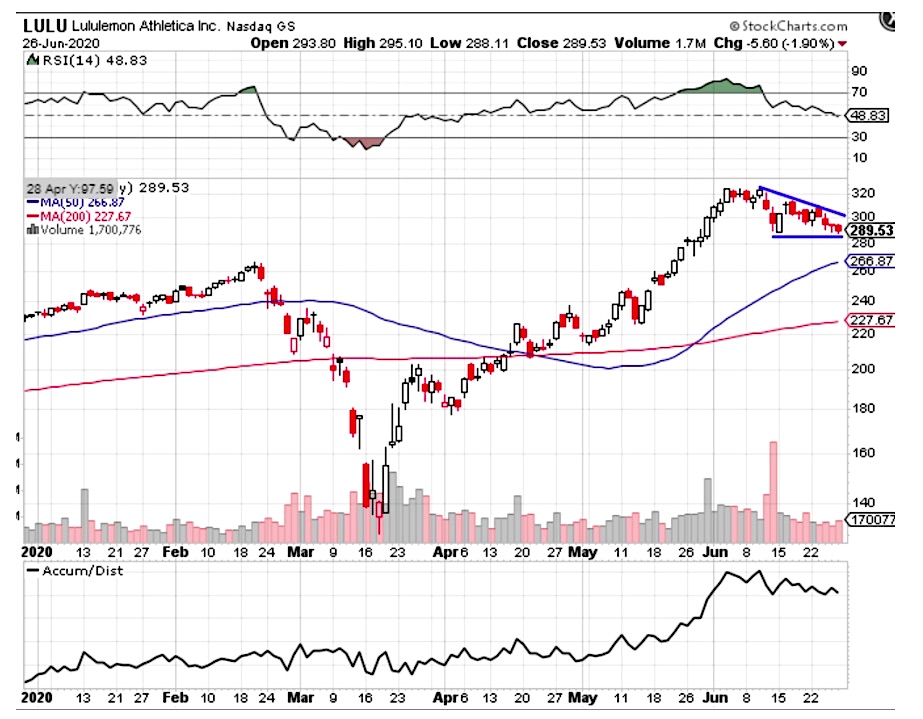

Lululemon stock (LULU) has been on fire since mid-March rising from 130 to a high near 325.

Since then the stock has pulled back to around 290.

After putting in a series of recent lower highs, Lululemon’s stock price is testing key support around 288.

The question is, will that support level hold?

Thankfully, option traders have the ability to trade any market opinion.

Here are three option trade ideas on LULU stock:

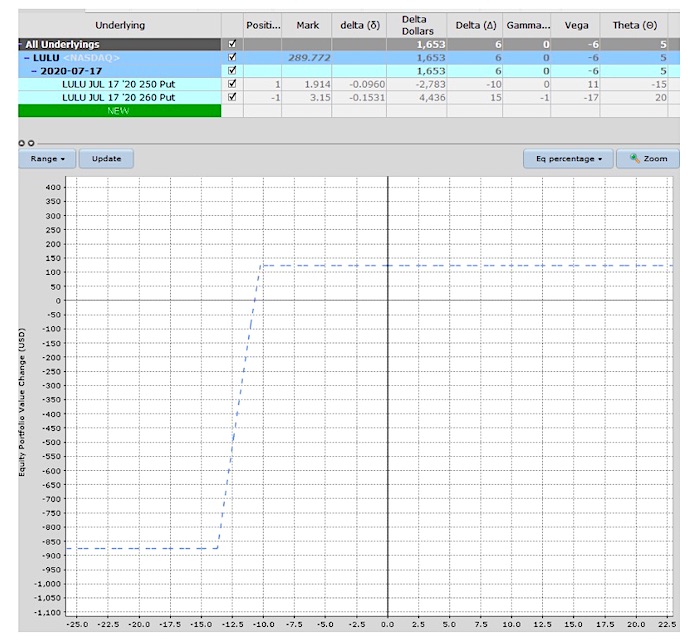

BULLISH TRADE

For bullish traders that think support will hold, a bull put spread can achieve a nice return in a short space of time.

Selling a July 17th put spread at 260-250 can generate around $1.05 in premium with risk of $895 for a potential return of 11.73% in around three weeks.

