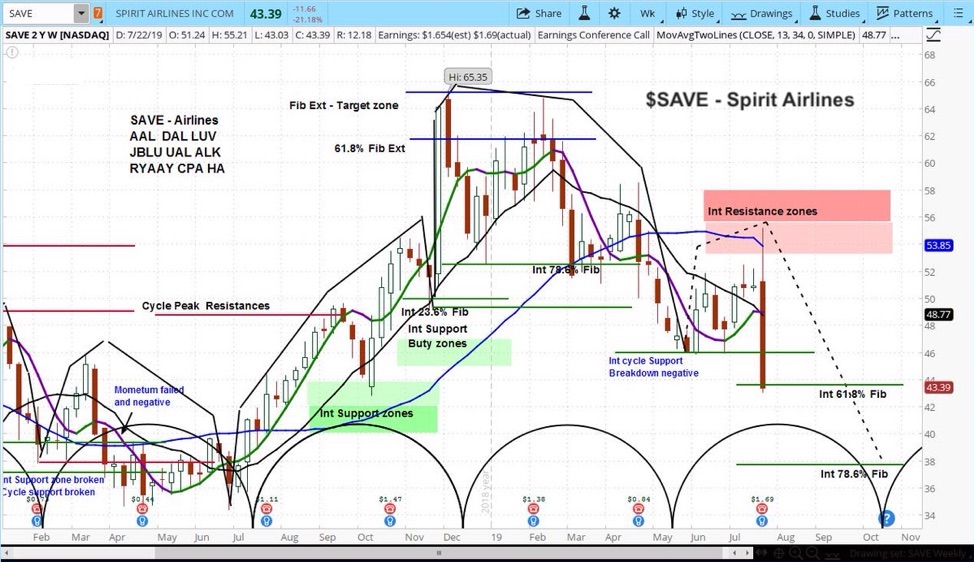

Spirit Airlines (NYSE: SAVE) Stock Weekly Chart

Spirit Airlines (SAVE) fell over 20 percent on Thursday after the company posted earnings that beat Wall Street expectations, but warned of higher future costs.

We see further downside, based on the fact that the stock broke its cycle low support and has many weeks left in the declining phase of its current cycle.

My approach to stock analysis uses market cycles to project price action.

My analysis shows the stock failing from resistance, then breaking key support. This means the stock is likely in the declining phase of its current cycle. Our projection is $38 by October.

Spirit Airlines Earnings Report and Comments

The company reported earnings per share of $1.69 and total revenue of $1.01 billion, compared to analyst estimates of $1.68 and $1.01 billion. However, management warned of a possible increase in costs of 7-8% per seat per mile, compared to its previous estimate of 1-2%.

CFO Scott Haralson explained that, “We’re already making adjustments to our plan for the peak period next year for forecasting purposes, but we think it is appropriate to assume we will continue to see a higher level of disruptions from weather for the remainder of the year.”

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.