One of the perks of writing this “Daily” column on the stock market, is that I get to do research about things I would ordinarily never think about.

Then, I decide if the research applies as a useful metaphor for the stock market action.

Although I have admired wheel spokes on cars, I had no idea that they determine the overall weight and strength of a wheel.

Car manufacturers will make sure the spokes provide enough strength by considering the car’s weight, performance and the size of the tires.

Furthermore, there is no hard and fast rule about how many spokes a car should have.

With anywhere from 3-9 (or more) spokes on the wheels of varying cars, it becomes more a matter of style.

If spokes are too heavy, the car’s braking, agility and efficiency will eventually harm the car.

Here goes the metaphor.

If the Transportation Sector ETF (IYT), is like the spokes on a wheel, then we can surmise that it also determines the overall weight and strength of the market.

This is not a new concept. We have always believed that our Tran sib “drives” the macro picture and ultimately, the overall market.

Putting the new all-time highs in Tran’s sister, Semiconductors SMH, aside, will Tran improve or bog down the market’s agility, efficiency and essentially, its style?

There are important earnings on tap, starting tonight with CSX Transportation (CSX), a rail-based freight company.

The initial response to the earnings report is bullish with CSX rallying over 4% after market.

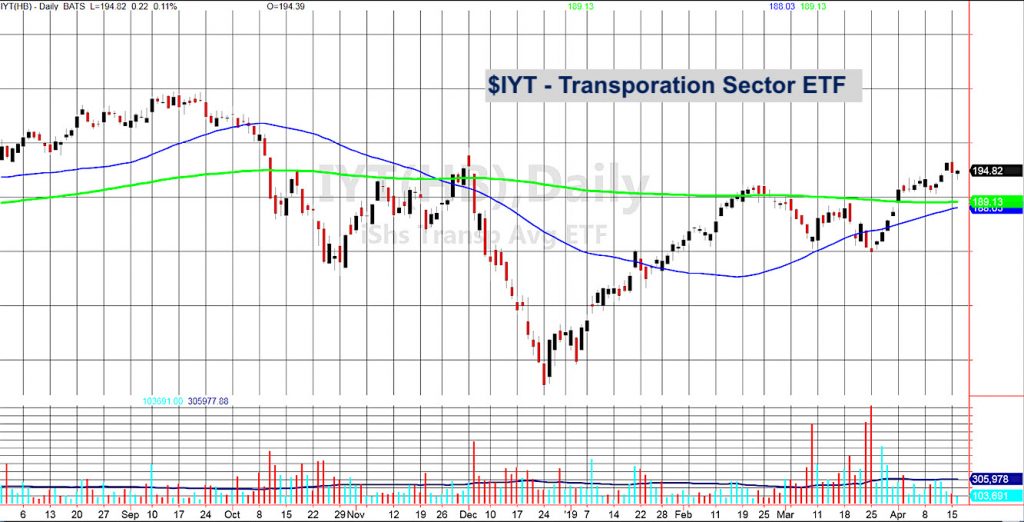

Looking at the Daily chart, yesterday, IYT made a new swing high at 196.45, then closed on the intraday lows.

Today, IYT closed up slightly and held 194.35 (yesterday’s low)..

Note the volume patterns.

In late-March, IYT saw the greatest volume patterns as it failed from the early March highs.

The day of the initial V-bottom on March 27th is also the last day of above average volume.

Since then, even on the ascent, the volume has been scant.

What does that mean?

If the bigger volume happens on selloffs, then it’s possible that most people are still under-invested and we could see a good rally on significant volume.

It’s also possible, that this low volume rally is like spokes that are too light for the weight of the car.

In that case, the market’s outer rim could easily disconnect from the bolts and lugs.

S&P 500 (SPY) – New Swing high at 291.01 with all-time high 293.94. 288.50 is the pivotal 10-DMA support.

Russell 2000 (IWM) – 159.50 the February high. Friday high 158.16 so still a way to go. 156.50 is the support to hold.

Dow Jones Industrials (DIA) – New swing high at 265.32. That means must hold 263.

Nasdaq (QQQ) – New swing high 186.91. All-time high 187.53. Has to hold 185.05

KRE (Regional Banks) – Unconfirmed recuperation phase making 54.30 pivotal

SMH (Semiconductors) – New all-time high today at 115.87

IYT (Transportation) – Swing high at 196.45. Far from its all-time high. 194.35 the immediate support to hold.

IBB (Biotechnology) – 110.84 the resistance to clear back above

XRT (Retail) – 45.50 now pivotal.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.