If you were to gauge global risk appetite by stock market performance, the answer would be clear. Investors are hungry for risk and the higher expected returns that come with it.

Looking across other asset classes, the answer isn’t so clear cut.

While credit spreads are back near the cycle lows, bond yields themselves remain well off where they were at the start of the year.

Across the currency market, we’re noticing a similar trend. The U.S. dollar, along with the Japanese Yen and Swiss Franc, are traditionally viewed as safe-haven currencies.

When volatility picks up from any source, such as economic growth concerns or geopolitical issues, these currencies tend to outperform others.

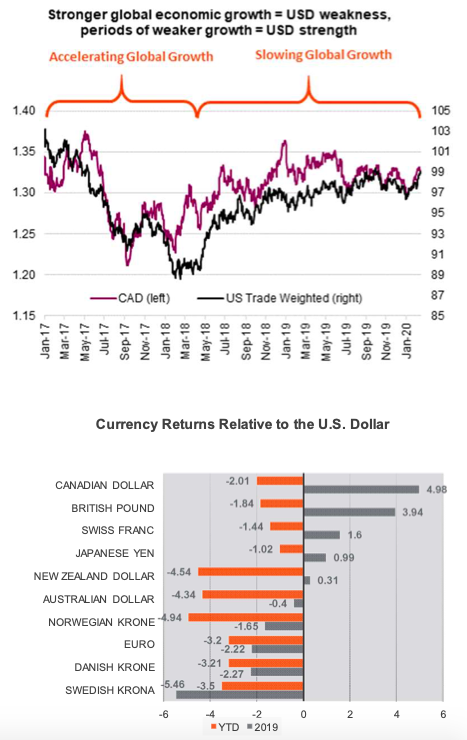

As Chart 1 shows, over the past few years the U.S. dollar has enjoyed a strong run. This entire period was associated with slowing global growth. Just when growth appeared to be starting to improve, a new curveball has been thrown into the mix in the form of the coronavirus (Covid-19).

It might come as a surprise, but the Canadian dollar was the top performer among the basket of G10 currencies in 2019. The basis of the outperformance was a relatively resilient domestic economy, which was surprising given the backdrop of slowing global growth and tensions on the trade front. Canada’s close relationship with the U.S. economy was a benefit to our economy, but general strength across the commodity complex – specifically oil and gold – also helped.

As any top performer would know, following such a strong performance

can prove difficult. Unlike the Toronto Raptors, who are having a fantastic season so far, the loonie has struggled to keep up, falling two percent against the U.S. dollar and giving up much of what it had gained over the past few months of 2019.

The real story, however, is more about U.S. dollar strength, and not loonie weakness.

A yield advantage

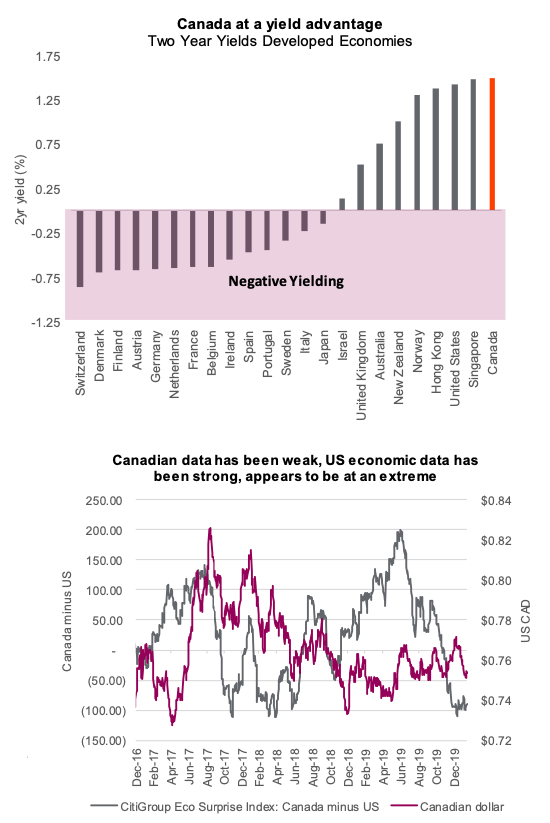

The Bank of Canada (BoC) was able to buck the trend of global central bank easing in 2019. This significantly improved Canada’s yield advantage over developed market peers – an advantage it continues to maintain. The top chart shows Canada at the top of the list for short-term bond yields. It’s still surprising just how many countries continued to have short-term rates in negative territory.

Stephen Poloz has made it clear that the BoC is not opposed to cutting rates. In January, the central bank opened the door to an interest rate cut should a recent slowdown in domestic growth persist (the rail disruption isn’t going to help the data). Fears of this slowdown might have gotten away from themselves with January job numbers coming well ahead of expectations. Rate-cut talk would normally crush a currency, but the BoC wasn’t acting alone. Expectations for a U.S. rate cut have risen in a similar fashion.

