The chart and data that follow highlight non-commercial commodity futures trading positions as of June 26, 2018.

This data was released with the June 29 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

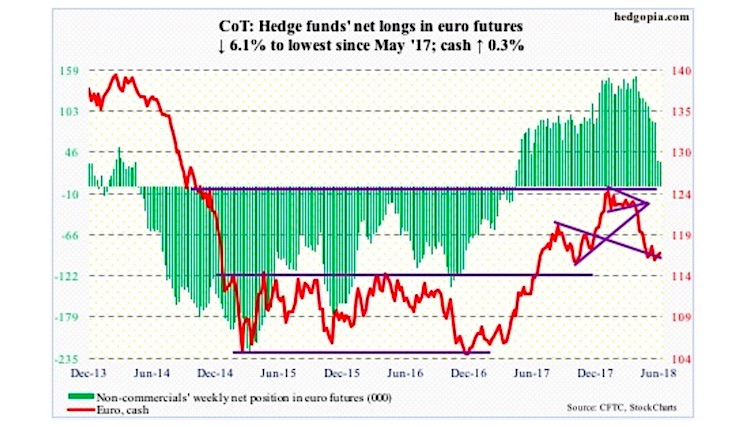

The chart below looks at non-commercial futures trading positions for the Euro currency (CURRENCY:EUR). For the week, the Euro rose by +0.2%.

Here’s a look at Euro futures speculative positioning. Scroll further down for commentary and analysis.

It was a volatile week for the Euro, as prices tested last week’s lows before rallying.

What’s next? Let’s look at the COT data and technicals…

Euro: Currently net long 33.9k, down 2.2k.

The Euro tested major support this week down near $1.14. The is roughly the point at which the Euro broke out of a 2 year sideways consolidation last summer. Tough to call it a retest because that happened late last year.

However, there are still reasons to look for a bounce.

Consider this: Last week, Non-commercial traders reduced their net longs by over 59 percent! And the euro still rose 0.4%! This week, they continued to reduce their positions and the Euro rose +0.2 percent, while putting in a weekly bullish hammer candle. Good signs for bulls… if they can capitalize.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.