) and regional banking (KRE) sitting in cautionary phases under their 50-day moving average.

However, most of the Modern Family closed lower or flat on the day while, semiconductors ETF (SMH) made a large push to new highs ending +2.44% on the day.

The blatant move in tech could be showing us the next chapter of the market.

In hindsight, the tech industry was the first to recover from pandemic lows last year and is again showing strength compared to the other sectors.

Despite having been interrupted from supply chain issues, demand stayed strong in the tech space.

Conversely, other sectors could be losing momentum.

With that said, one way to see if momentum is slowing or gaining is through MarkgetGauges proprietary Real Motion indicator.

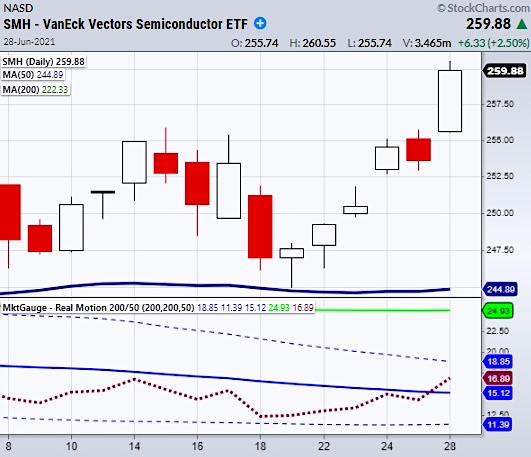

On the Semiconductors (SMH) chart, Real Motion has recently broken through its 50-period moving average.

This confirms that momentum is now following price, since the price is currently over its 50-DMA.

On the other hand, members such as Retail (XRT) and the small cap Russell 2000 (IWM) have a negative divergence with price over the 50-Day moving average and real motion under the 50-DMA.

With most of the Modern Family showing weakening or diverging momentum, will Semiconductors break to new all-time highs drag the other indices higher or will the rest of the family stay rangebound or begin to trend lower?

The Dow Jones Industrial Average is showing some stress. Mish walks you through and tells you what to look for before getting overly bullish in current market conditions:

Stock Market ETFs Analysis and Summary:

S&P 500 (SPY) is trading at new highs.

Russell 2000 (IWM) is struggling with price resistance at 234.

Dow Jones Industrial Average (DIA) has confirmed a bullish phase with second close over the 50-day moving average at 342.29 but still looks weak.

Nasdaq (QQQ) is trading at new highs.

KRE (Regional Banks) has support at 63.63 support. 68 choppy area.

SMH (Semiconductors) is trading at new all-time highs.

IYT (Transportation) has price support at 254.65

IBB (Biotechnology) has price support at 159.

XRT (Retail) traders should aware of 97 pivotal area.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.