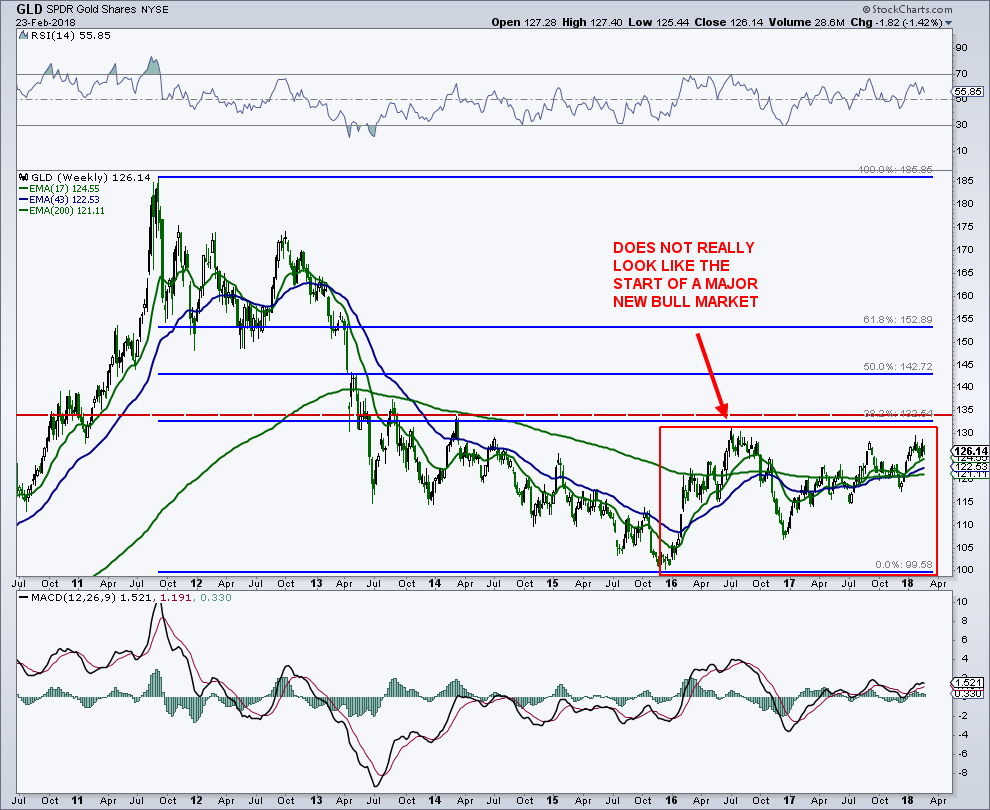

Today, I want to provide a quick update on gold trading and the iShares Gold Trust (GLD). Gold has been meandering beneath major price resistance.

So what’s going on here?

On the weekly chart, the yellow metal remains in a volatile sideways pattern, which may be a very large inverse head-and-shoulders formation. But bulls have yet to power price higher and through resistance. A thrust through 135 would be bullish.

Considering the size of the prior bull and bear market, it’s not surprising that the price of Gold and its ETF (GLD) have been all over the place, but in the end, really have gone nowhere.

For a long-term buy signal, we would like to see the top of the base taken out in the 135 price area. That would open up many different bullish scenarios.

The U.S. Dollar Index has bounced a bit, while yields keep heading higher. This is not a great combination for gold. The COT data and sentiment are both back to neutral.

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”. Thanks for reading.

Twitter: @MarkArbeter

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.