There have been a number of IPO’s in Tech the past few months in the hottest area of growth: Software.

So I felt it is prudent to dive into several of these names to become more familiar and determine if any of these are worthy investments.

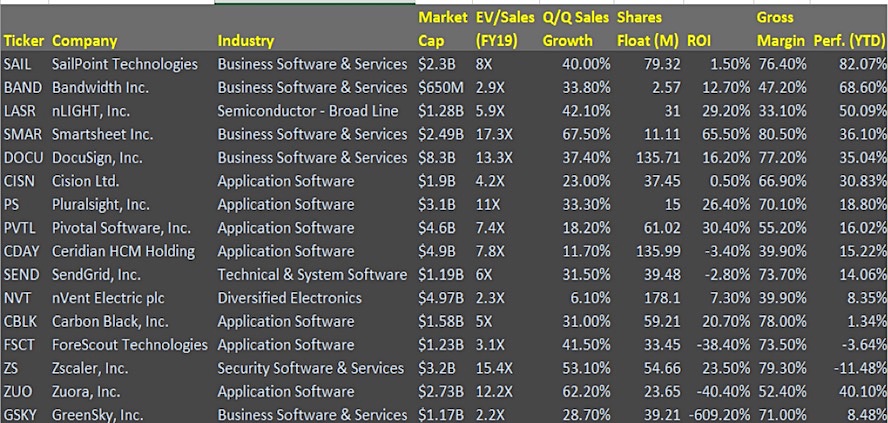

I have created a table below with some of the most pertinent details with EV/Sales the key valuation metric. While Revenue Growth and FCF Yield are important fundamental indicators, the latter is difficult to come by at this stage but worth eyeing as these company’s start to generate more cash flow.

Another indicator to observe is Research and Development (R&D) as a percentage of revenues.

We are a few years into these sizable industry tailwinds with major themes like cloud adoption, big data & analytics, IoT, mobility, digitalization, and cyber-security with ample room for new players to steal market share from legacy providers.

*Note that my statistics are sourced from:Sentieo and images come from company presentations.

I will go through each of these names individually to detail a bit about what the company’s do, the potential market opportunity and other details I see as important. As is always the case, it is worth monitoring the quarterly earnings reports and conference calls to get an even more in depth view and gain confidence in the investment.

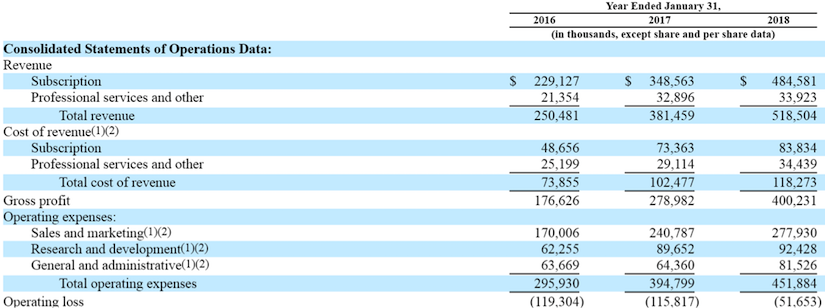

DocuSign (DOCU) is the largest name on this list at $8.3B and is trading 13.3X EV/Sales with 77.2% gross margins and after posting 35.9% revenue growth in 2019 is expecting around 20% CAGR the next three years. DOCU is a provider of cloud-based electronic signature solutions for data collection, collaboration and workflow automation. It is a niche play that is positioned well for the big digitalization theme as everything moves to electronic and away from paper, a trend that still has a long runway.

Citi was out recently positive seeing the eSignature solutions market reaching $7B by 2025 and potential to offer online transaction services across a broad variety of vertical markets. Forrester Research called DocuSign the strongest brand and market share leader, a company with a name that is becoming a verb. DOCU estimates its TAM (total available market) to be $25B as of 2017. E-signature usage is rising but remains in the early stages of the adoption cycle. DOCU solutions accelerate transactions, improve customer experience, and reduce costs to businesses. The company’s key to success is signing on new customers but also has the ability to expand use cases with existing customers, an example of a recent customer that grew from a single use case to over 300. There is also a substantial International opportunity with just 17% of sales currently overseas. DOCU’s subscription model also offers less variability with results with high retention rates. My overall take on DOCU is that it is a wonderful long-term opportunity but currently priced aggressively at 13X EV/Sales and there are likely to be ample opportunities to build a position at lower levels over the next year. Over the next 3-5 years I can see it growing to a $15B-$20B company.

