Apple (AAPL) traded 6% lower on Friday morning, after posting earnings that beat Wall Street expectations.

We believe this downside risk for Apple’s stock price (AAPL) will continue in the coming weeks, before AAPL resumes its upward trend.

The consumer electronics company reported earnings per share of $2.91 and total revenue of $62.9 billion, above analyst estimates of $2.78 and $61.4 billion. However, it’s guidance for the current quarter was $89-93 billion, which was on the low side of the $92.9 billion consensus.

CEO Tim Cook pointed out that the rising dollar may affect demand in emerging markets such as India. The rupee is down 12% versus the dollar over the last 12 months, which has made imported products more expensive.

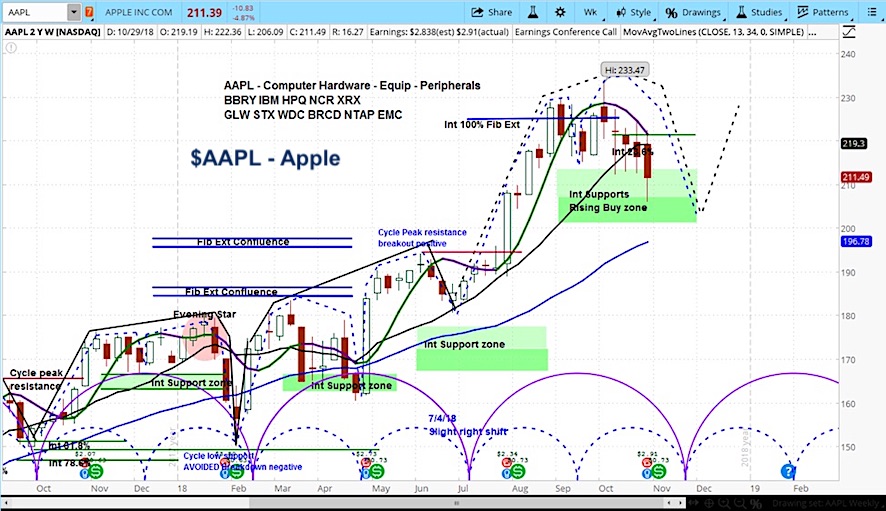

Our approach to analyzing stocks and futures focuses on market cycles. In reviewing Apple’s stock (AAPL), we can see that it is in the declining phase of its current cycle.

As the cycle still has a few weeks to go, our projection for AAPL is around $200, which defines the bottom of our support zone. Our intermediate and long-term views are positive.

Apple (AAPL) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.