Through the cycle a lot of factors push and pull bond yields around, but as I was doing some research on governance rankings across countries I found an interesting yet intuitive correlation.

Based on my analysis there is a discernible link between the quality of a country’s governance and the level of a country’s bond yield.

The chart in this article comes from a report on governance risk premia in bond yields from a recent edition of the Weekly Macro Themes report.

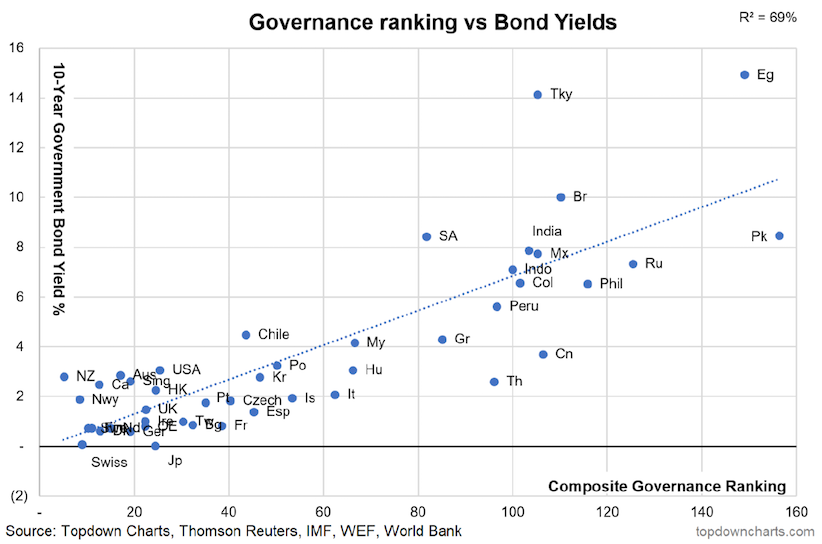

The chart shows 10-year government bond yields against my composite country governance ranking.

Governance & Bond Yields Chart

The composite governance ranking includes inputs from the IMF, World Economic Forum, and World Bank, and is designed to give a composite view of how a given country ranks overall governance-wise.

With an R2% of almost 70%, and just visually you can see there is a decent correlation.

In my view this reflects a couple of things. Firstly, there is bound to be a country risk premium aspect, in that countries with worse governance will probably have a higher risk of default or other possible impairment of capital. Second, countries with worse governance are likely to have more volatile growth, higher interest rates in general and most importantly: higher inflation.

The results are similar to the work I’ve done with governance risk premiums and expected equity market returns. And similarly when you adjust for such a risk premium the prospective return landscape can look very different.

Certainly, at the very least it highlights the importance of governance in country selection.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.