Real Estate Investment Trusts have performed very, very well in 2019 with the SPDR Real Estate ETF (IYR) rising 18.80% so far.

The Real Estate Sector has outperformed the S&P 500 Index which sits at 15.60%

There is one segment of the REIT market however, that has significantly underperformed and that is Outlet malls. Tanger Factory Outlets (NYSE: SKT) stock has dropped over 20% so far this year.

This is partly due to the Amazon story and the fact that retail stores seem to be closing down at a fast rate.

When stocks sell off like this, volatility also shoots higher which means juicy option premiums for option sellers.

Implied volatility on Tanger Factory Outlets stock (SKT) currently sits at 29% which is fairly high for a REIT stock.

The stock price has been trending lower since Feb and I feel like it may bounce around the $15-16 level for a few months while it tries to form a base.

Selling cash secured puts is a great way to gain exposure to a stock and potentially take ownership at a lower price.

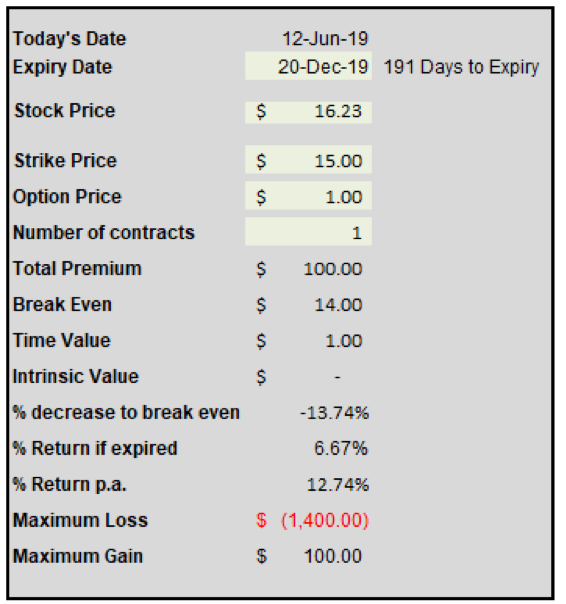

With SKT, traders could sell a $15 December 20th put for $1.00 while the stock is trading at $16.23.

Here’s how the trade looks:

If the put expires worthless, that results in a 12.74% p.a. return for the trader and there is a 13.74% margin for error.

If the option is assigned, the effective cost base on the position would be $14.

While it can be dangerous to try and catch a falling knife in a situation like this, long-term investors who see value in a stock can get paid to wait and potentially pick up a stock with a healthy dividend at a much cheaper price than it is trading today. Trade safe!

Twitter: @OptiontradinIQ

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.