For a trade like this I would close out the trade pretty quickly if support is broken, otherwise look to hold to expiry.

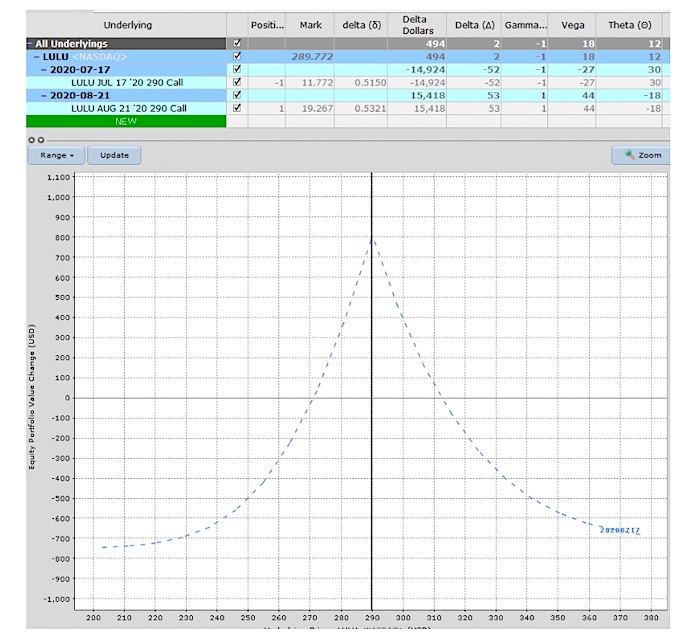

NEUTRAL TRADE

For traders that think the stock will stay flat for the next few weeks a calendar spread is a nice neutral trade this will also benefit from a rise in volatility.

With the stock trading around 290, placing a calendar spread at 290 makes sense.

Selling a July 17th 290 call and buying an August 21st 290 call would cost around $765 per spread. With a maximum theoretical gain of around $800.

For a trade like this, I would set a profit target of 20% and a stop loss of 20%.

A good understanding of volatility is important when trading calendar spreads.

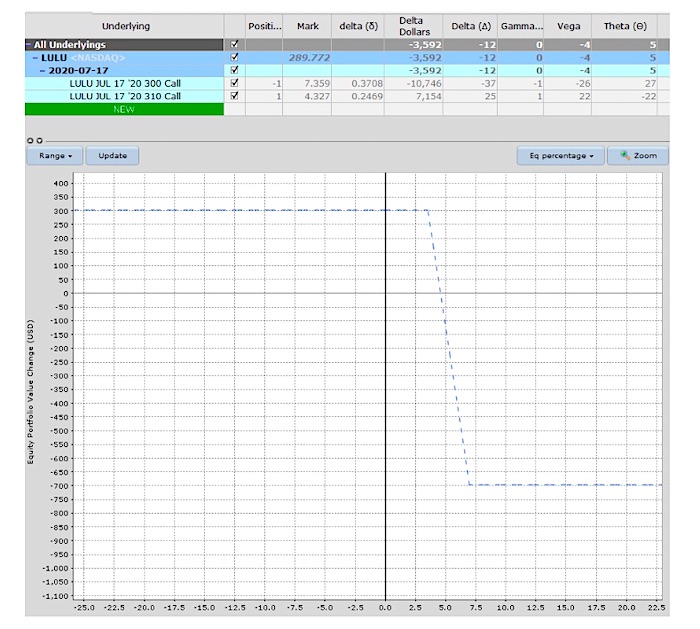

BEARISH TRADE

For traders that think LULU will take out the support level in the next month, a bear call spread could be a good idea.

A July 300-310 bear call spread would generate around $290 in premium with risk of $710 for a potential return of 40.84%.

This trade is close to being at-the-money so traders would want to be confident in a decline.

For a trade like this I would set a stop loss if LULU breaks above 300.

CONCLUSION

No matter what your opinion is on Lululemon stock over the next few weeks, there is an option trade to suit. Hopefully these three trade ideas give you some food for thought.

Remember that options are risky and you can lose 100% of your investment.

If you have any questions, feel free to reach out. Happy trading!

Twitter: @OptiontradinIQ

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.