It’s a relative game

Canada’s economic data has been improving this year versus expectations. The Citigroup Economic Surprise Index has risen from an extreme low of -107 at the beginning of January to a more respectable -45. But, over the same period, U.S. data has also been beating expectations; so much so, that the spread between the two indicators (Canada minus U.S.) has remained firmly around -100 (2nd chart). This isn’t helping the case for a stronger loonie, but with the gap still at an extreme divergence, it’s a safe bet that they will converge in due time.

From a purchasing power parity perspective, the Canadian dollar remains undervalued by around 10%. It remains our base case for global economic data to continue to firm over the course of the year, though now we’ll have to get through a potential soft patch due to the coronavirus’ economic drag. It is still too early to tell if it will be material. The underlying trend of global growth (ex virus) has been improving, which should embolden currency traders to embrace the Canadian dollar over the U.S. dollar.

Technical perspective

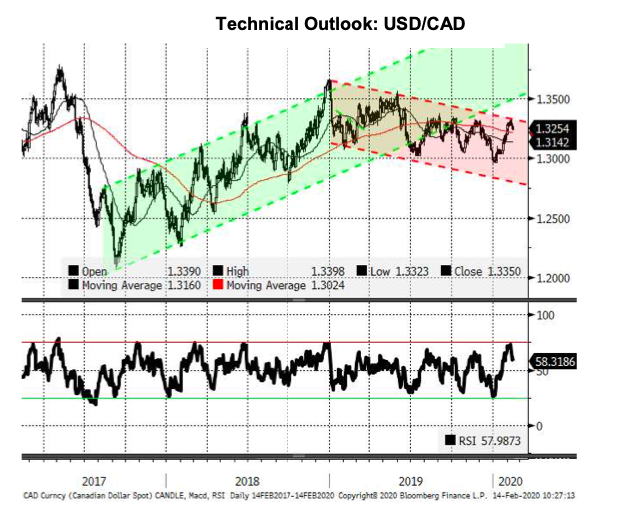

After very briefly breaking through $1.30 at the beginning of 2020, the loonie appeared to be moving sharply higher, having broken through fairly substantial technical support. But this wasn’t to be the case. The loonie quickly moved, breaking sharply lower with resistance now established at $1.33. It looks favorable from a technical perspective as the most recent move brings it back to the upper range of the downward-sloping trend channel. (apologies for the jargon!).

In the chart, you can see the current trend channel (red shaded area) and that current rate has moved to touch the upper levels. With the general expectation that this channel will hold, the most rational expected move from this point would be for it to move lower (strong loonie), and retest $1.30 with the potential to eventually break through.

Who’s driving the bus?

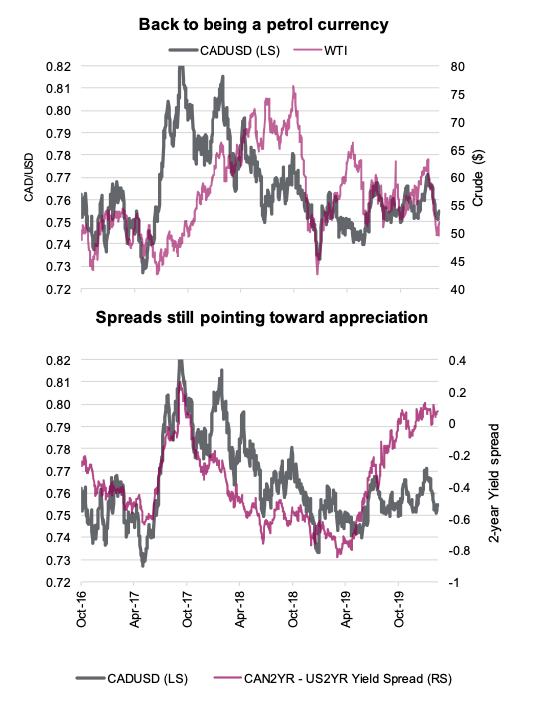

The Canadian dollar is potentially reverting to its reputation as a petrol currency. While it typically always has a positive correlation to oil, one-month correlations have risen to almost their highest level in the past three years.

The two charts to the right show that oil prices are currently the primary driver, while the correlation to interest rate spreads has diminished. Rate differentials, or the difference between Canadian and U.S. two-year bond yields are still pointing towards further appreciation.

Portfolio implications

Investing is difficult, and the brain can often cause more harm than good. One of the most prominent behavioral biases is recency bias – a tendency to focus on events that happened in the recent past and project them into the future. Following a year with a rising loonie, we’ve noticed an increase in appetite for hedged global investment products. To hedge or not to hedge is an age-old question with no simple answer.

Over a long enough timeframe, we’re firm believers in leaving global exposure unhedged, though a case can be made for hedging to minimize volatility, especially with fixed income products.

In the shorter-term, being active with currency hedges can add value, but you have to be right.

At present, the cost to hedge USD exposure is negligible and our view is that the swift bout of weakness this year for the Canadian dollar has driven it too far too fast. As such, we’ve entered a partial hedge on our U.S. dollar exposure within the Purpose Core Equity Income fund.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.