We have seen several analysis of precious metals on See It Market over the past few weeks.

Articles by Chris Kimble and Michele Schneider on the Silver to Gold ratio are must reads. NYSEARCA: SLV NYSEARCA: GLD

So why is silver in the news? Why is it important?

The reason is because silver carries the same importance that small caps and tech stocks do too equities. When silver is outperforming, it means that precious metals are “risk-on”. Several gold rallies have failed because silver hasn’t been playing along. BUT the recent rally has metals bulls excited again.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

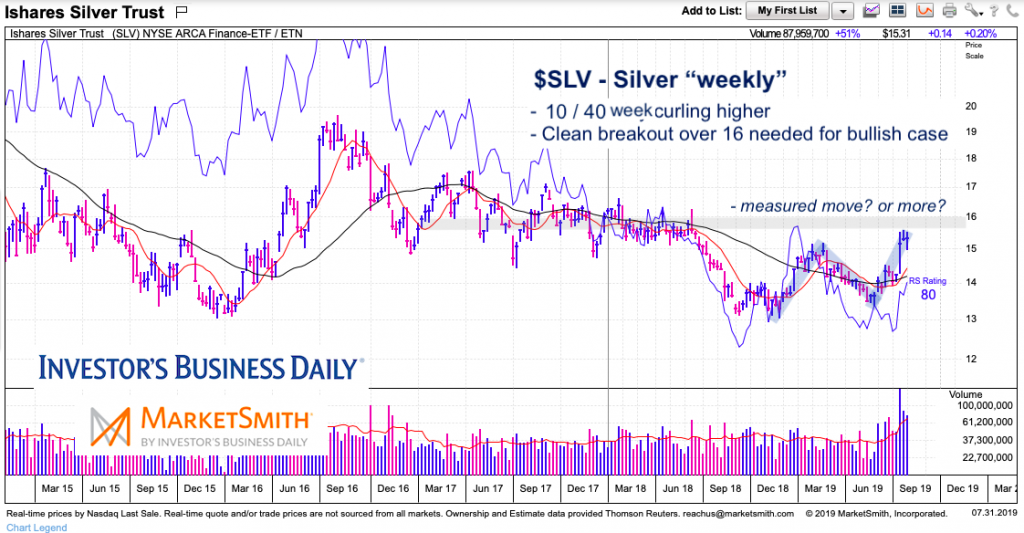

Silver “weekly” Chart

We have yet to receive confirmation that precious metals are in a new bull market. Yes, gold has broken out over important resistance and many have declared a new bull market… but gold cannot “run” until silver confirms it. I’d like to see the Silver ETF (SLV) clear the $16 level.

As you can see in the chart below, SLVs 10 / 40 week moving averages are curling higher (bullish). But we need momentum to pick up and a breakout to occur.

Silver “daily” Chart

The daily chart shows momentum picking up and the 50 day moving average recently crossed up through the 200 day moving average.

Can silver form a bullish flag and breakout higher? This would go a long ways in giving precious metals bulls confidence that this rally is meaningful.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.