Intel (INTC) declined by 5% on Thursday, after the company said that it expected single digit growth for the coming years.

We see additional risk for a few more weeks before the stock bounces along with the start of a new market cycle.

At the company’s latest investor conference CEO Bob Swan said he expected “single digit” percentage growth over the next three years for both earnings and revenue. He does see this being mitigated by “double digit” growth in chips targeting the data center market segment.

He confessed, “We let you down and we let ourselves down. We’re a team built on credibility and we know we have to earn and maintain your credibility.”

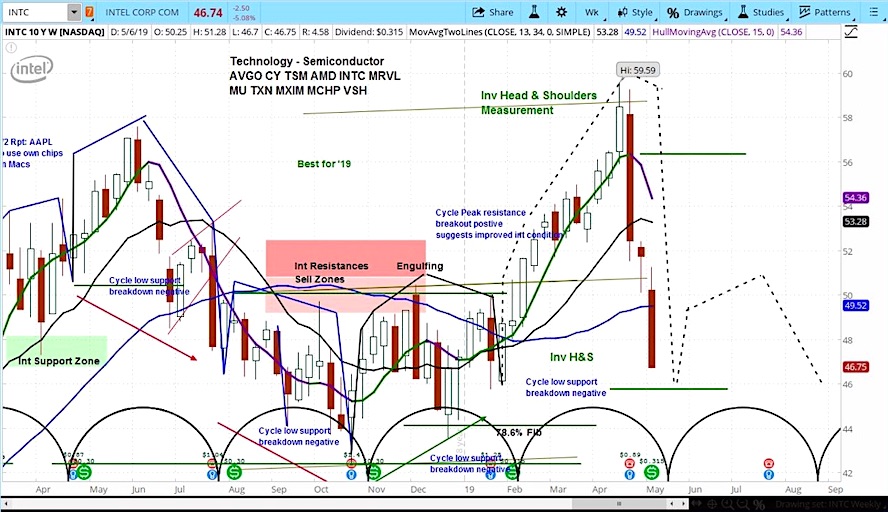

Our analysis on this stock focuses on its market cycles. We see INTC as being in the declining phase of its current cycle, which will likely last for a few more weeks.

We see it testing below $46, with a rebound in the summer offering a selling opportunity.

Intel (INTC) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.