In this case the bond market is calm, relaxed and whistling as it walks past the inflation data (aka the graveyard).

From recent client events and advisor conversations, the future path of inflation and yields in the coming months has been the most persistent topic of discussion, and for good reason.

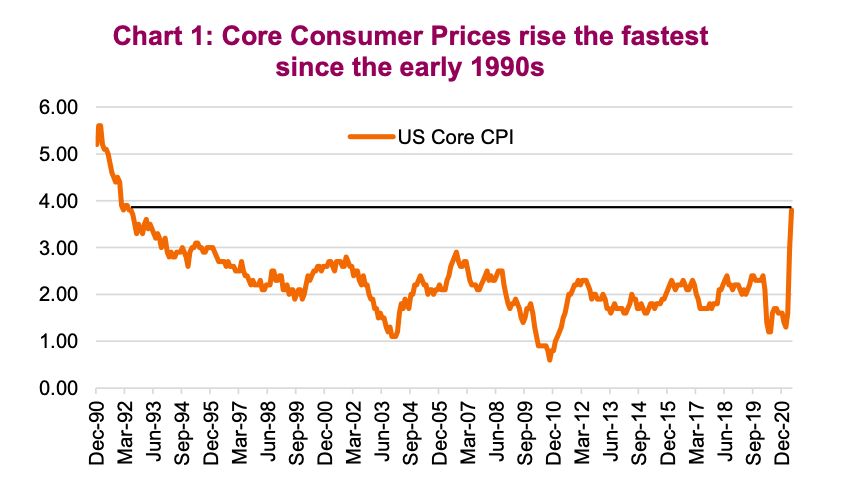

U.S. consumer prices (ex the more volatile food & energy components) have posted two big up months, 3.0% and 3.8% respectively for April and May. The headline number including food & energy was 4.2% and 5.0%. These are the highest Consumer Price Index (CPI) readings since the early 1990s. Yet since these data points were released, the 10-year Treasury yield has retreated from 1.63% to 1.46%.

To be fair, bond yields kind of knew this inflation spike was coming and rose from 0.60% to 1.63% during the preceding six months. The bond market is a forward-looking mechanism. So what lies ahead?

There are two camps: ‘inflationistas’ is a term being given to those who believe inflation will run hotter than the past decade or two for an extended period. And the other group, which doesn’t have a fancy name so we will call them ‘anti- inflationistas’, believe this spike will fade as quickly as it arrived and we will be back to a low inflationary environment. In this Ethos we’ll share some key evidence and points from both camps, then share our opinion.

Anti-inflationistas

This view is prevailing in the bond market today given how yields have remained tepid despite the spike in inflation. At the core, the anti-inflationists believe this is 100% transitory and there is no denying much of the spike in prices is temporary. This increase has been caused by supply chain disruptions due in part to the pandemic and logistics, plus a surprising rise in demand especially for durable goods. As an anecdote, the price we just paid for new foam inserts for our patio

furniture was elevated because so much foam was consumed to make PPE. Examples like this are almost endless but these mismatches between demand and supply will pass. Demand will normalize and/or supply will adjust.

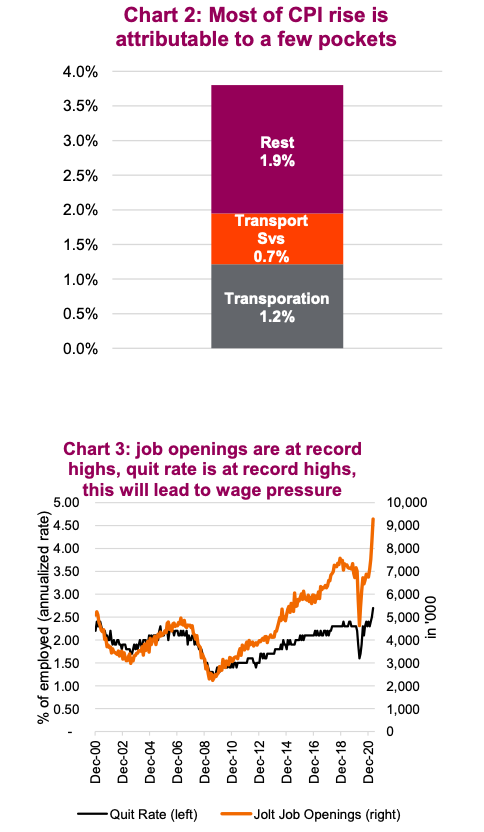

With core CPI up 3.8%, it is worth noting half of this can be attributed to Transportation and Transportation Services (Chart 2), which have a combined weight in core CPI of only 12.5%. Car & truck rental prices have ballooned, rising about 100% over the past year. Yes, this is coming off depressed levels but it seems many rental providers sold off a large portion of their fleets during the pandemic due to lack of demand. Now the demand is back, big time. As a knock-on effect, the sudden need to replenish the fleet has caused used car prices to rise 30%. Again, a temporary adjustment.

As the temporary imbalances are resolved, inflation will come back down and continue to be suppressed by the same forces that have been in effect for the past ten+ years. Demographics, global trade and technology. Adding to this is an increasing large amount of debt, which is deflationary.

Inflationistas

While the current inflation spike is largely transitory, there are underlying trends that will continue to put upward pressure on inflation even after the spike fades. Wages are starting to see upward pressure even with unemployment elevated. This can be seen in the job vacancies, quit rate and compensation intentions surveys (Chart 3). Companies are starting to reconfigure supply chains to make them more robust to shocks. While this is good, it is likely not as cheap, contributing to cost push inflation.

The amount of stimulus, both monetary and fiscal, is unprecedented and remains in place despite the economy already reaching new all-time highs (US GDP in Q1 $22 trillion). The central bank playbook is to allow inflation to get going before acting. Inflation builds and it is becoming more evident in expectations and in corporations’ mindsets.

Longer term, the disinflationary pressures of globalization are slowing. And demographics too are softening on the disinflationary side as the inflationary impulse from millennials rises and disinflationary baby boomers fade.

Our View

We do expect this inflation spike to fade as bottlenecks are resolved. However, how long is transitory? This elevated inflationary period could last longer than the bond market currently expects. Yields have remain flat, whistling past two high inflationary readings. What happens if we have a 3rd, 4th, 8th month of elevated inflation? We would bet yields will begin to rise in response.

Longer term after this spike period, we expect to see a higher base rate of inflation due to the demographics and slowing globalization. If the base inflation rate for the 2020s proves to be around 2.5% instead of 1.5-2.0% seen over the past decade, yields too will find a higher floor.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.