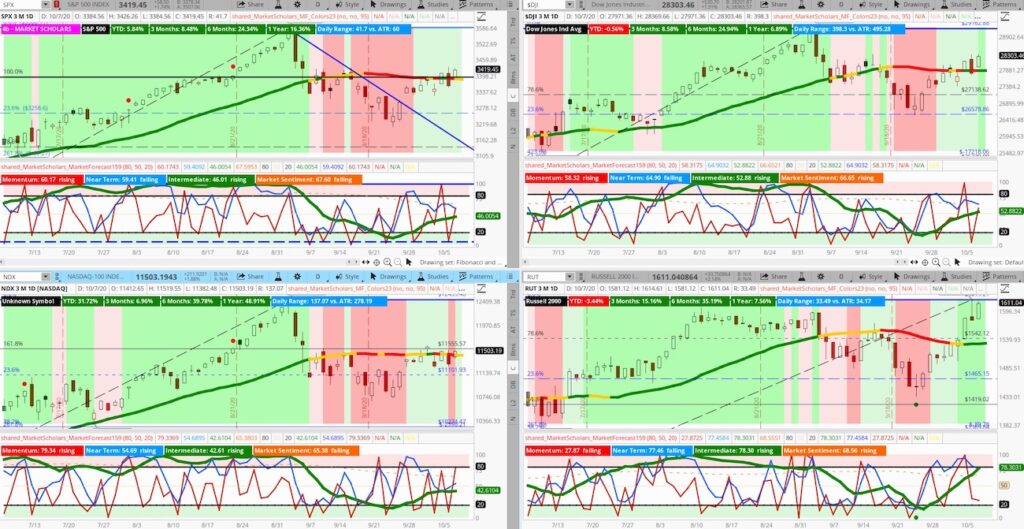

Stocks are rallying higher this week and small cap stocks are leading the way via the Russell 2000 Index.

The Market Forecast for the Russell 2000 is by far the strongest among the major indexes. In fact, its intermediate line (green line) is the only one above the 60th percentile and is close to getting into its reversal zone.

The small-cap index also has stronger short-term sentiment (blue line) with all three lines above its Market Sentiment (orange dotted line).

Other instances of strong small-cap outperformance relative to the recent leadership of the market suggest more of a retracement may be coming. The DMI-ADX, RSI and CCI for the S&P 500 is hardly showing strong bullish patterns as the S&P languishes in its retracement zone (shown in the video below).

Volatility remains high despite this past two weeks’ rally. Similar to other pullbacks in the past – including preceding the November 2016 election, the worst of the volatility may come at the end of the pullback rather than the beginning. The Russell 2000’s long-term underperformance suggests most of any weakness we may get over the next month may be realized more in the tech space.

Long-term bonds are finally breaking down, which is a major tailwind for equities in the long-term as the yield curve dropped to zero from Fall 2018 to the COVID low. Now, the curve is rising that suggests after we get through the volatility of elections, good chance S&P can continue to trend higher for a while.

We continue to have weak leadership with Energy and Materials strong and Financials and Utilities – two interest-rate sensitive sectors on opposite sides – moving higher together. Given the lack of cyclical leadership, this may be a sign not to trust the recent bullish sentiment completely…yet.

Get market insights, stock trading ideas, and educational instruction over at the Market Scholars website.

Stock Market Video for Trading Into October 8, 2020

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.