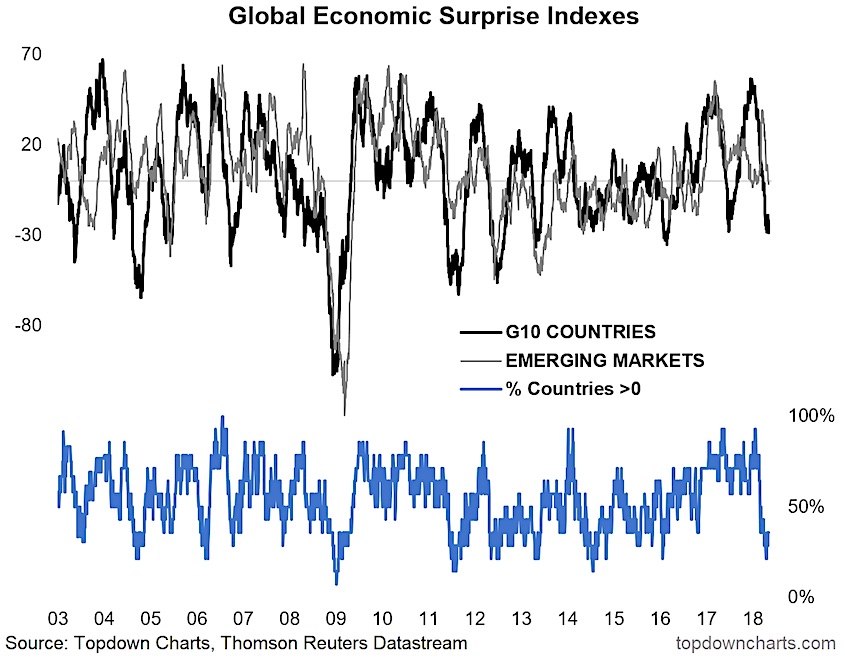

Something unusual has happened to the global economic surprise indexes.

Not only have the emerging markets and G10 indexes fallen sharply, but the breadth of global economic surprise indexes has dropped to levels rarely seen outside of recession.

The chart in question comes from a broader discussion on the path of global trade, early warning signs, and the global economic cycle from a recent Weekly Macro Themes report.

The chart shows the G10 & emerging markets economic surprise index, alongside the breadth of the various economic surprise indexes across countries.

Global Economic Surprise Indexes

For clarity, the Citi economic surprise indexes track the degree to which economic data is surprising to the upside vs downside. High readings on the index indicate more positive surprises in the data vs expectations. This can reflect either economists being too pessimistic and the data turning out average, or it can reflect average or even optimistic expectations which are blown away by outstanding data.

It’s important to clarify those dynamics, because probably part of the big and broad trend of upside surprises was due at least initially to expectations being too pessimistic. Subsequent solid economic growth figures across the globe have mean surprises to the upside.

So what then should we make of this sudden lurch to the downside?

Is it simply a matter of economists and analysts getting too excited and just getting carried away with their expectations and the data just turning in average against overly optimistic expectations? Or is it the more sinister sort where the data is just running away to the downside and an imminent slowdown is upon us?

My view is that it’s probably mostly the former. When you have a period of such substantial and broad upside surprise it’s only natural that expectations become more and more optimistic as analysts extrapolate ad infinitum. The easing off in some of the soft data that truly has been going on is hard to make out as to whether that’s just sentiment/market volatility driven or a true sign of a slowdown. But across much of the key leading indicators and hard data activity indicators I monitor I’ve seen a distinct lack of true red flags. Indeed, if anything the crash in the surprise indexes could drive a “healthy reset” in expectations.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.