Alcoa Corporation (NYSE: AA) traded 9% higher on Thursday morning, after posting earnings that beat Wall Street expectations.

The aluminium company reported earnings per share of $0.63 and total revenue of $3.39 billion, compared to analyst estimates of $0.36 and $3.31 billion.

Aloca also raised its revenue guidance from $3.1-3.2 billion from $3.0-3.2 billion.

Alcoa actually benefited from the trade war, as CFO William Oplinger explained, “Our smelters benefited from tariffs pushing up the Midwest regional premiums, so the impact of tariffs was a net benefit to Alcoa of $27 million.”

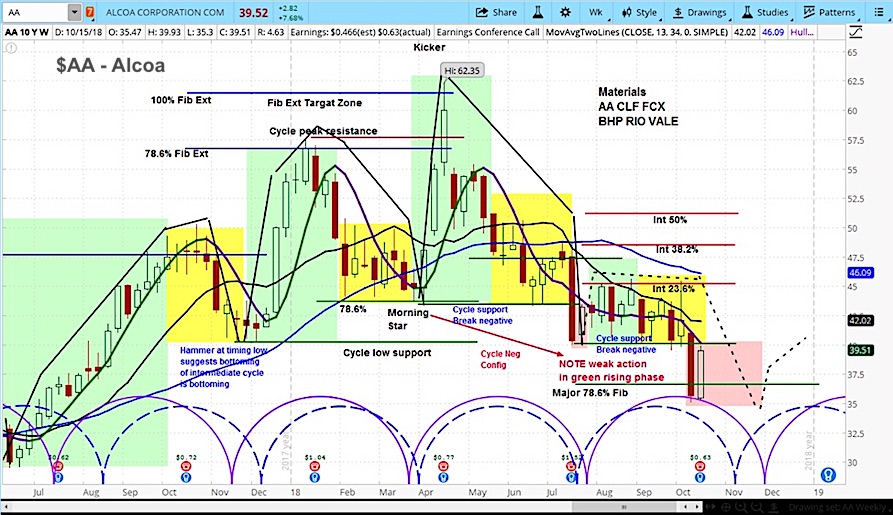

In analyzing the market cycles for AA, we can see that the stock is still in the declining phase of the current cycle and that it down its cycle low last week.

As such, we believe today’s move higher is premature, likely to test the recent lows near $34 by late-November.

Alcoa Corporation (AA) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.