The price action of Apple (AAPL) has been very harmonic and balanced.

Today, I aim to provide an update on where the most-watched (and most important?) stock may be headed next.

I have blogged about $AAPL here on See It Market several times. Here’s a recap of articles:

- Feb 2015: Apple $AAPL was finishing the end of a very strong 3 wave sequence w/ price targets ID’d: Apple (AAPL) Nearing Major Wave Completion – Price Targets

- Dec 2015: I provided price targets for the ID’d Wave 4 pullback: Assessing The Top In Apple (AAPL) with Downside Price Targets

- August 2017: I warned a very important top was in the works w/ upside price targets: Apple Nearing Major Elliott Wave Top

Note that the targeted area for this wave completion was in/around 163-168. Momentum pushed $AAPL just past that, but…

Apple (AAPL): Major Top Still In Play?

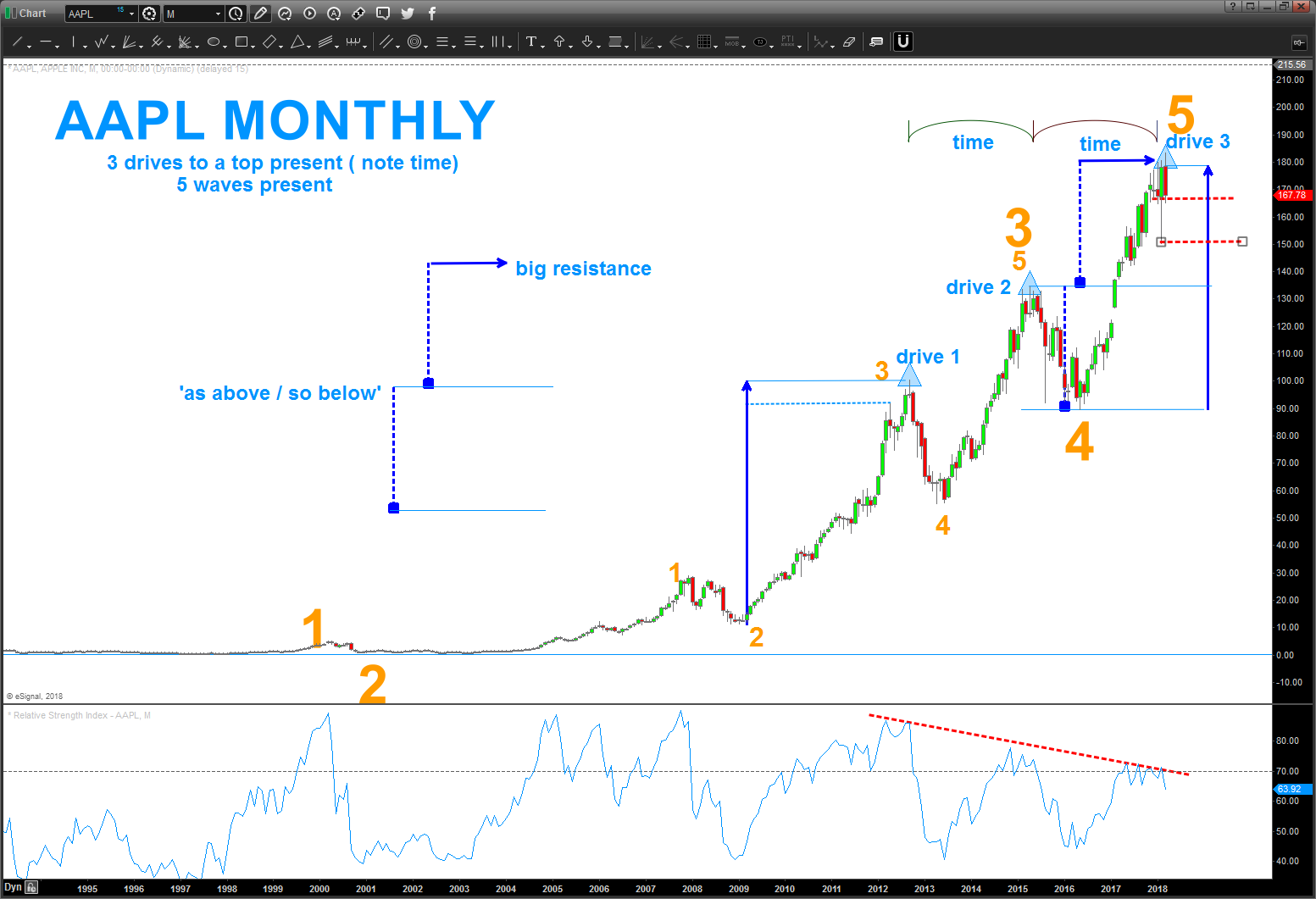

As you can see in the chart below we have a LOT of techniques pointing to very formidable resistance OR even a very formidable top in AAPL.

Here’s a list of technical considerations, in no particular order:

- The ORANGE Elliott Wave count is still preferred. It’s the count that’s worked for the past couple years. Could this big ORANGE 5 extend –certainly. However, let’s look at the form/proportion.

- Big Orange 5 is 1.27*Big Orange 3

- Note 1.27 is the square root of 1.618

- The Big Orange 4 depth is equal to the move higher from Big Orange 3.

- Shown is the “as above / so below” basic price projection technique

- A very harmonic 3 drive to a top (shown by the blue triangles) is present w/ the time component of each drive shown a the top right of the chart pattern (next to the big 5)

- Bearish Divergence present on the monthly chart

Watch the coming weeks/month very closely. A monthly/ weekly close below 167 would add probability of a major top in place. A MONTHLY close below 150 would be a strong confirmation and lead to a move that will, initially, target around 90 bucks.

Be sure to check out my unique analysis of stocks, commodities, currencies over at Bart’s Charts. Thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.