The stock market has been in a tight trading range due to the ongoing themes – the rising rate of the 10-year Treasury note and the prospect of trade wars.

Additionally, the canceling of talks with North Korea may have added to investors’ concerns.

The fundamentals, however, continue to point to strong economic growth going forward.

First-quarter GDP revisions are anticipated to show the economy expanded at a 2.3% clip. Although that is down from 2.9% in the fourth quarter, first-quarter results have been soft for the past three years. The latest reports on retail sales, industrial production and the fact that household income hit a new record high in May has encouraged estimates for second-quarter GDP to rise above 3%.

Additionally the labor markets remain strong with expectations that Friday’s Employment Report will show the economy generated 185,000 new jobs last month with the unemployment rate remaining at 3.9%.

Corporate earnings continue to rise at the strongest rate since 2011. This week offers investors good news with support from the positive economic numbers, last week’s 5% drop in oil prices and easing concerns on the geopolitical front with the potential for discussions with North Korea to go forward.

The technical indicators remain mixed. Encouragement is found by the fact that recent periods of weakness have been accompanied by less selling pressure in terms of downside volume. But rallies have been lacking a strong increase in breadth which is typically found at the start of significant upside moves. The percentage of S&P 500 stocks trading above their 200-day moving average remains at just 60%, down from 77% in January.

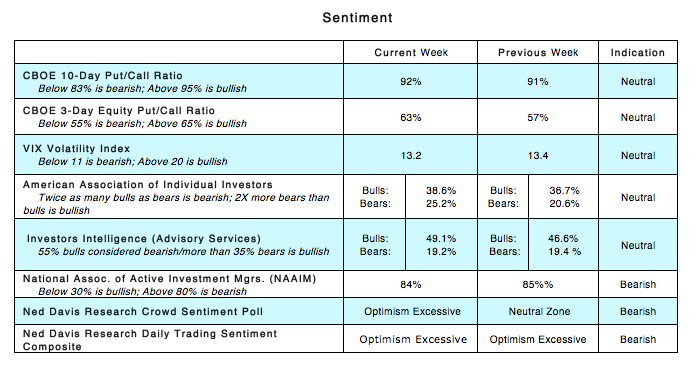

Sentiment indicators show a growing conviction toward increased optimism. This is seen in the latest report from the American Association of Individual Investors (AAII) that shows a rise in bulls last week to 38.9%, the highest since mid-February. This is considered a negative given that the best and sustainable rallies often begin with investors cautious or fearful. The drop in the CBOE Volatility Index (VIX) in recent weeks is further evidence that the mood of investors is best described as complacent. Low VIX readings and investor complacency are not often associated with a market bottom.

Additionally, the widely followed Ned Davis Sentiment poll moved into the excessive optimism zone for the second week in a row. From a contrary opinion perspective, this would suggest that for the short term the upside is limited.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.