The stock market continues to respond to the concerns of increasing numbers of COVID-19 outbreaks versus positive economic news, reports on developing treatments for the virus, and the prospects for more monetary and fiscal stimulus.

Signs that the economic recovery has begun were seen in the May jobs numbers that reported a gain of just over 2.5 million jobs versus an expected loss of 8 million jobs and the retail sales jump of 17.7%, the biggest monthly increase on record.

The Federal Reserve announced last week that it would continue its support of the credit markets by buying corporate bonds.

A Phase Four stimulus plan is in the cards which would purportedly include incentives for re-shoring American supply chains out of China, cutting payroll taxes, infrastructure plans, and litigation reform so businesses are protected if an employee contracts the virus.

The Virus

There are looming concerns, chief among them would be bankruptcies and continued levels of high unemployment, as well as geopolitical tensions. But the largest concern at the moment is the possibility of a significant acceleration of the COVID-19 virus that could have major health implications and also impact the economy.

Currently we are seeing an acceleration in the number of outbreaks but mortalities and hospitalizations are trending down. We knew when the economy began to open there would be an increase in virus outbreaks as more people begin to circulate in public.

Additional testing is also responsible for the increasing numbers of those who have the virus. If social distancing is indeed a valid precautionary measure, which I believe it is, then we can expect to see an acceleration of virus outbreaks in areas where large groups have gathered. The good news is that we are better equipped to handle the hot spots.

The virus will likely continue to shape the economic outlook but we have to get on with our lives and we are learning to adapt.

Civil Unrest

Historically, civil unrest has not had much impact on equity markets. I was a trader on Wall Street in August 1967 when Abbie Hoffman stormed the gallery and threw dollar bills from the balcony of the New York Stock Exchange to protest capitalism and the Vietnam War. At that time there was unrest in inner cities and on college campuses and riots at the 1968 Democrat National Convention, but the stock market ignored the unrest and continued on its way to post a 50% gain between October 1967 and early 1969.

And there are many other examples of the market ignoring painful events in our history. In the aftermath of John F. Kennedy’s 1963 assassination, the 1965 march in Selma, Alabama, Martin Luther King’s assassination in 1968, the 1992 Los Angeles riots, and the riots in Ferguson, Missouri in 2014, there was volatility in the market for only for a few days before the S&P 500 moved higher in each of those years. The market has a history of looking past economic and social turmoil to better days ahead.

The Federal Reserve

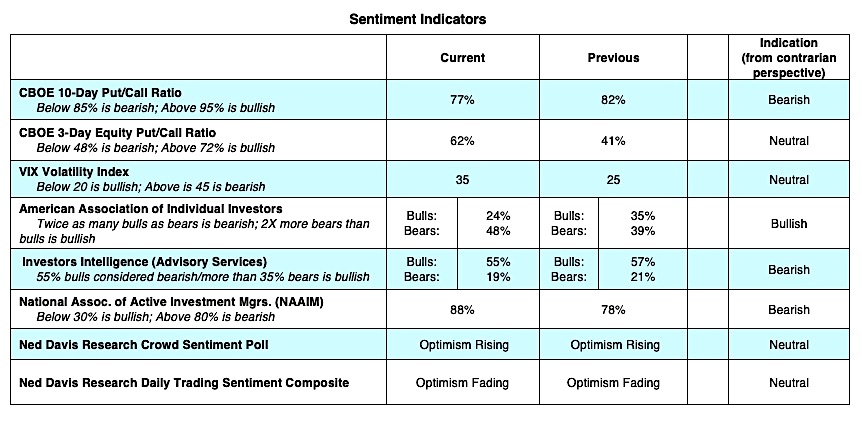

By almost every measure, equities are overvalued compared to their projected earnings but we have seen many examples, including recently in 2019 and January 2020, where investor momentum powered the market higher in spite of weak fundamentals. Currently examples of excessive optimism are seen in the high levels of call buying at the Chicago Board Options Exchange and a record number of new accounts at discount brokerage firms, which from a contrarian standpoint suggests a pullback in the market.

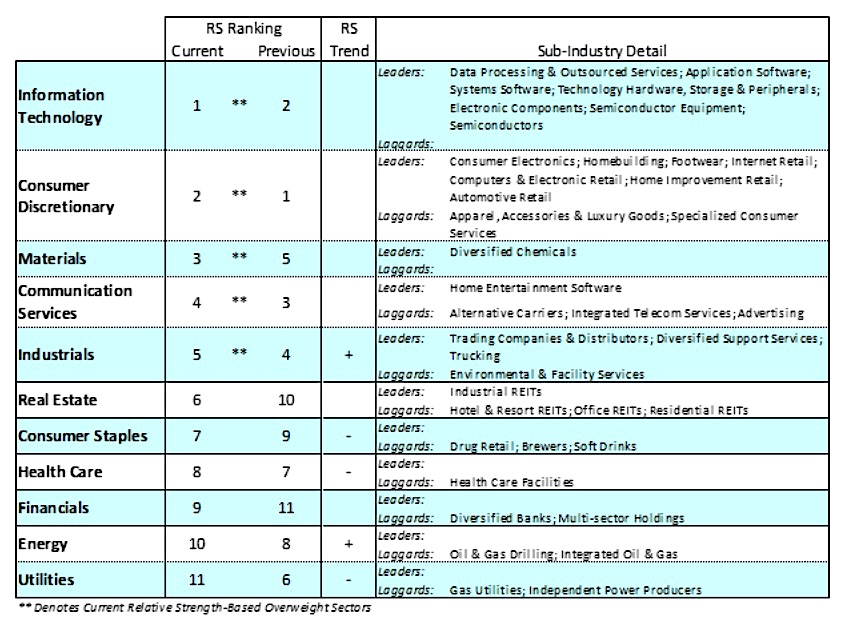

However, the low interest rate environment and commitment by the Federal Reserve that the central bank will continue to do everything in its power to help the economy indicates the market can maintain its strength. Volatility should remain high and stock prices will likely consolidate at this level over the short term. The sectors that are more economically sensitive typically lead the market during recoveries and we have recently seen the small-caps and cyclical stocks begin to break out. Also, we like gold or gold mining stocks as a hedge against potential dollar weakness and inflation.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.