The market is finally starting to wake up after a dream run for the Euro.

Speaking to the title, about this time last year I was telling my clients that the Euro looked like a good buy, as it saw a bullish divergence, substantial undervaluation, and heavy shorts.

Now we have almost the complete opposite, making it more of a “good bye”.

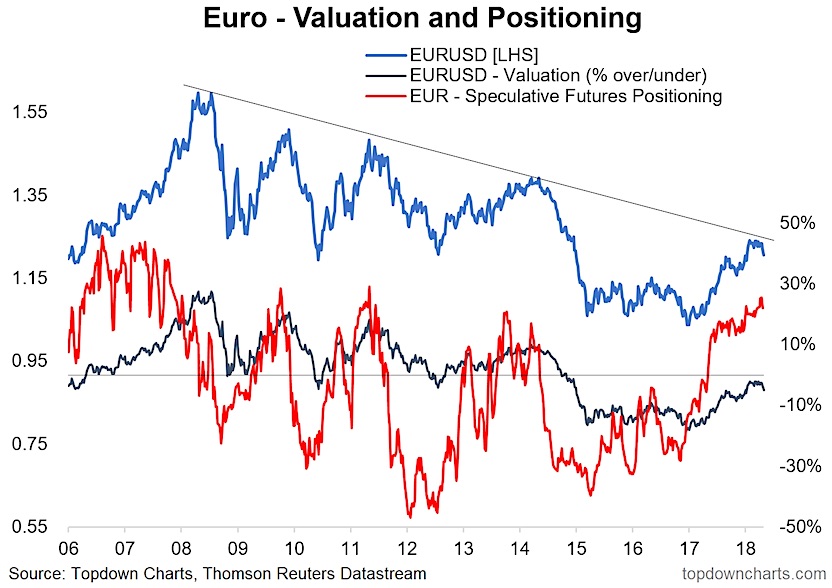

The chart below comes from a recent edition of the Weekly Macro Themes report, which covered key developments in the Eurozone economy, monetary policy dynamics, and the macro/earnings pulse.

The chart shows how even before the latest move began, the Euro’s days were numbered…

Time for a little bit of explanation around the chart. Firstly, that red line is speculative futures positioning (standardized by open interest, shown on the right hand side). Second, the black line is our valuation indicator – showing the extent to which the Euro is over/under valued against the US dollar. And perhaps most important is that downward sloping black trend line, which has turned out to be a bit of a glass ceiling for the Euro.

It’s a good example of how I approach markets. My research process basically looks to leverage multiple factors – my view is any piece of data can be useful, this means anything from technicals through to valuation, cycle, sentiment, and others.

Typically I will look to start the thesis with the anchor or valuation (is it over or undervalued, and ideally is it at an extreme?), then I will look at cyclical factors such as the economic cycle, earnings cycle, inflation and monetary policy. Finally the use of sentiment, positioning, flows, and technicals help round out the view from a tactical/practical standpoint – i.e. the all important issue of timing.

Going back to the Euro, the valuation picture is about neutral (and thus carries less weight at that point). On the cycle, some of the higher frequency economic data out of Europe is wavering (vs solid in the US), and monetary policy is still heading in the opposite directions. Also, yield differentials are a notable headwind for EURUSD.

On sentiment and positioning, long Euro has clearly become a crowded trade. Finally on technicals the chart shows a failure to break (let alone touch) the down trend line, and there is minor bearish divergence on the weekly chart. So as I said, the weight of evidence has shifted from “good buy” to “good bye”.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.