The following chart and data highlight non-commercial commodity futures trading positions as of June 12, 2018.

This data was released with the June 15 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

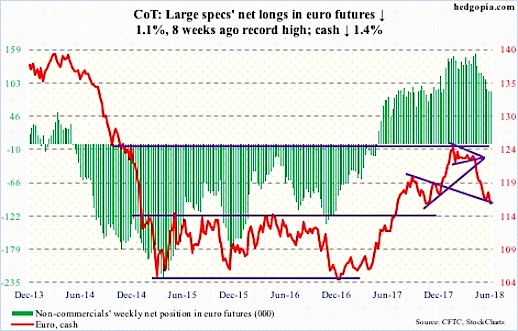

The chart below looks at non-commercial futures trading positions for the Euro. For the week, the Euro declined by -1.4%.

Here’s a look at Euro Currency futures speculative positioning. Scroll further down for commentary and analysis.

Euro Currency Futures: Currently net long 88.2k, down 1k.

ECB President Mario Draghi is likely to be feeling good about the markets reaction to Thursday’s ECB policy decision. The Euro cash index collapsed nearly 2 percent during that trading session.

The daily chart could see more downside if it cannot hold near-term support.

Critical support lies at $114-115 – this is key. Euro currency bulls cannot afford to lose this level. A few weeks back (on May 29), the Euro declined to $115.19 intraday before bouncing.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.