The S&P 500 was little changed last week, but both the NASDAQ Composite and the small-cap Russell 2000 continued to rally and closed higher on the week (in both cases closing at new highs on a weekly basis).

While stocks seemed to shake off any potential concerns from an interest rate hike from the Fed (with expectations of two more in 2018), a timetable for ending quantitative easing from the ECB, and hints of tit-for-tat tariffs with China, both the bond market and commodities market showed less than sanguine reactions.

The yield on the 10-year T-Note moved lower in the wake of the central bank actions and the CRB commodity index fell nearly 2% on the week.

These pullbacks in bond yields and commodity prices come within the context of emerging up-trends and there is little evidence at this point that economic fundamentals in the U.S. are beginning to deteriorate (conditions overseas could be getting more challenging).

At the same time, broad market improvements have struggled to keep pace with the index-level gains and investor optimism is at or near the levels seen in January.

We have yet to witness a breadth thrust which would suggest this period of consolidation has come to a close. Moreover, despite the string of new highs being recorded on the NASDAQ Composite, less than 70% of NASDAQ stocks even trade above their 50-day averages and the net number of stocks making new highs is contracting not expanding.

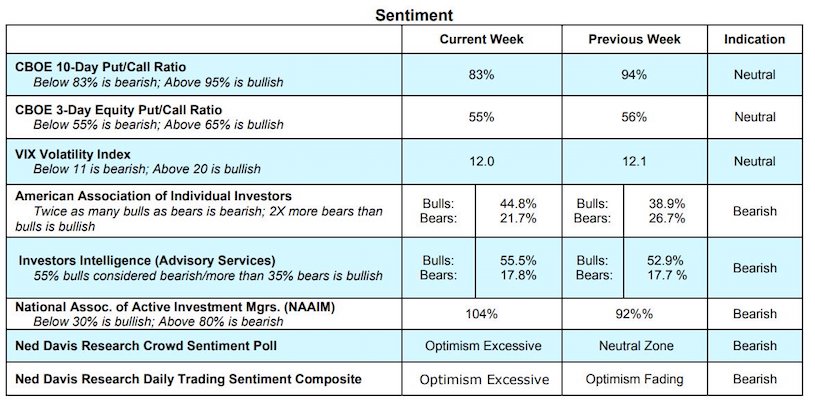

From a sentiment perspective, the NAAIM data this week showed further capitulation by the bearish contingent and both the AAII and Investors Intelligence surveys show more than twice as many bulls as bears. The NDR Trading sentiment composite has moved further into the excessive optimism zone and has now surpassed the peak seen in January.

For a more complete look at both the macro and market factors as we move to the second half of 2018, please review our recently published second half outlook (Weight of Evidence Argues for Near-Term Caution).

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.