The major U.S. stock market indices closed out the first quarter with its best overall start since 1998. The S&P 500 (SPX) rose over 13 percent.

The principal support for the rally came from the Federal Reserve’s 180-degree decision to halt interest rate increases, the stock market’s rebound from a rough fourth quarter in 2018, better-than-expected earnings and investor optimism regarding a trade talk resolution with China.

Gross domestic product was revised downward last week to 2.2% from 2.6%, pointing to steady but slower growth. Most companies have been issuing negative guidance for the first quarter, according to FactSet, with consensus outlook for second-quarter profits to be flat.

Investors may have become complacent as seen by the resilience of the stock market in the face of slowing economic growth and trade uncertainty. We continue to believe interest rates will remain low and the year-end returns for the stock market will be positive.

However, we expect a near term increase in volatility as the stock market digests the recent gains and slower growth prospects.

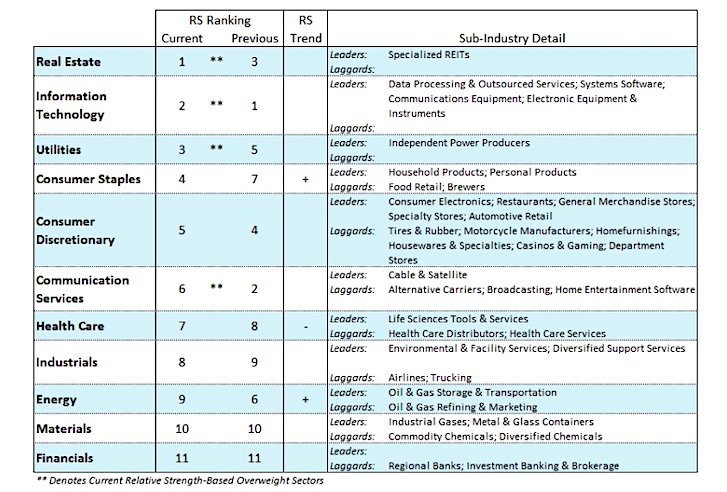

Defensive sectors with attractive dividends, like utilities, consumer staples and real estate investment trusts (REITs) have performed very well in this environment along with the information technology sector that is less dependent on the economy to grow profits. The rise in relative strength in defensive sectors is consistent with a global economic slowdown and flattening and inverting of the yield curve. We anticipate that these performance trends will continue and suggest investors remain focused on the above areas that have been most rewarding in the current environment.

Although the S&P 500 and Dow Industrials showed positive gains in March, the Russell 2000, S&P Small- and Mid-Cap averages along with the Dow Transports were actually down for the month and down from levels seen in February.

The longer these divergences persist the more problematic they become for the current rally.

Further evidence of deteriorating market breadth is offered by the fact that the number of issues making new highs on the NYSE and NASDAQ declined last week and is down from levels seen in mid-February while the percentage of S&P 500 stocks trading above their 200-day moving average is also down from levels seen more than a month ago.

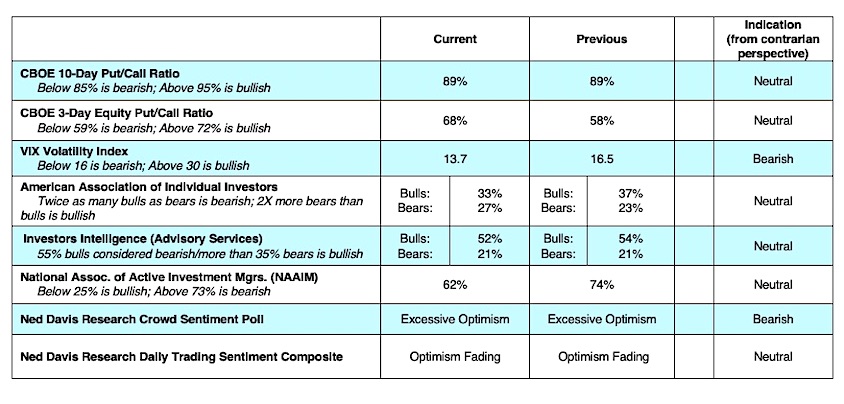

Investor sentiment indicators are in a caution mode showing widespread complacency in the face of a slowing economy and a less than exciting profit outlook. This is evident by the fact that the demand for put options (puts are bought in anticipation of lower stock prices) continues to decline and by the fact that the Chicago Board of Options Volatility Index (VIX), which measures the level of fear in the market, is near the low for the year.

The fact that the IPO market is heating up and is likely to surpass what was seen near the peak in the stock market in 1999 is further evidence of unusual investor optimism.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.