The following chart and data highlight non-commercial commodity futures trading positions as of January 30, 2017.

This data was released with the February 2 COT Report (Commitment of Traders). Note that these charts also appeared on my blog.

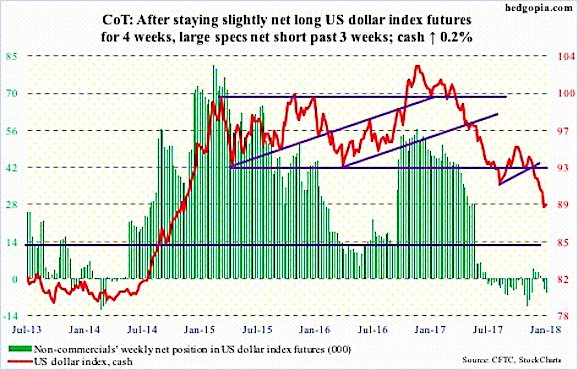

The chart below looks at non-commercial futures trading positions for the US Dollar. For the week, the Dollar was unchanged – much of this due to Friday’s rally. Dollar currency speculation is near multi-year lows.

US Dollar Index

February 2 COT Report Spec positioning: Currently net short 5.8k, up 1.6k.

The inability of the US Dollar Index (89.04) to rally in the face of 10-year Treasury yields that are ripping higher must be unnerving the bulls. Friday, however, was an exception to this, with the dollar index rallying 0.6 percent. During the week, yields rallied another 19 basis points to 2.85 percent, while the dollar index inched up 0.2 percent.

Support at 88-89 goes back to early 2004. The low of 88.25 Thursday last week also tested a rising trend line from May 2011.

As long as recent lows are not violated, a tradable bottom is probably in.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.