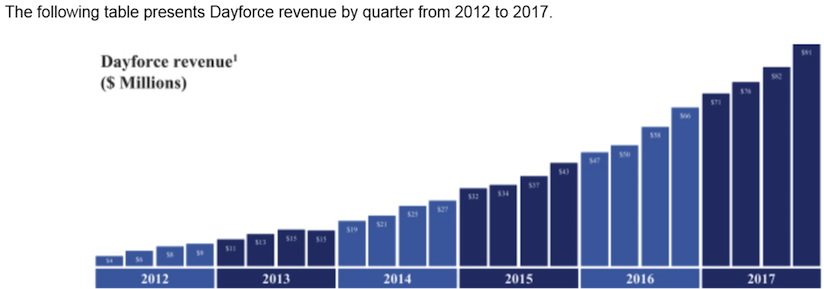

Ceridian HCM (CDAY) is a $4.9B provider of HCM (human capital management) solutions trading 7.8X FY19 EV/Sales. The largest players in this industry include SAP AG (SAP), Workday (WDAY), Automatic Data (ADP), Oracle (ORCL), Linked-In (MSFT), and Ultimate Software (ULTI). For reference, WDAY, a top growth name in the group, trades 12.9X EV/Sales with 25.8% revenue growth forecasted this year. CDAY actually expects revenues to fall Y/Y in 2018 before accelerating in 2019 and 2020.

Ceridian HCM is transforming into a cloud technology company and saw cloud revenues rise 38% Y/Y last quarter, now accounting for 60% of total revenues. CDAY is targeting a highly fragmented $20B market that leaves ample opportunity with growth expected to accelerate each of the next three years. CDAY is also a developing margin expansion story. “Dayforce” is its flagship cloud HCM platform and is showing 95% retention rates. CDAY has an opportunity to both increase market share in North America and expand globally. Live Dayforce customers have risen to 3,001 in 2017 form 1,770 in 2015. My overall take on CDAY is that it is fairly attractive at this level considering it’s a cloud transformation story and an accelerating revenue growth with expanding margins story, which calls for multiple expansion. I see a clear path to $1B in sales with a multiple around 9X, offering around 80% upside over the next three years.

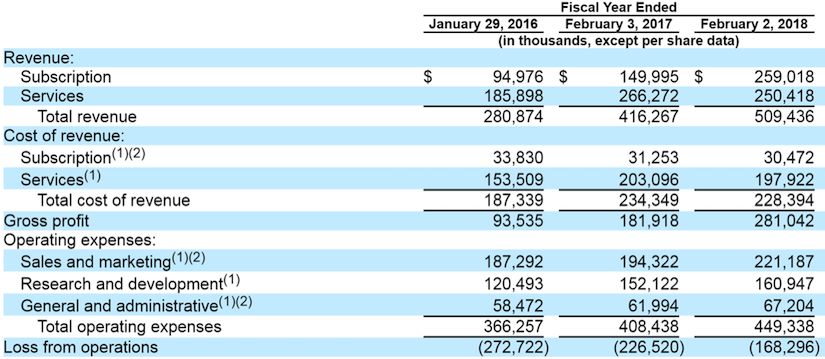

Pivotal Software (PVTL) is a $4.6B provider of customer relationship solutions for businesses trading 7.4X EV/Revenues and forecasting 22-25% annual revenue growth the next three years and profitability to be achieved in three years. PVTL estimates its TAM at $50B and has added 319 subscription customers over the last four years with 73% revenue growth. The main markets targeted are PaaS, a $16B market in 2018 expected to reach $29B by 2021, and application infrastructure, a $43.2B market set to grow to $51.4B by 2021.

The Pivotal Cloud Foundry is a single platform built to run an entire enterprise scaling to support thousands of developers and applications. PVTL has go-to-market relationships with Dell Technologies and VMware and also works with Google and Microsoft to bring customer workloads to the cloud infrastructure. FY18 is the first year that PVTL’s subscription revenue exceeded its services revenue. Its two offerings are PCF and Labs, the former accelerates and streamlines software development, and the latter delivers strategic services to enterprises to accelerating cloud transformation. One concern with the name is Dell’s 70% controlling stake. At this multiple with strong growth and providing a key product for transforming software development for businesses, PVTL does look attractive as a leading PaaS provider with strong customer relationships. I think PVTL can be worth $8B-$10B over the next three years.

Zscaler (ZS) is a $3.4B provider of cloud-based security applications and trades 14.4X EV/Sales FY19. ZS considers itself a leader in cloud security and is disrupting a large market with secular tailwinds like cloud shift, mobility and IoT leading to rising demand for its services. ZS reported Q3 results this week with 49% revenue growth, 73% billings growth, and generated positive free cash flow.

The company grew revenues 56.5% in 2017 and is on its way to 42.5% growth for FY18 with 30% growth expected in 2019 & 2020. ZS currently counts 200 Fortune Global 2000 as customers, so plenty of room for growth. IDC estimates $17.7B annual spend on disparate security appliances to perform the functions ZS offers on its platform. According to a McKinsey & Company survey, large enterprise adoption of the public cloud as the primary environment for at least one workload type will jump from 10% in 2015 to 51% in 2018. Its growth strategy revolves around winning new customers, expanding offerings to existing customers, and entering new market segments as well as entering the Asia Pacific region.

continue reading on the next page…