A weak US Dollar and uncertain economic and geopolitical environment are providing reasons to stay long precious metals. And more important then that is the price action, which has been strong as the holidays near.

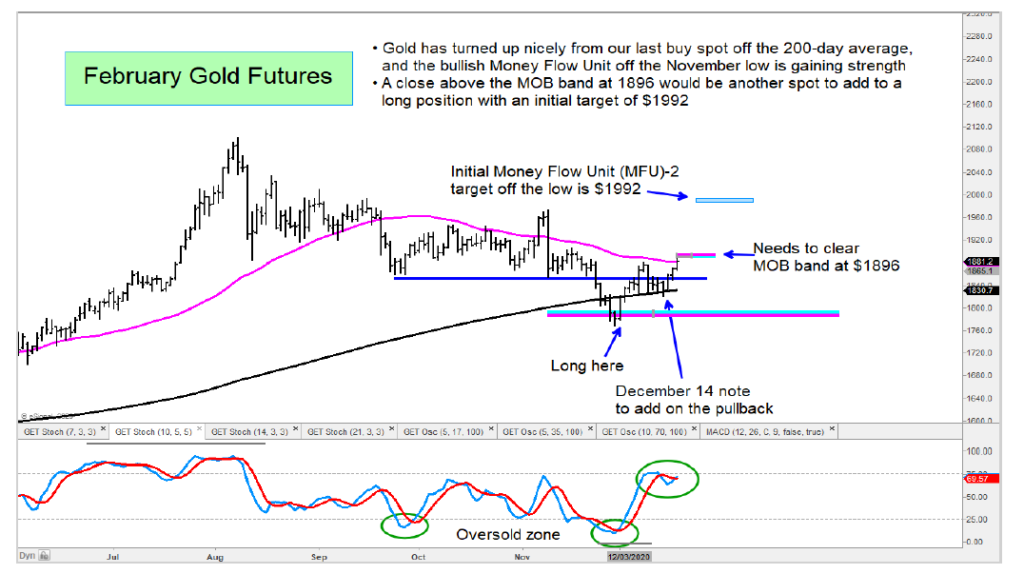

Both gold and silver futures continue to move higher off recent buy zones, with good momentum.

Silver has exhibited stronger momentum and has a well defined bullish Money Flow Unit (MFU) off the November low, and is clearly leading gold.

I see more upside in both metals – see charts below with comments.

I am also seeing some strength developing in select mining stocks as well, including Newmont Mining (NEM), Pan American Silver Corp (PAAS), and Barrick Gold (GOLD) to name a few.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.