The Big Picture

After a week off, I’m glad to be back. Investors are operating in a climate that is prone to reversals and quick moves so we must remain focused on stock market trends within our given trading timeframes.

There is still a lot of “noise” out there as bulls vs bears continue to state their case. As traders we need to follow the price action (and trend indicators) and steer clear of noise and opinions.

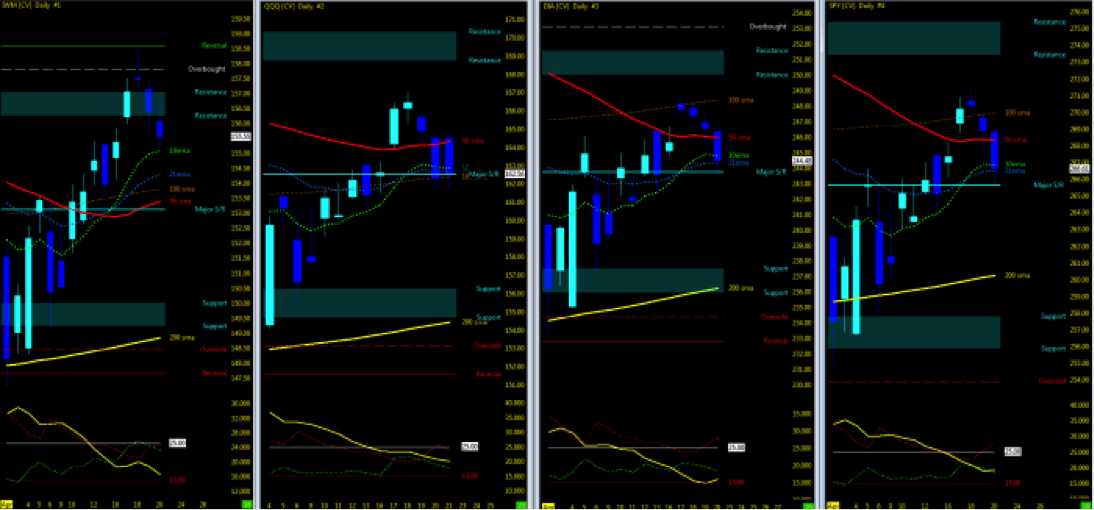

Below is my weekly trading update and stock market trends outlook. Let’s start by looking at a chart of the S&P 500 ETF (SPY).

Stock Market Trends For Week 17 (week of April 23)

Current Technical Trends

- Stock market indices on pullback to Major S/R and under 50ma. IWM exception.

- Daily VXX (VIX Volatility) momentum downtrend

- Weekly uptrend momentum stalling

- Dow Jones Industrials/Transports

- Monitor for the two ETF indices to remain in sync as supporting indicator of momentum (Up or Down)

- Momentum uptrend /ADX flat

- Advances-Decliners/INDU in sync

- Indices Futures momentum stalled on downtrend probability increasing

The Bottom Line

Low volume and turn-around in week 16 back downside as the key moving averages fail to gain momentum in sync upside. The 200ma continues to be the strong conduit for market draw and bounce back upside in a bigger pic consolidation. Just enough of a correction to keep us within shouting distance of the highs. Technically, the momentum has stalled in favor of the downtrend as price action will either break to the upside and regain synchronous traction on the moving average sot take us higher, or we retest the 200ma once again. either way. For the intraday trader, both directions offer opportunity. Swing traders, be ready for major earnings to move the market and respond at the 50ma. Long term, sit quietly and wait to re-balance at lower price at the end of Q3.

Big Picture Market Pulse: Consolidation at the key moving averages (10/50ema) as they are out of sync. ADX momentum downside on Indices as VIX volatility stalls and turns downside.

Thanks for reading and remember to always use a stop at/around key technical trend levels.

Twitter: @TradingFibz

The author trades futures intraday and may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.