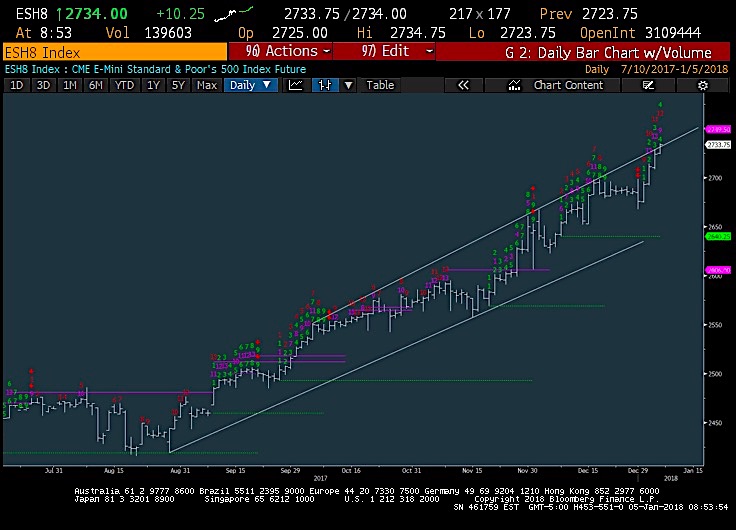

S&P 500 Index Trading Outlook (2-3 Days): BULLISH

Still looks a bit early to turn bearish given the breakouts yesterday in Financials (XLF) and in Technology (XLK) while Industrials (XLI) have begun to accelerate after making its own minor trend breakout.

While it was thought that a move over 2715 would find resistance, the Demark sell counts on the S&P 500 daily charts are still incomplete. As well, most weekly charts are pinpointing 1/6/1/20 for a possible turn.

Overall, despite the degree of overbought conditions and seemingly cramped upside room, we’ll have to wait for a reversal. Especially given these sector breakouts.

An upside move to 2749-51 is possible near-term.

TECHNICAL THOUGHTS & TRADING IDEAS

I like Pharma and Health Care Devices/Services for a further near-term push higher and likely outperformance vs the broader market. Health Care (XLV) broke out again yesterday, and the Pharmaceutical Index DRG looks quite attractive to continue higher.

Metals stocks still remain the preferred play. Gold stocks and Silver continue to make progress – looking for opportunities.

The Financials breakout was impressive yesterday and can still allow for some near-term outperformance. Weekly counter-trend sell signals remain 2 weeks away, so its right to use this range breakout to favor the Financials for a bit more strength into mid-month.

I’m still overweight Energy. OIH has broken out and signs of near-term exhaustion are still 2-3 days away. Staying long Energy and specifically most Oil Service names for the next 3-5 days. This goes with the broader theme of Overweight Commodities.

Favoring US over Europe. The bounce in European stocks remains at make-or-break areas, and while SX5E did rebound Thursday, it hasn’t moved enough to think this can begin to outperform until 3625 is breached. I’m still favoring US over Europe.

The Bottom line: While the stock market indices looked stretched heading into yesterday, we still haven’t seen the completion of the proper upside exhaustion signals, or a key reversal for that matter. And now Financials and Technology are breaking out again, joining the recent breakouts in Industrials and Healthcare. While any reversal of these moves would be important and one to follow, for now the breakouts have to be trusted. A near-term bearish stance is probably a bit premature, despite the growing enthusiasm and speculation. One should wait for at least a pullback to multi-day lows.

Thanks for reading.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.