Amazon’s (AMZN) stock price decline has accelerated toward key areas of price support, that are worth highlighting as the stock looks for a tradable low.

Note that this was written early Monday afternoon.

Today, we’ll look at daily and weekly Amazon (AMZN) stock charts.

AMZN peaked out in early September, and has faced relentless pressure since. It’s worth noting, though, that this is not all that uncommon from how the stock has acted historically when long-term weekly / monthly momentum gets severely overbought.

I expect the pullback to move past initial support at 1534 to the 1491-5. And if selling really accelerates, then 1456-7 would become the next price target (and strong support). Both areas mark potential lows for this initial move lower.

Let’s look across timeframes…

Amazon (AMZN) Daily Stock Chart

Daily charts show the trend violation the occurred back on October 4.

At present, the break of mid-October lows has NOT coincided with a move to new lows in momentum (a mild positive). This appears to be the final wave down of this first decline from early September (using a 5-wave Elliott-wave style decline).

That said, Demark indicators are premature for this a bottom to occur here and likely require another 3-5 trading days.

AMZN bulls need to see a reversal that regains the price area that was broken in mid-October (near 1685)

Until that happens, the trend is negative.

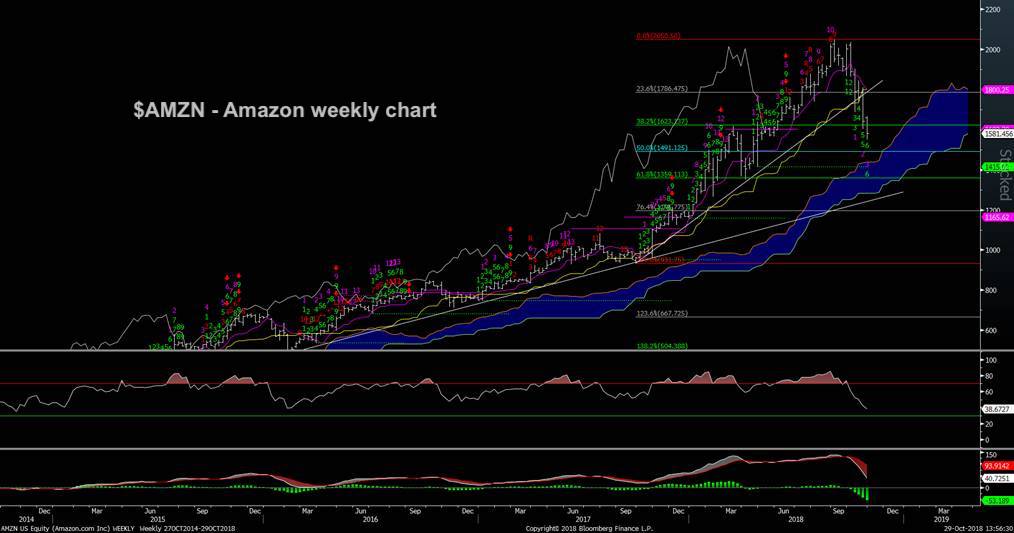

Amazon (AMZN) Weekly Stock Chart

An RSI divergence occurred at the peak and now AMZN has nearly given back 50% of the entire advance since late last year.

IF this “broader” decline were to take another 2-3 weeks in TIME, it would have a greater probability of bringing a successful bottom (as the weekly Demark setup count would line up).

THE BOTTOM LINE: 1491 is the 50% Fibonacci retrace. Below that is CLOUD SUPPORT and the 61.8% Fibonacci support near 1415-30. So we’re heading into support… but patience is required.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.