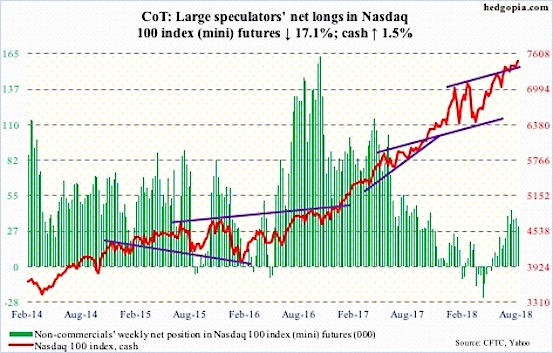

The chart and data that follow highlight non-commercial commodity futures trading positions as of August 21, 2018. This data was released with the August 24, 2018 COT Report (Commitment of Traders).

Note that this chart also appeared on my blog.

The chart below looks at non-commercial futures trading positions for Nasdaq 100 Index futures. For the week, the Nasdaq 100 finished up +1.5%, while the Nasdaq 100 ETF (NASDAQ: QQQ) closed up +1.4%.

Here’s a look at Nasdaq 100 futures speculative positioning. Scroll further down for commentary and analysis.

The Nasdaq 100 shook off a relentless stream of political news and rallied hard on Friday.

Let’s look at the COT data and technical to see what’s next…

Nasdaq 100 Futures: Currently net long 621.6k, down 35.2k.

Stock market bulls found support at 7300 and used it to rally. The Index made all time trading highs five weeks ago and is now just 0.3 percent off those highs. On a micro level, the index is battling resistance here and is overbought.

As of the latest COT report, non-commercial Nasdaq 100 futures traders were not expecting this a rally. They had been trimming their net long exposure… could Friday’s big rally change that (in the next report).

Fund flows have been mixed, but the PowerShares QQQ ETF (NASDAQ: QQQ) saw $646 million of inflows in the week ended Wednesday (data from ETF.com).

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.