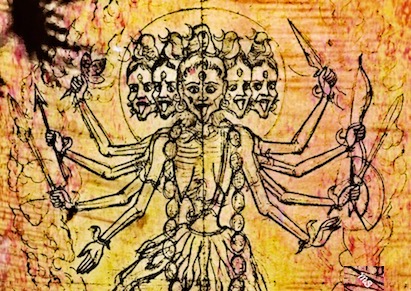

The stock market has 5 heads and 8 arms.

It stands victoriously on 2 legs atop its victim.

It could be because the victor has more arms and heads than its victim.

The stock market has a similar picture.

The bulls put up a good fight. However, the bears have more arms and heads. Their daggers are sharper.

With lots of technical damage done in the last 2 weeks, on top of the Chinese astrological prophecy, is there any good news for the coming week?

The S&P 500 (NYSEARCA: SPY), the Dow Jones Industrials (NYSEARCA: DIA) and NASDAQ (NASDAQ: QQQ) are still holding their 50-WMAs.

Transportation Sector (IYT) , the Russell 2000 (IWM), Semiconductors (NYSEARCA: SMH), and Regional Banks (KRE) – the Economic Modern Family – all are below their 50-week moving averages.

Furthermore, we can add Granny Retail XRT to that list.

The silver lining?

The SPY’s 50-WMA at 274.30, DIA at 249.85 and QQQ’s at 169.17 held.

I also checked the Semiconductors monthly chart.

If you recall on October 15th, I posted the chart for the Russell 2000 IWM.

The monthly chart found support at 150 or its 23-month MA (blue line), despite failing the 50-WMA.

Similarly, the Semiconductor ETF, SMH, which has also taken quite a beating, finds support at its 23-month moving average.

Plus, the February low was 93.88 and in October 2017, the opening print was 93.83. Triple level support over a year’s time.

If we add all that up together, SPY, QQQs, DIA held the critical 50-week moving average.

IWM and SMH are holding their 23-month MAs.

I look at it 2 ways.

If bears are the victor, the levels will fail. The blow could be lethal.

But, if the current bullish victims have any fight left, we will see buyers on Monday’s open and the SPY (with an inside day Friday and an inside week), clear back over 280.

Otherwise, we may root for the underdog, but smart money always bets on the victor.

Trading levels for key stock market ETFs:

S&P 500 (SPY) – Inside day and week. Unconfirmed distribution phase which makes 276.50 the 200 DMA pivotal. 50-WMA 274.30

Russell 2000 (IWM) – 151.88 low from 10/12, under there could see 150 fast-what happens from there is noteworthy. And if IWM can clear over 157 could be back in the game.

Dow Jones Industrials (DIA) – Inside day. 251.55 the 200 DMA and 249.85 crucial support. Over 256.50 better

Nasdaq (QQQ) – 171.97 the 200 DMA. 169.17 crucial support and if can clear over 177, better

Regional Banks (KRE) – 54.56 and 54.55 the last 2 lows-plus, this has broken the 23-month MA-been a lead indicator thus far

Semiconductors (SMH) – Has the 23-month MA coming in at 93.81-Feb low was 93.88 and Oct 2017 the opening print was 93.83. Only if clears 97.75 does it get interesting for Monday

Transportation (IYT) – Inside day. 191.50 will help if clears. Otherwise, 180 in focus

Biotechnology (IBB) – 115.70 resistance to clear and 111 the best underlying support to hold

Retail (XRT) – Failed the 50-WMA with 23-omonth MA support at 44.50

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.