December corn futures closed Friday at 3.76, as traders continue to find a narrow price range under $4.

Our weekly corn outlook analyzes the latest news, WASDE report data and forecast, as well as the current price action on March 2020 corn futures.

Monday’s Weekly Crop Progress report showed the U.S. corn harvest reaching 89% complete as of December 1st, 2019, which compares to 97% a year ago and the 5-year average of 98%.

At face value the current harvested percentage nationally would suggest that approximately 1.5 billion bushels of corn still needed to be picked as of Monday morning with approximately 300 million bushels of that total stranded in North Dakota corn fields. North Dakota’s corn harvested percentage was estimated at 36%, just a 6% improvement from the week prior and 59% behind its 5-year average.

It’s apparent a significant percentage of North Dakota’s corn crop could spend the majority of the winter season exposed to the elements. Meanwhile, Michigan and Wisconsin were both reported at 66% harvested versus a 5-year average of approximately 90% for both states.

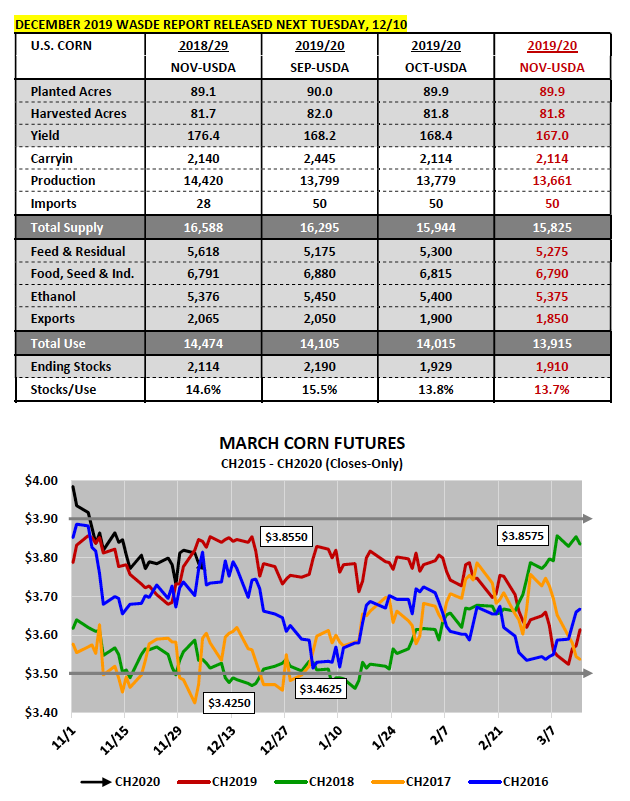

Traders are coming to the conclusion that U.S. corn production will likely be lowered in the USDA’s January 2020 WASDE report; however, opinions vary as to just how many bushels will be forfeited. Based on recent price action, it doesn’t appear the market is overly concerned about significant production losses threatening 2019/20 U.S. corn ending stocks; last forecasted at 1.910 billion bushels in the November 2019 WASDE report.

Wednesday’s EIA report showed U.S. ethanol production surging for the second consecutive week. For the week ending 11/29/19, U.S. weekly ethanol production averaged 1.060 million b/d, the highest weekly run-rate since July 12, 2019.

Furthermore for the month of November U.S. weekly ethanol production averaged 1.039 million b/d, up significantly from October’s average of just 0.983 million b/d. U.S. ethanol stocks responded with a week-on-week build totaling 362,000 barrels. Total U.S. ethanol stocks were estimated at 20.639 million barrels.

That said, despite the stocks increase, U.S. ethanol inventories remain more than 3.8 million barrels below the 2019 record high of 24.468 million barrels (July 26, 2019) and approximately 2.4 million barrels below a year ago versus the same week.And finally, with U.S. ethanol production/stocks now both trending higher, it should be noted that Chicago Argo ethanol values have endured a sharp downward correction since trading up to $1.70 per gallon on 11/26, their highest level since December 20, 2016. At last check Chicago Argo ethanol was trading back under $1.50 per gallon.

