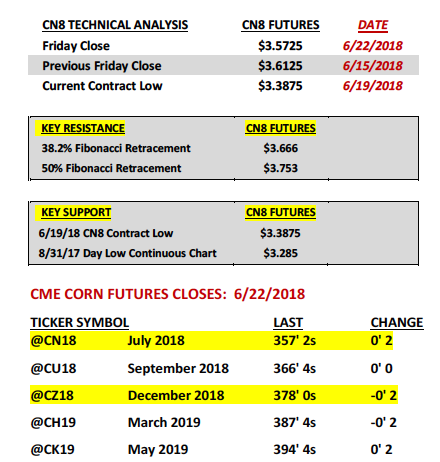

July corn futures closed DOWN 4-CENTS per bushel week-on-week, finishing at $3.57 ¼.

Bulls hope to reverse their recent fortunes… but it will take work.

Weekly Highlights and Market Outlook

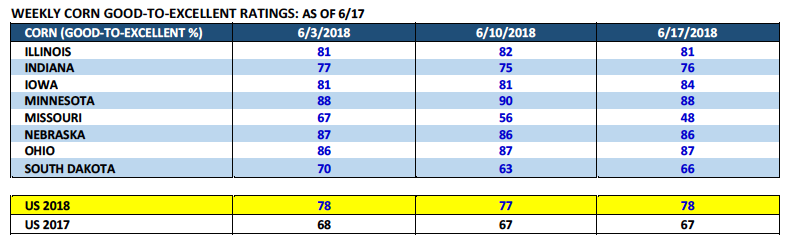

Monday’s Weekly Crop Progress report offered an unexpected increase in the U.S. corn good-to-excellent rating, which improved to 78% versus 77% a week ago and 67% in 2017.

The market was expecting to see a small decline. Furthermore the top 4 U.S. corn producing states of Iowa, Illinois, Nebraska, and Minnesota all managed good-to-excellent ratings of 81% or better. On paper this would seem to suggest all 4 remain capable of surpassing their previous record high state corn yields. Iowa’s current record corn yield is 203 bpa (2016), Illinois 201 bpa (2017), Nebraska 185 bpa (2015), and Minnesota 194 bpa (2017).

Due to the strong start in those 4 states (which collectively on average have accounted for approximately 55% of total U.S. corn production the last 3 crop years), certain analysts have already starting to throw out national yield estimates above 180 bpa, which compares to last year’s record U.S. corn yield of 176.6 bpa. Do I think this is premature? Yes…however until NOAA’s 6 to 10-day forecast offers something other than above normal precipitation for the bulk of the U.S. Corn Belt, Corn Bulls are not going to win this argument.

That said, is the 73 ½-cent break in July corn futures since making a day high of $4.12 ¼ on May 24th solely the result of strong crop condition ratings? In my opinion no.

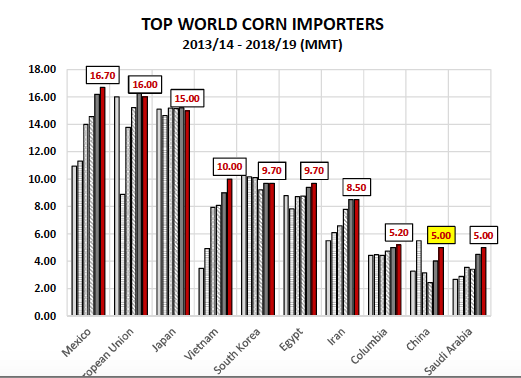

Late Monday President Trump more than doubled down on his desire to force China to capitulate in the ongoing trade war by suggesting that an additional $200 billion in Chinese goods could be hit with a 10% tariff if China doesn’t seriously look to narrow its current trade deficit with the U.S. This following the 25% tariff Trump placed on $50 billion in Chinese goods a week ago. China responded by saying that since they don’t import $200 billion in U.S. goods, they would simply consider raising the 25% tariffs they initially countered with on an equal quantity of U.S. goods back on June 15th. This would then include increasing the 25% tariffs China placed on U.S. soybeans and corn.

