Stocks closed slightly higher last week while gold hit the highest level since 2011.

Outbreaks in COVID-19 cases are rising and will likely slow the economic recovery.

As the economy began to reopen, the outbreaks of the virus increased. We knew this would happen. But the infection rate in the U.S. has increased from around 20,000 cases per day in June to over 68,000 daily cases reported this past Saturday.

Some of this can be attributed to increased testing but some of this is due to people disregarding the CDC guidelines of wearing masks and social distancing.

The latest data on the economy has shown rapid growth in consumer confidence and spending. Retail sales, housing demand, and car sales have picked up.

The unemployment rate has surprised two months in a row with 7.5 million jobs recovered in May and June. However, there are still about 15 million fewer jobs than pre pandemic months.

As we see more outbreaks in the virus, the improvement in the jobs numbers may stall.

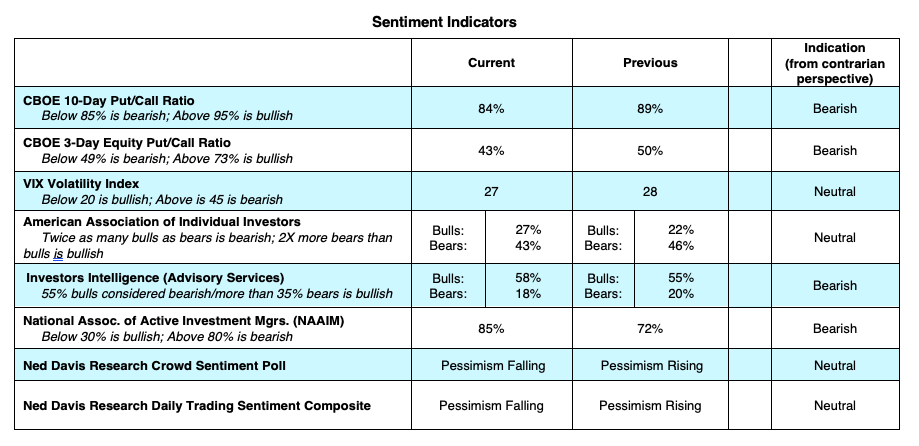

Signs of investor optimism are creeping into the stock market sentiment indicators, which from a contrarian stance, points to a short-term pullback.

Demand for put options (puts are bought in anticipation of a market decline) has dropped to levels seen just before the June market weakness. Investors Intelligence (II) which tracks the mood of Wall Street letter writers showed the bullish camp expanding to 58%. A reading above 60% has often led to market corrections.

The current rally has produced a falling number of S&P 500 stocks trading above their 50- and 200-day moving averages. When fewer stocks participate in the rally, the rally is often not sustainable.

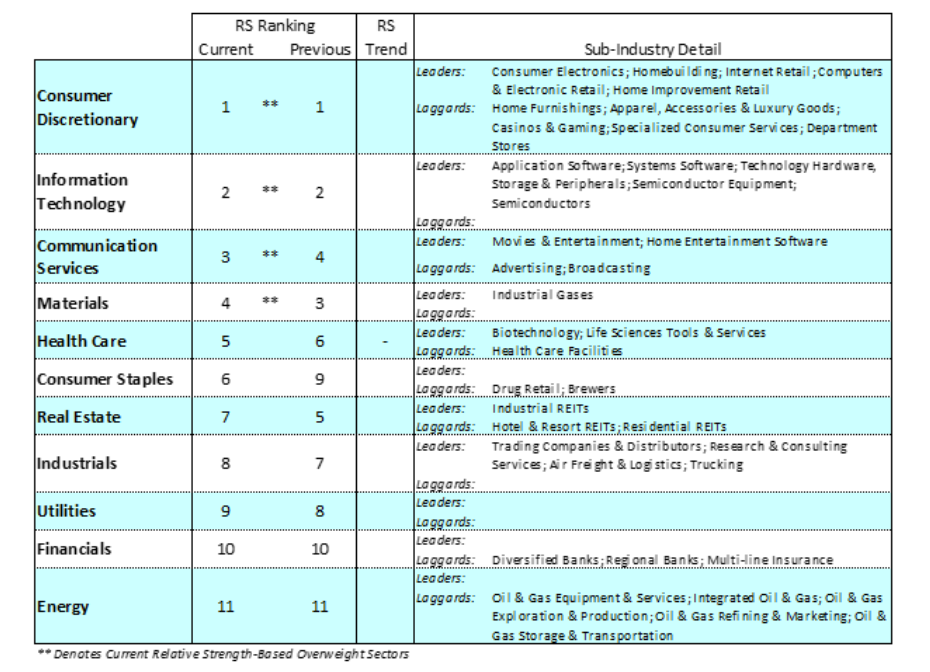

The technology sector led the stock market higher in the second quarter of the year. Facebook, Amazon, Microsoft and Apple are at or close to their all-time highs. History has shown that quick moves up in a concentrated sector eventually lead to dramatic pullbacks.

As long as the pandemic is with us, work from home trends, virtual business meetings and live streaming events will direct investors’ attention to the technology sector. This sector is appropriate for the growth portion of a portfolio but investors should be mindful of how much exposure they want to devote to this area. We encourage investment in cyclical sectors as the economy improves as well as health care where we will see increased spending.

We like utilities as a defensive sector and gold or gold mining stocks which tend to be a resilient asset and provide diversification in periods of uncertainty.

The Bottom Line: We may see disappointing economic data in July as a result of the COVID-19 outbreaks. Businesses will struggle to overcome major setbacks caused by the virus and it may take years before GDP reaches pre-pandemic levels. But with renewed emphasis on the guidelines to control the virus and with improving trends in consumer and business confidence the economy should continue its slow and steady path to recovery.

The technical data suggests a consolidation phase for the markets short term. But the ongoing fiscal and monetary support combined with ample amounts of investable cash on the sidelines provides a solid underpinning for this market.