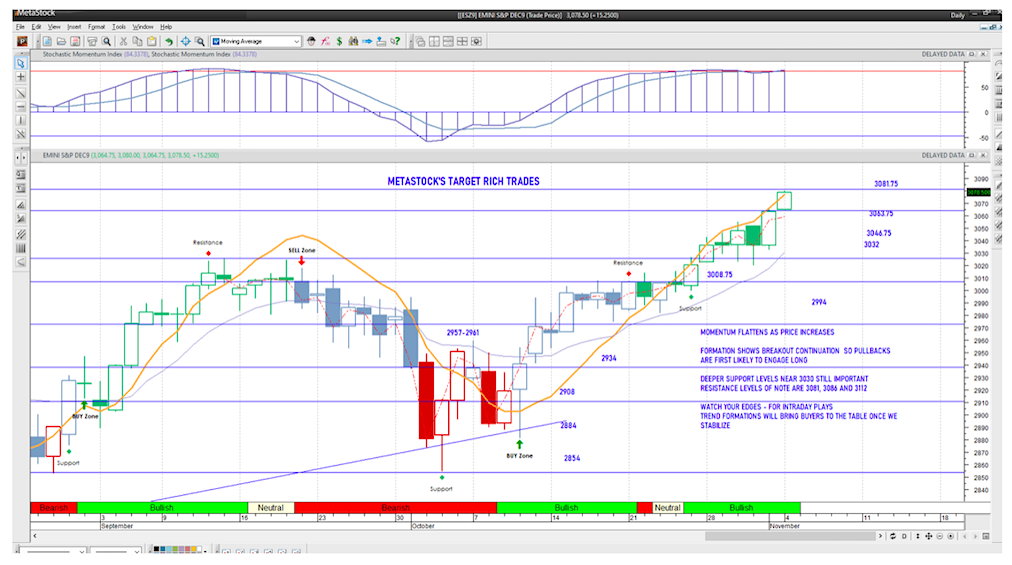

S&P 500 Index Futures – Trading Chart November 4th

MARKET COMMENTARY

Traders continue in the ‘all clear’ signal break higher with an unexpectedly good jobs number (relative to the environment, that is). Trade deal news keeps markets pressing higher without dips into Friday’s range- quite a bullish signal in the premarket (broadly speaking).

WEEKLY PRICE ACTION

Bullish action with a close today over 3061 keeps us bullish (in terms of weekly closes), with positive momentum present and building.

Weekly patterns remain quite strong as do the monthly patterns- from a bullish perspective. Pullbacks ought to be buying regions. Be cautious adding to swing positions in either direction – particularly if you are considering shorts.

COMMODITY & CURRENCY WATCH

Gold prices sit on the upside of support even as charts break higher. We should see some measure of capitulation from buyers, if the bullish action holds in the broad markets.

Breakout patterns look like tests of 1520 to 1535. Certainly a mixed signal as traders test all time highs while gold continues a march higher. Use caution with size – there is significant risk in the charts.

The US dollar has failed at a major support region but still holding above 97. The longer it sits outside of the channel, the more likely it is to break down. This would help the Fed in its plan to stop interest rate drops. WTI sits right above 57 after a bounce off on Wednesday of last week. Resistance now sits at 57.85.

TRADING VIEW

Buyers have pressed higher- well above the breakout level above 3063 in the ES_F which will hold as baseline support with sellers likely to try to wage a battle there. Buyers have the advantage currently, but be patient and wait for your setups. Understand your levels and prepare for them.

The theme of motion is:

POSITIVE AS LONG AS WE HOLD ABOVE 3061ish today (with big spikes likely fading back into congestion)

NEGATIVE IF WE DECLINE AND HOLD BELOW 3032ish today (with sharp bounces failing and deep pullbacks holding)– choppy inside the range.

Do what’s working (that means follow short trend and momentum signals while in the intraday spaces) and watch for weakness to develop away from your trade direction in order to leave.

Learn more about my services over at The Trading Book site.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.