Broad Market Outlook for Jan 31, 2018

The stock market is in the process of bouncing higher today, after breaking into lower support regions yesterday. Until the S&P 500 recaptures 2846, we are at risk of developing a short cycle shorting space.

Note that you can access today’s economic calendar with a full rundown of releases.

S&P 500

Early morning bounces today into resistance near 2836 are in process. Now lower support sits near 2825. Watch your resistance – if buyers can’t breach and hold, we have another drift down on the horizon. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2846.75

- Selling pressure intraday will likely strengthen with a failed retest of 2825

- Resistance sits near 2841.75 to 2846.75, with 2854.25 and 2867.5 above that.

- Support sits between 2825 and 2818, with 2802.25 and 2794.75 below that.

NASDAQ Futures

The failure at 6982 yesterday now provides the line for resistance today. Momentum is mixed as buyers are at work this morning. Support is lower once more at 6930 to watch. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6984.75

- Selling pressure intraday will likely strengthen with a failed retest of 6930.5

- Resistance sits near 6982.25 to 7002.25 with 7028.5 and 7047.5 above that.

- Support sits between 6943 and 6916.5, with 6902.25 and 6887.25 below that.

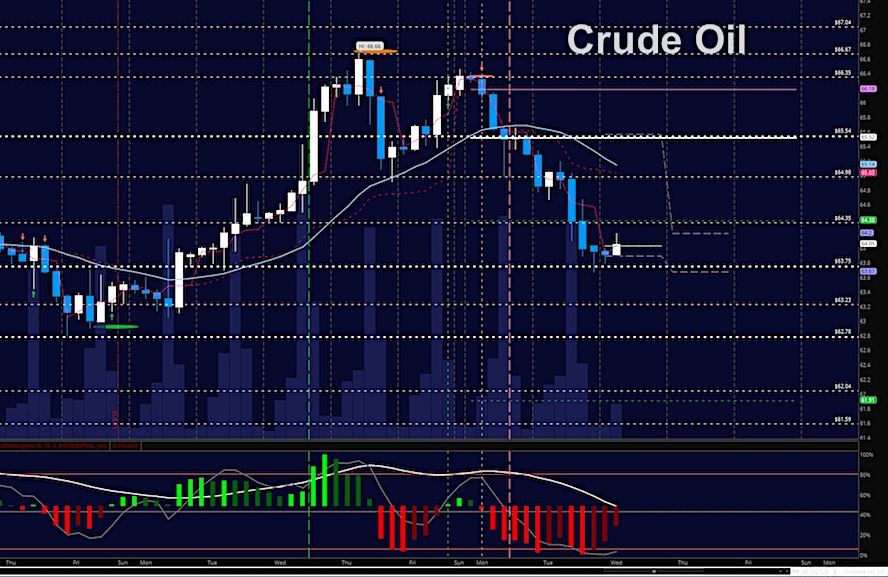

WTI Crude Oil

Not only did sellers test the 64.04 level, but we lost it and slipped to 63.78 and further below. The selling has been organized and not frantic, hence I suspect it is a shifting of contracts to the forward month. The failure to hold 63.6 will bring us into 63.23 and 62.84. Watch price resistance near 64.40 to see if the strength of sellers continues. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted. EIA report at 10:30 ET.

- Buying pressure intraday will likely strengthen with a positive retest of 64.4

- Selling pressure intraday will strengthen with a failed retest of 63.67

- Resistance sits near 64.14 to 64.67, with 65.05 and 65.54 above that.

- Support holds near 63.67 to 63.2, with 62.87 and 62.26 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.