EBAY (NASDAQ:EBAY) had a tough day on Thursday.

In fact it was the stocks worst day in 2 years for the stocks as it dropped 10% on the day.

The reason for the drop was sluggish growth and a reduced revenue forecast for the remainder of the year. Also contributing to the decline was the “challenging near term outlook” for Ebay’s subsidiary, StubHub.

EBAY’’s earnings of 53 cents came in 2 cents above analysts expectations, but it was a $50 miss on revenue that really impacted the stock today.

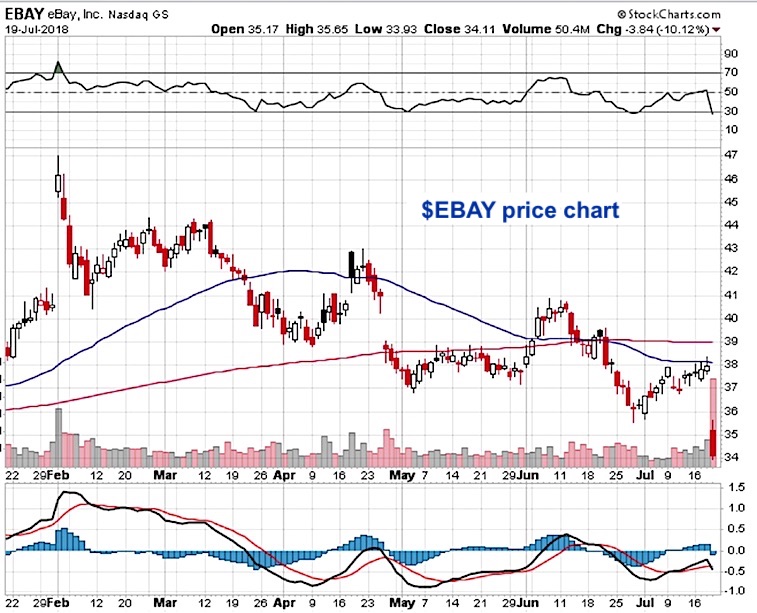

$EBAY Stock Chart

On the chart, we can see the big gap down on huge volume today. The stock has been in a clear down trend since February, putting in a series of lower highs and lower lows. In addition, the stock suffered a death cross, where the 50 day moving average crosses below the 200, back in June.

Wild moves like this provide opportunities for option traders.

On way to play this view is via an iron condor. An iron condor is an option strategy that benefits from a sideways movement in the underlying stock over a specific period of time.

The trader doesn’t care which way the stock moves, as long as it doesn’t move much.

The downside of the trade is a big move in the underlying will see losses develop. This is particularly true if the move comes early in the trade.

An iron condor has negative vega, meaning that the trade benefits from a decrease in implied volatility.

After a big move like this, EBAY may consolidate sideways for the next month or so.

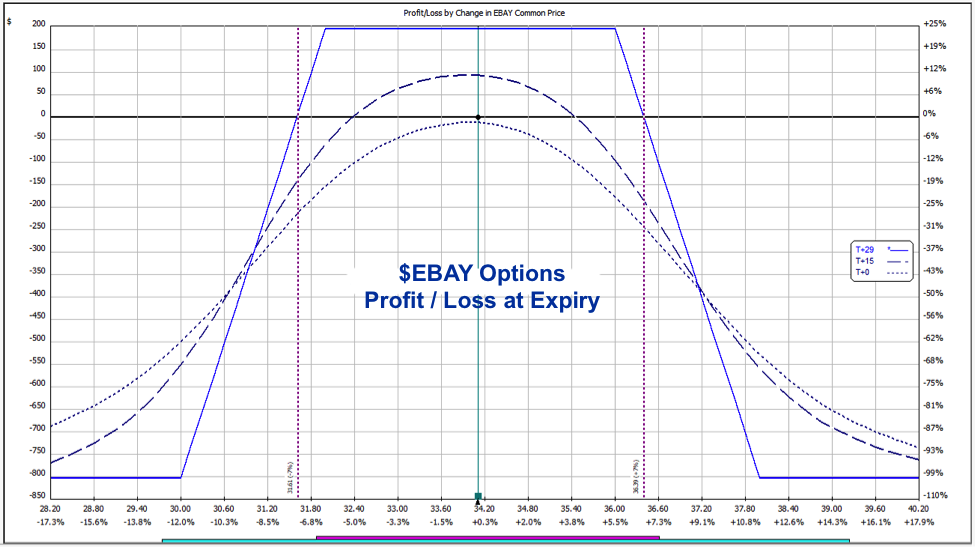

Traders thinking sideways action is on the cards, could trade the August 17th32-30 put spread and the 36-38 call spread. That trade currently generates $195 per contract in premium with a maximum loss of $805.

If the trade were to expire worthless, that represents a 24.22% return on capital.

This trade would need EBAY to stay above 32 and below 36 at expiry to be profitable. However, profits can be made earlier in the trade, particularly if markets are quiet and there is a decrease in implied volatility.

The chart below shows the profit or loss at expiry.

Iron condors are a great trade for investors expecting a low level of price movement in an underlying stock or index.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.