S&P 500 Trading Outlook (3-5 Days): BULLISH

It’s tough to sell stocks based on Wednesday’s rally. And, despite having reached the March highs, exhaustion remains premature.

Dips should continue to be bought and I expect further strength, with the NASDAQ outperforming the S&P 500.

It’s still difficult to consider selling into this rally. Both the NASDAQ and S&P 500 managed to get up above the March highs intra-day on Wednesday, and breadth is improving.

Momentum is now nearing overbought levels and NASDAQ has pushed up above the upper 2% Bollinger band on daily charts.

Yet there has been no evidence of any counter-trend exhaustion is present, and it’s thought that any near-term pullback would represent a buying opportunity into late March/early April before any peak.

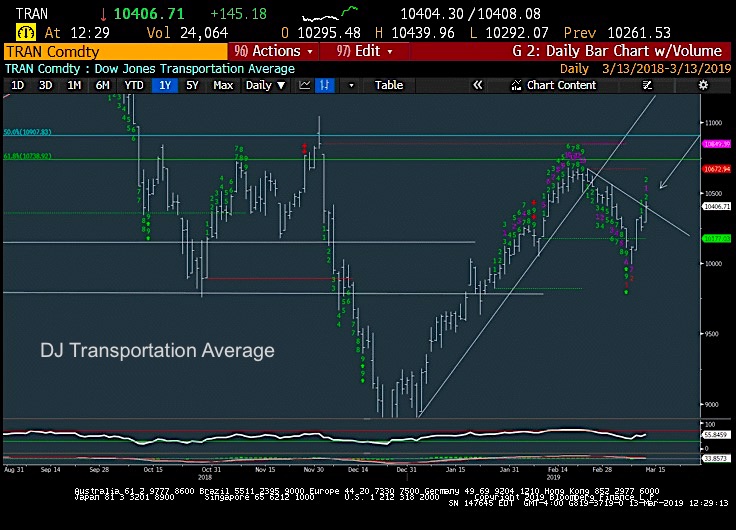

Chart Spotlight: Dow Jones Transportation Average

Overall a few things have happened in the last 24-48 hours that are worth mentioning: First, Transportation stocks look to be on the verge of playing “catch-up” after lagging the broader market advance lately, with Boeing “turbulence” having caused this to underperform dramatically before stabilizing in recent days. The late FAA decision on Wednesday failed to turn BA and many Airline stocks down further and the group in general looks to have absorbed the bad news and now trying to carve out a bottom.

Crude oil extended gains sharply given the inventory drawdown which was unexpected yesterday. WTI Crude gained ground to multi-day highs, and this was technically significant in suggesting further Crude gains in the days/weeks ahead, with targets up near $61-$63 for WTI.

Additionally, Healthcare services stocks have also rebounded sharply in recent days, and the S&P Healthcare Equipment and Services index has gotten up to levels that makes further strength here likely in the short run, as part of its oversold bounce. While the downtrend in Healthcare relative to SPX remains intact at this time, it looks to be close to trying to make a stand and turn higher, as evidenced by strength in the last couple days.

Bottom line, the groups that were initially weak on this market rally look to be trying to claw back and rally to help in participating, namely Healthcare and Industrials (transports) This is a good development overall and the broadening out in this participation likely can help the rally continue into late March/early April before waning.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.