Thursday’s Weekly Export Sales summary showed U.S. corn export sales totaling 21.5 million bushels for the week ending 11/28/2019.

This was down 32% from the previous week and 18% below the prior 4-week average. Crop year-to-date U.S. corn export sales increased to 575.4 million bushels versus 1.053 billion bushels a year ago, a negative differential of 477.6 million bushels or -45%. As of the November 2019 WASDE report, 2019/20 U.S. corn exports were forecasted at 1.850 billion bushels, 215 million bushels below 2018/19 (-10%).

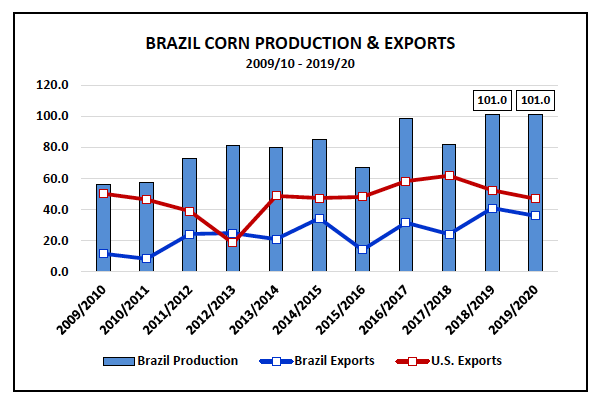

It’s recently been reported that due to a rise in domestic corn prices in Brazil, U.S. corn values have become increasingly more competitive in the world export market.

That said there hasn’t been any notable improvement in weekly U.S. corn export sales to date that would solidify this narrowing price spread.

Furthermore, there was a survey published earlier this week via Reuters indicating Brazilian farmers intended to plant more than 18.0 million hectares of corn in 2019/20 (44.5 million acres), a 3.5% increase from a year ago, with total 2019/20 Brazil corn production estimated at 101 MMT (equal to last year’s record high). This would then seem to suggest that assuming Brazil’s safrinha corn crop gets planted in a timely fashion this February, while also avoiding any major weather-related setbacks during the growing season, Brazil will remain a strong, opposing force in the world corn export market.

Please note: Brazil’s second corn crop (safrinha) represents more than two-thirds of total Brazil corn production and is seeded after the soybean harvest primarily in Mato Grosso, Parana, Mato Gross do Sul, and Goais. It’s harvested in July, August, and September and therefore works to aggressively diminish U.S. corn export sales in the late summer and fall.

CORN FUTURES TRADING OUTLOOK – week of December 9th

The narrative in corn largely remains the same with traders unwilling to chase fresh corn longs on account of harvest delays in the upper Midwest.

Corn Bulls have been attempting to sway public opinion as it relates to the 1.5 billion bushels of corn that have yet to be harvested, which essentially equates to approximately 80% of the USDA’s projected 2019/20 U.S. corn ending stocks forecast of 1.910 billion bushels. However thus far, the market has opted to instead focus primarily on disappointing U.S. corn demand in all 3 major usage sectors.

Furthermore, the continued back on forth on a potential U.S. – China phase one trade deal has essentially worn traders out, making most, if not all skeptical of any real, enforceable deal being consummated prior to December 15th (which is the deadline before new U.S. tariffs go into effect on approximately $156 billion of Chinese goods). I continue to believe that even if a trade deal is made with China, it’s far more likely to benefit soybeans than corn over the short-term.

Next week the USDA will release its December 2019 WASDE report (12/10).

The average trade guess for 2019/20 U.S. corn ending stocks is 1.919 billion bushels, up 9 million bushels from the November estimate. Historically the USDA does NOT make any adjustments to yield and/or harvested acreage in the December report (those changes are reserved for January). Therefore, my assumption is that traders anticipate possible cuts to corn-ethanal use and/or exports.

Friday’s Commitment of Traders report showed Money Managers buying back nearly 31,000 contracts of their net corn short (which was estimated at -85,137 contracts as of the market closes on 12/3).

However, even that wasn’t enough to help generate a higher weekly close in March corn futures. Ultimately, I still see a range bound market in CH20; actively trading between $3.65 to $3.90 over the next 30 to 45-days.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.