Tensions between the U.S. and Russia are mounting.

The two global powers are at odds over their interests in the Middle East, and particularly Syria.

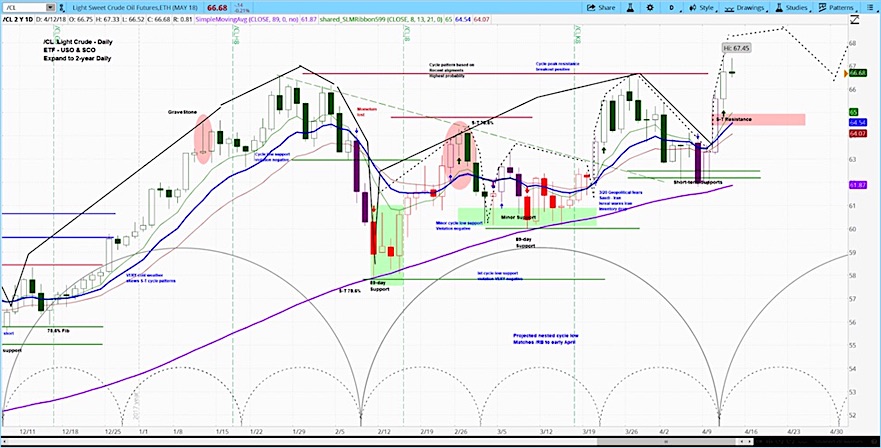

The latest threats have sent crude oil prices higher. Below is our latest “cycle” research on oil prices and where they are headed.

Summary:

- The price of crude oil rose over $4 this week, a significant rise of 7.5%.

- This is related a chemical attack in Syria, along with the US and Russian bluster that followed.

- The price action in crude also coincided with the start of the rising phase of market cycles on the weekly and daily charts.

Crude Oil (/CL) Chart with Weekly Bars

The price of crude oil exploded, as can be seen on the large, green bar on the right on the weekly chart above. Last week it appeared as if oil prices might decline further. President Trump proclaimed, “We’re coming out of Syria, like, very soon,” with the price of Crude Oil futures (/CL) settling around $62 on Friday.

However, over the weekend, images surfaced depicting Syrian civilians being treated for exposure to chemical weapons. The last time that happened, President Trump proclaimed that the attack went “beyond a red line” and launched 59 Tomahawk cruise missiles at Syrian military targets.

Trump promised a “forceful” response. However, Russia later clashed with the US at the United Nations Security Council over how to investigate the incident, and later vowed to shoot down any missiles launched at Syrian targets. Not surprisingly, Trump responded, “Get ready Russia, because they will be coming,” referring to a fresh round of missiles. The rise in oil prices is not surprising, given that exchange, as well as the fact that OPEC production fell to 32.04 million barrels a day in March.

However, what the television pundits didn’t tell you is that the price of crude may have been looking for a reason to increase, at least in the short term. We can see on the weekly chart above that crude recently entered into the rising phase of a new market cycle, and a similar occurrence on the daily chart below.

Crude Oil (/CL) Chart with Daily Bars

This certainly isn’t to say that oil prices would have risen without the events that occurred. However, it may be that prices were ready to rise and may have extended further in the short term due to being aligned in the rising phases of market cycles in two time frames.

For more on how market cycles affect the price action in crude oil futures, check out my latest video in the “askSlim Special Presentation” series below:

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.