The Ag markets did not respond kindly to this this development early Tuesday morning with July soybean futures essentially opening down 67-cents per bushel, this after soybeans had already broken $1.11 per bushel from high-to-low from 6/6/18 through 6/18. Tuesday’s losses in corn were somewhat more muted however largely because whereas China accounts for more than half of all U.S. soybean exports, U.S. corn exports to China have been essentially negligible. That said there’s little doubt that the recent significant losses in the soybean market have been a key contributing factor in the corresponding sell-off in corn futures (irrespective of crop condition ratings).

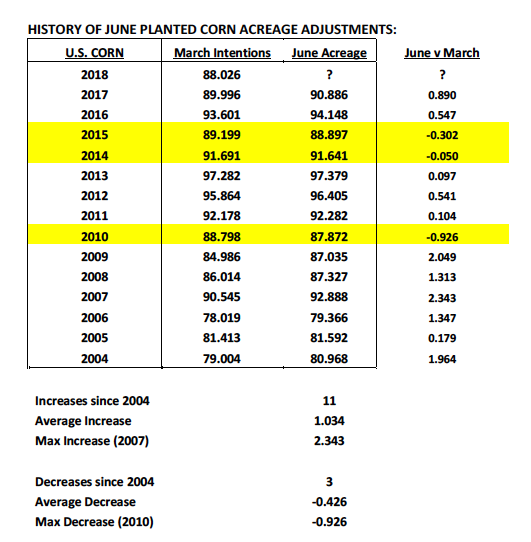

The other critical S&D related topic gaining traction this week was a look ahead to the USDA’s June Acreage report, which will be released next Friday (6/29).

I would argue most traders expect to see 2018/19 U.S. corn planted acreage go up in the June report versus the USDA’s March forecast of 88.03 million acres. Historically: Since 2004 there have been 11 corn planted acreage increases compared to just 3 decreases. The average corn planted acreage increase has been 1.03 million acres. I’m estimating a 500,000 acre increase for 2018, which if realized would theoretically add 89 million bushels to the USDA’s current 2018/19 U.S. corn production estimate of 14.04 billion bushels (applying a 174 bpa yield). If however I assume a 500,000 acre increase and a U.S. corn yield increase of 4 bpa, the production improvement goes up by 414 million bushels. This too is providing temporary overhead price resistance.

JULY CORN FUTURES TRADING FORECAST

There are two ways to look at this week’s price action in corn. If you’re a Corn Bull the preferred narrative focuses on July corn futures bouncing 18 ½-cents per bushel off the day low (and new contract low) of $3.38 ¾, which was established early Tuesday morning (suggesting a bottom has been formed). That said if you’re a Corn Bear you’d argue the script hasn’t changed with July corn futures continuing to close lower week-on-week despite now trading 55-cents below the day high of $4.12 ¼ on May 24th. If I had to choose…I’d opt for being somewhere in the middle of either extreme. Purgatory seems a fitting description for my current feelings on the state of the corn market.

Overall I continue to believe the corn market’s biggest impediment to sustainable rallies moving forward isn’t S&D related.

This isn’t to say the U.S. corn crop’s current good-to-excellent rating of 78% or the belief that the USDA could raise planted corn acreage in next Friday’s June Acreage report aren’t creating topside resistance in corn futures. But rather to suggest that the exaggerated sell-off remains more a byproduct of the complete meltdown in soybean futures and corn being pulled lower as a result. On Tuesday when July corn futures were trading down 17 ¼-cents on the day, July soybean futures were trading 67-cents lower. Point being…the corn market isn’t going to be able to avoid collateral damage when soybean futures are under that type of selling pressure.

Ultimately the corn market needs two things to shift momentum higher.

1) Signs of excessive heat and below normal precipitation in the 8 to 14-day forecast; right now it appears we’ll have the heat, however not without the presence of above-normal precipitation, which effectively neutralizes the “hot and dry” argument.

2) Trump needs to throw U.S. soybean producers a life rope in trade negotiations with China. China’s retaliatory 25% tariff on U.S. soybeans has been responsible in my opinion for at least an additional $1.00 break in July soybean futures. That said Trump’s comments this week would suggest he has no plans of a compromising with China prematurely.

For the Corn Bull, I will leave you with this… in 2017 September corn futures rallied from a day low of $3.64 ½ on 6/23 to a day high of $4.04 on July 11th. This occurred during a growing season when the final U.S. corn yield achieved a record high of 176.6 bpa. On Friday, 6/22/18, September corn futures closed at $3.66 ½. There is still hope…

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service